According to a report shared with U.Today, IntoTheBlock analytics company reckons that the second biggest cryptocurrency is likely to keep growing, even though ETH is in a correction after reaching a new all-time high above $1,400.

Below are several reasons for this assumption.

DeFi industry growth

The report from IntoTheBlock discusses several reasons that are likely to push ETH growth in the near future. The first is DeFi adoption and development growth.

Decentralized finance apps (DeFi) are dapps that offer financial services without any intermediaries. Many are also busy with yield farming—lending their crypto to other projects and reaping their profits.

This industry turned into a full-scale one in 2020, though the first DeFi dapps emerged earlier and have been around since 2017.

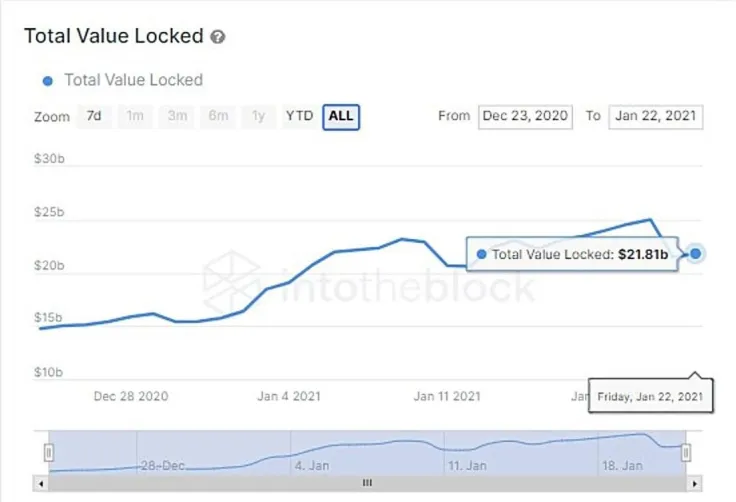

The majority of DeFi protocols exist on the Ethereum chain, and the most widespread metric for monitoring DeFi growth is called Total Value Locked (TVL)—which is the overall amount of USD deposited into smart contracts that power DeFi apps.

A year ago, TVL amounted to approximately $840 million. A few days ago, it hit a major peak of a whopping $25 billion; that is a 29x rise over a 12-month period.

This signifies rapid growth of the ecosystem. Examples of such DeFi dapp leaders are Compound and Uniswap.

Ethereum network adoption expands

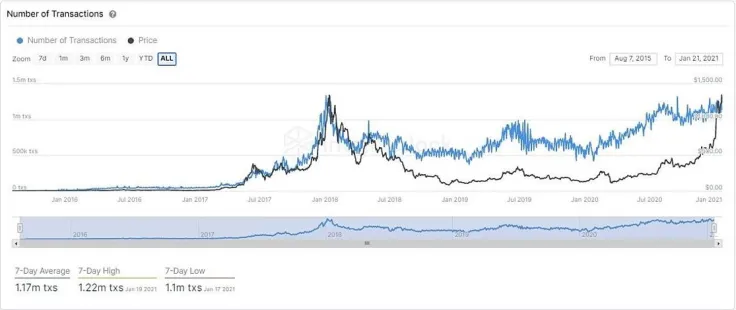

Thanks to DeFi growth, a rise in the number of transactions on Ethereum has been noticed. Over the past several days, according to the report, 1.17 million daily transactions have been observed on Ethereum.

This has also spurred growth in ETH's daily active wallets, 550,000 per day on average—that is 100 percent growth compared to January 2020.

As for the number of non-zero ETH wallets, they have been growing since Ethereum emerged. On Jan. 21, there were 51.79 million wallets with a balance on them, representing 50 percent growth over the past year.

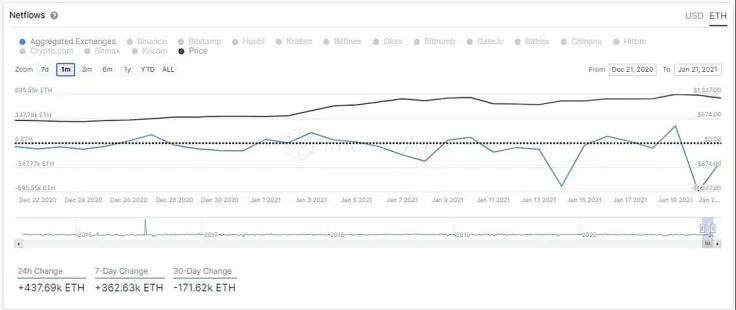

Shrinking ETH supply on exchanges

This is the final aspect that the IntoTheBlock team believes to be important for ETH to continue its exponential growth, as the ETH supply has been quickly decreasing recently.

In the last month, large amounts of ETH have been taken off centralized crypto exchanges. On two particular days, Jan. 14 and 20, 620.49k and 695.55k, respectively, found their way from exchanges to wallets.

The demand for ETH is rising, and soon the community may face a supply crisis. More ETH is being locked in DeFi apps—it is above 6.9 million at the moment—and the total amount of ETH staked on the ETH 2.0 deposit contract equals 2.5 million.

The fact that, on Feb. 8, CME intends to launch ETH-based futures contracts is also positive for ETH's potential to continue rising this year.

Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Tomiwabold Olajide

Tomiwabold Olajide