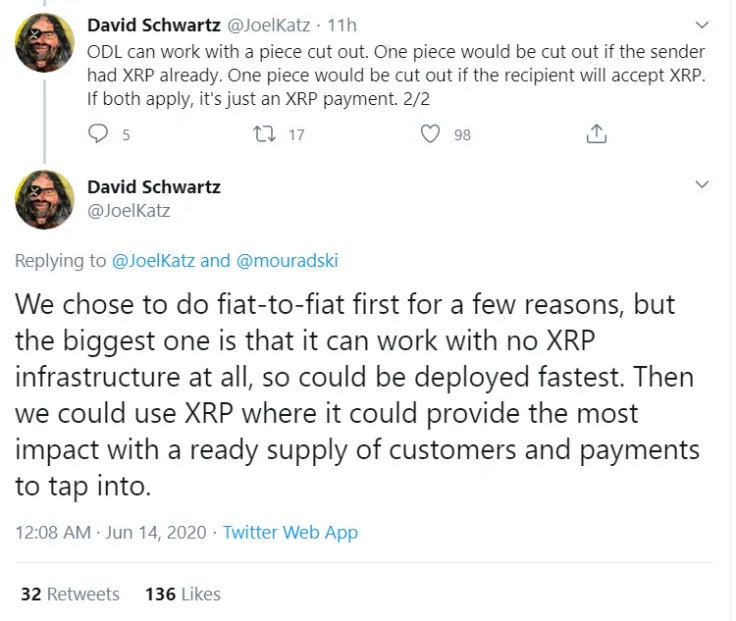

In a new tweet, David Schwartz, the CTO of blockchain payments provider Ripple, has explained why Ripple chose to go with xCurrent before transitioning to the On-Demand Liquidity (ODL) solution, which allows conducting instant cross-border payments.

The executive claims that fiat-to-fiat transactions didn't require fiat-to-fiat transactions, which is why they could be deployed faster. XRP comes in handy for providing ‘the most impact’ when it comes to taping into ‘a ready supply of customers.’

ODL can function with ‘a piece cut out’

Ripple aims to solve one of the biggest shortfalls of the legacy banking system by eliminating the need for pre-funding.

The product, which was formerly known as xRapid, is able to bridge different fiat currencies in practically no time, with XRP being used as the source of liquidity. xCurrent, Ripple's previous-generation product, didn't use the token to settle transactions.

When asked whether ODL can function without buying or selling XRP, Schwartz replied that it could still work with ‘a piece cut out,’ meaning that there doesn't necessarily have to be a fiat-to-fiat transaction.

For instance, this might be the case the sender already has XRP or the recipient is willing to accept the token instead of fiat.

More ODL corridors

Multiple Ripple partners such a FlashFX and MoneyGram currently rely on ODL for transferring money. Mercury FX recently confirmed that it was still using the product with the help of XRP and teased ‘exciting news.’

So far, Ripple has ODL corridors in Australia, the Philippines, and Mexico that routinely reach new all-time highs in terms of transaction volumes.

As reported by U.Today, Ripple is expected to open new ones this year, setting its sights on Brazil and other Latin American countries.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov