Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The cryptocurrency market just saw one of the biggest liquidation events since 2021, wiping out over $879 million from leveraged positions, blasting short-sellers. Market leaders Bitcoin and Ethereum launched a vicious attack on bears, nearly instantly changing the mood of the market. Bitcoin continued to rise toward $104,000 after surpassing the psychological barrier of $100,000 before encountering minor opposition.

This action completely wiped out traders, who were betting against the rally and liquidated hundreds of millions in short positions. With a robust uptrend rising volume and an RSI that is comfortably in bullish territory, the price action of Bitcoin is clearly strong. Resistance slightly above $104,000 continues to be a short-term obstacle, while the support zone around $93,000 now acts as a crucial floor that could support additional upside.

Ethereum was the true surprise, though. ETH, which typically trails behind Bitcoin in these rallies, jumped by almost 31% in less than 48 hours, smashing through several EMA resistances and soaring above the $2,300 mark. Its sudden and powerful momentum caught many traders off guard. Without much hesitation, the asset broke through the 200 EMA, which usually indicates a long-term bullish reversal.

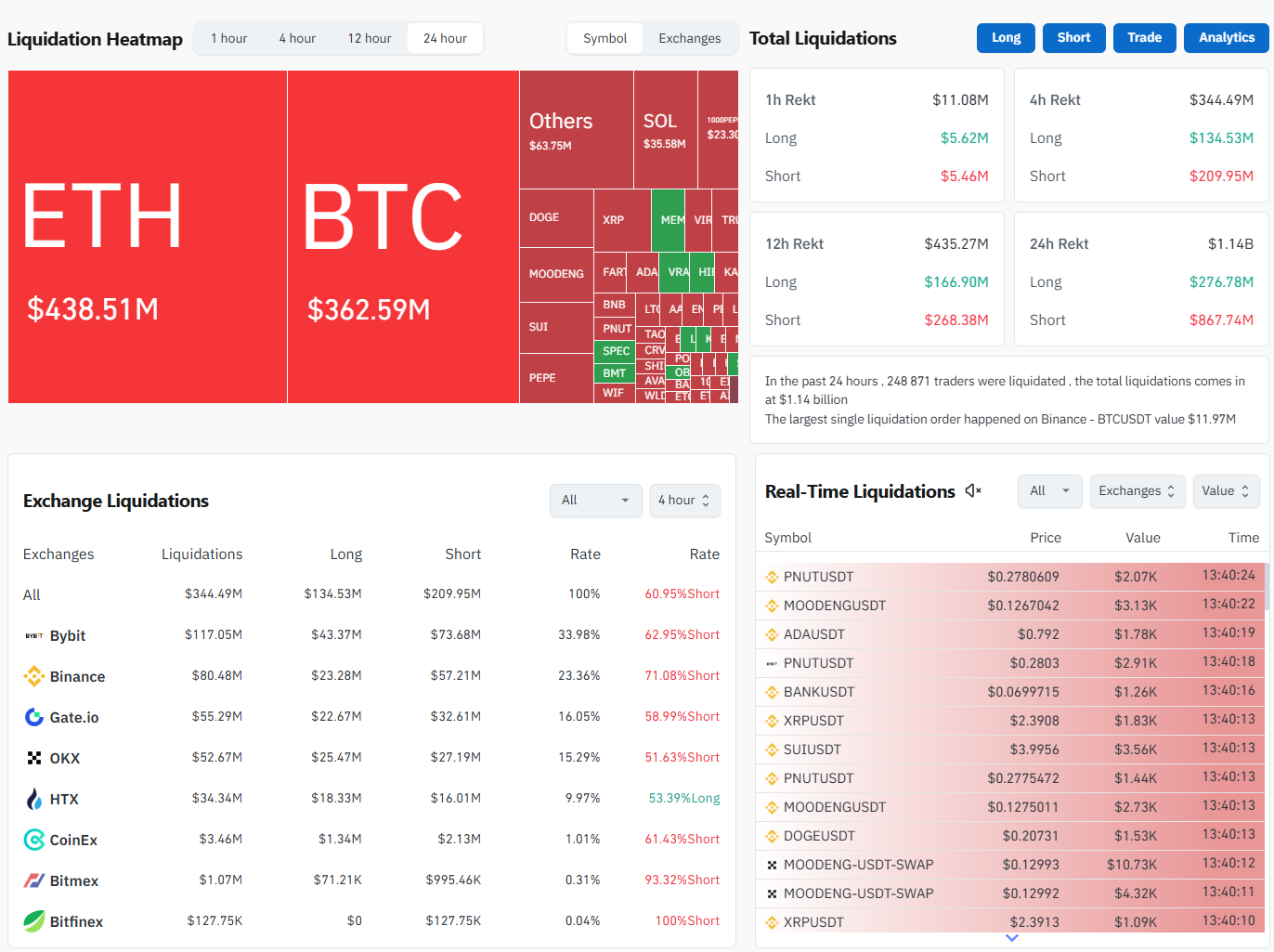

Ethereum's $438 million total even overtook Bitcoin's $363 million on the liquidation charts, an odd but interesting divergence that highlights how undervalued ETH's upside potential was. One important dynamic that is highlighted by this historic liquidation event is that in structurally bullish markets, short positions with excessive leverage become more vulnerable.

A total of 248,000 traders were liquidated in the last 24 hours, highlighting the extent of the damage. In the future, Bitcoin might consolidate above $100,000 if this momentum continues and retail inflows increase, while Ethereum might aim for a march toward $2,800 and higher. This could be the start of a wider market squeeze unless macro headwinds step in and the bears are bleeding.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov