According to the charts shared by Glassnode analytics company, Bitcoin has reached several new all-time highs to do with wallets on the network.

Meanwhile, the CEO of ShapeShift Erik Voorhees believes that BTC might become a reserve currency and inspire financial heavyweights to use it as the collateral for launching their own stablecoins.

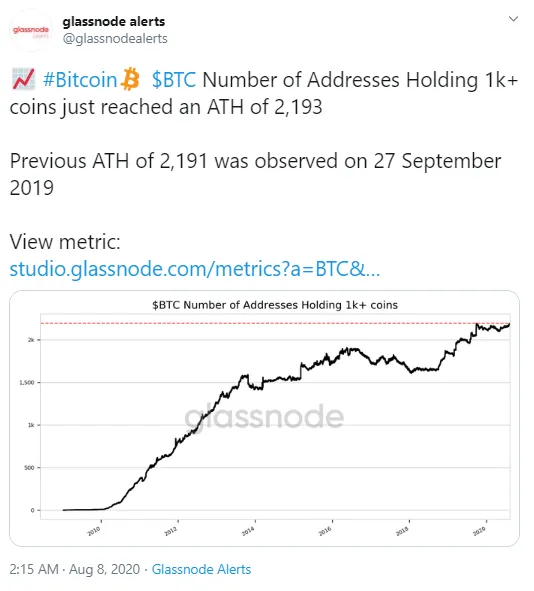

Bitcoin on-chain fundamentals hit new ATHs

Glassnode stated that the amount of Bitcoin wallets that hold more than 1,000 BTC has increased since September 2019.

Another chart published by the analytics provider is that the percent of BTC supply that has not been moved over the past three years has reached a new high in 2 years, hitting almost thirty percent now.

Erih Voorhees shares his vision of Bitcoin future

The CEO of ShapeShift Erik Voorhees took to Twitter to share a view that Bitcoin may become a de-facto reserve global currency.

This, in its turn, could prompt large financial companies to begin issuing their own stablecoins based on the value of Bitcoin, Vorrhees wrote. He compared Bitcoin to gold in the nineteenth century and banknotes as opposed to it.

When asked for the reasons that led him to thinking this, Voorhees wrote that bond market maths would not allow fiat to last much longer.

“Possible Future: Bitcoin becomes de facto reserve currency, replacing fiat. AND also, large financial firms issue their own stable tokens, partly or fully backed by Bitcoin. The modern version of 19th century gold + bank notes?”

“Bond market math doesn’t permit fiat to last more than one more generation.”

ShapeShift on the list of PPP loan recipients

Curiously, ShapeShift was among the blockchain companies that filed for receiving the PPP payroll loan.

Along with them, there were a big number of other blockchain companies, including Cardano, ConsenSys, Electric Coin Company, crypto news outlet The Block, etc.

ShapeShift received a sum between $1,000,000 and $2,000,000 as part of that stimulus solution.

Bitcoin maximalist Max Keiser slammed all the CEOs of crypto companies who heatedly criticized the stimulus program initiated by the Fed, saying that the massive QE would push the BTC price up, when they took the newly printed cash from the US government.

Bitcoin dev Peter Todd publicly questioned Electric Coin Company regarding the reasons why it, being the emitter of an anonymous Zcash coin, agreed to accept the stimulus check from the Fed Reserve and president Trump.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin