Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

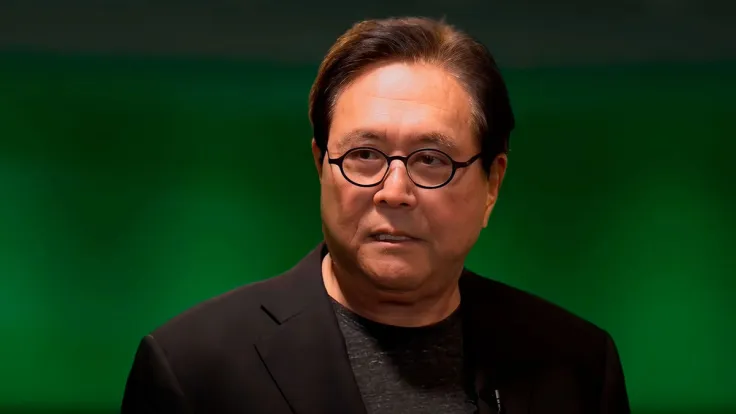

The author of extremely popular financial self-education book "Rich Dad, Poor Dad," Robert Kiyosaki, expressed his negative forecast on the current state of the market and the possibility of a crash in the future.

According to the prominent investor, the biggest crash has been building since the 1990s, and instead of fixing the problem at the beginning, the Fed decided to increase the monetary supply in the country, which negatively impacted the value of the national currency.

EVERYTHING BUBBLE into EVERYTHING CRASH. I warned in my books, the biggest crash has been building since 1990s. Rather than fix problems FED printed FAKE $. In Everything Crash everything crashes even gold, silver, BC. Your ultimate asset in giant crash, your financial wisdom

— therealkiyosaki (@theRealKiyosaki) September 26, 2022

Apart from the crash on volatile markets like stocks, traditional inflation safe havens like gold, silver and other precious metals are also crashing in the same manner as stocks, or even cryptocurrencies.

The only ultimate asset in a giant crash that investors gain is financial wisdom, says Kiyosaki. According to various on-chain indicators, the profitability of most digital assets is at an absolute low, showing that the majority of the market is in deep losses.

Bitcoin is recovering

Despite the grim forecast described by Kiyosaki, the first cryptocurrency has not followed the stock market recently and managed to climb back over the $20,000 threshold, which was an unexpected move by the first cryptocurrency considering its poor price performance in the last few weeks.

The main reason behind the recovery could be tied to the correction of the U.S. Dollar against a bracket of foreign currencies. Previously, the British Pound almost reached parity with the USD, which shows how devastating the effect of the rallying U.S. currency is on assets like Bitcoin.

Despite all of the bearish factors, BTC still has the support of a small part of market participants and will most likely enter a prolonged consolidation from there.

Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Tomiwabold Olajide

Tomiwabold Olajide Gamza Khanzadaev

Gamza Khanzadaev