Bitcoin custodian and trading firm New York Digital Investment Group (NYDIG) has raked in $200 million worth of funding from the likes of George Soros' Soros Fund Management, investment bank Morgan Stanley and Massachusetts-based life insurance company MassMutual, according to a March 8 press release.

NYDIG CEO Robert Gutmann claims that all of these firms are more than investors, explaining that they will be collaborating on "Bitcoin-related" initiatives.

The firms participating in this round are more than investors—they are partners, each well known to us for years. NYDIG will be working with these firms on Bitcoin-related strategic initiatives spanning investment management, insurance, banking, clean energy and philanthropy.

Accelerating institutional adoption

Back in December, MassMutual purchased $100 million worth of Bitcoin, which was viewed as a major step in the asset's institutional adoption. It had also made a $5 million equity investment into NYDIG prior to the announcement of the most recent funding round.

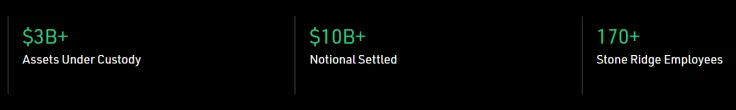

NYDIG claims that over $1 billion worth of Bitcoin is now held on its custody platform.

It is a Bitcoin subsidiary of the $10 billion asset management firm Stone Ridge.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov