Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Amid the ongoing bearish recession, traders, investors and DeFi enthusiasts are looking for newbie-friendly “safe haven” opportunities for decentralized crypto trading and “yield farming.”

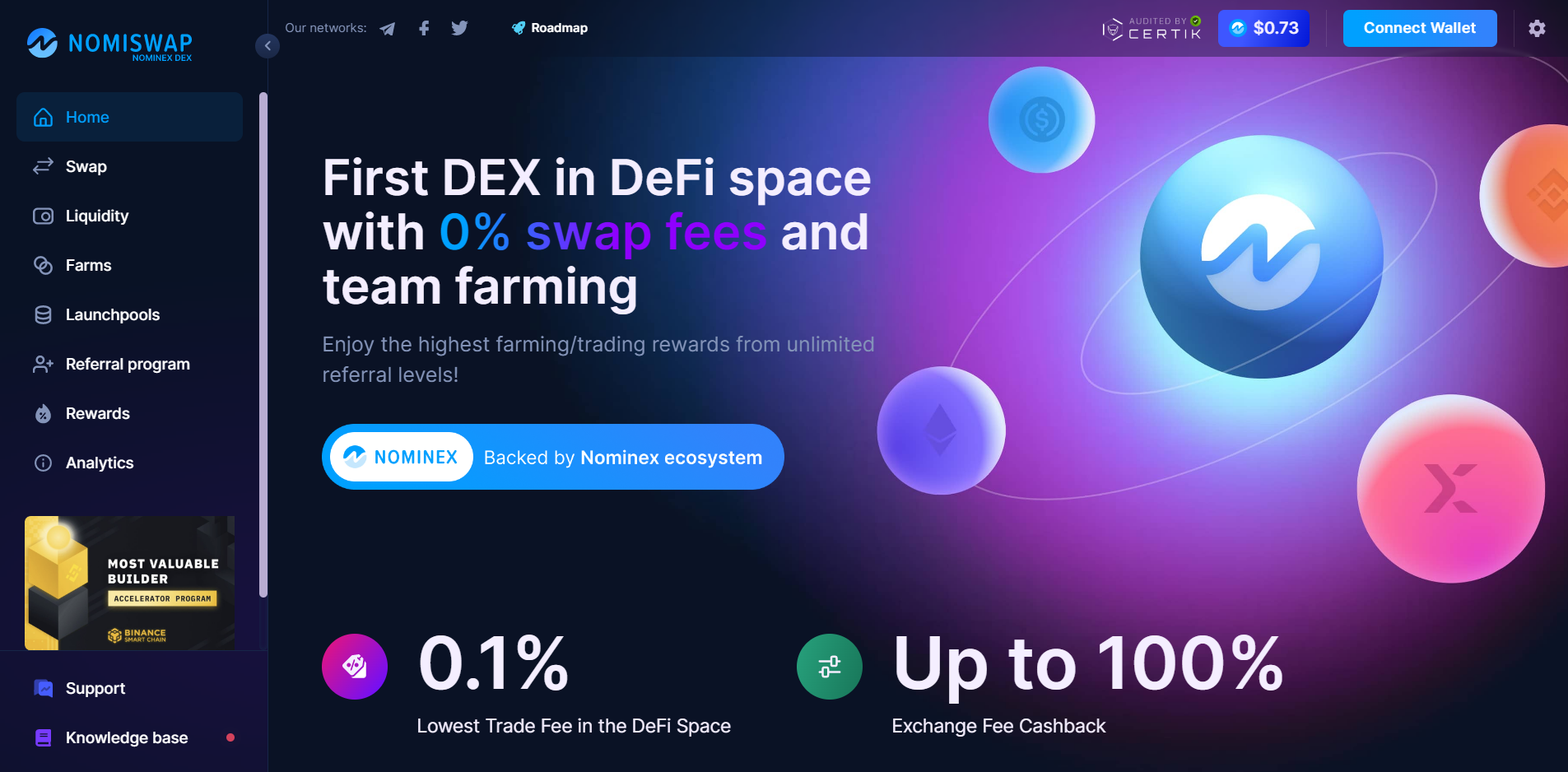

Backed by Tier 1 CeDeFi ecosystem Nominex (NMX), novel decentralized crypto exchange Nomiswap with its automated market making (AMM) instrument is set to push the barriers for professional traders, liquidity providers and Web3 newbies.

Introducing Nomiswap, a one-stop zero-fee DEX with AMM and “yield farming” module

Launched in January 2022, Nomiswap DEX addresses all major bottlenecks in the turbulent segment of decentralized cryptocurrency exchange with AMMs. It melds the one-click DEX with a multi-asset “yield farming” dashboard.

Nomiswap allows its users to exchange assets on BNB Chain (BSC) among each other and to provide liquidity to obtain periodic payouts on their assets.

So, what is special about Nomiswap and its DEX tooling?

- Lowest possible transaction fees on the market (0.1% with 100% cashback option);

- Top-5 DEX on BNB Chain (DeFiLlama), Top-40 DEX by trading volume (CoinMarketCap);

- Fastest and most resource-efficient technical basis for lightning-fast exchange (BNB Chain or BSC);

- Utilitarian farming and staking: the more liquidity this or that trader injects, the higher rewards he/she can get;

- Generous holder bonus program: users are incentivized to hold NMX tokens which protects NMX price from selling pressure as well as to keep their coins in liquidity pools;

- Unique binary multi-level referral system;

- Super-high APRs for mainstream LP pools - Nomiswap offers higher APRs than industry leader PancakeSwap (CAKE);

- One-click access to trading and liquidity-providing mechanisms: no KYC/registrations/downloads required.

- Single-asset staking in launchpools.

As such, Nomiswap, with its feature-rich toolkit and solid Nominex ecosystem backing, is setting new benchmarks in the AMM-powered DEXes segment.

What are decentralized exchanges?

Decentralized cryptocurrency exchanges, or DEXes, should be considered a type of platform for cross-asset conversion of digital assets (cryptocurrency tokens) that does not include centralized storage and governance mechanisms.

Decentralized exchanges are also called “on-chain” exchanges: all their operations are executed directly in blockchains removing the need for centralized mediums. While on centralized exchanges, people trade “against” centralized trading engines; on decentralized ones, orders are executed by automated market making instruments, or AMM.

AMM leverages liquidity provided by users themselves; that is why decentralized exchanges are manipulation-resistant and have much stronger protection from attacks. Uniswap is the most popular DEX on Ethereum, while PancakeSwap (CAKE) is the largest BNB Chain’s DEX.

What is “yield farming?”

“Yield farming” is a practice of obtaining periodic rewards for providing liquidity. Typically, decentralized cryptocurrency exchanges attract liquidity from liquidity providers in the form of tokens needed for a platform’s operations.

For instance, to “farm yield” on BNB-USDT liquidity pool, Web3 enthusiasts should lock their liquidity in Binance Coins (BNB) and U.S. Dollar Tethers (USDT). The majority of pools accept liquidity in two assets; however, one-, three- and even four-asset pools are also available.

Technically, “yield farming” works not unlike bank deposits: DEXes distribute a portion of their trading fees between their “donors.” Some protocols also distribute its native tokens as an additional incentive to provide liquidity. However, APRs on trending pairs can exceed 100-150%. “Yield farming” on stablecoins, typically, is rewarded with 10-15% in APR.

Nomiswap by Nominex: Newbie-friendly trading and farming experience with zero fees

Developed by a heavy-hitting team of Web3 professionals, Nomiswap exchange melds the instruments of a decentralized exchange (DEX) with a newbie-friendly “yield farming” dashboard.

Basics

Nomiswap’s ecosystem boasts a one-click swap module, liquidity provision (LP) toolkit, a number of “farms” (they allow LPs to inject liquidity into various assets to get rewards in NMX, a core native asset of Nominex ecosystem) and so on.

Also, in the “Launchpools” segment, Nomiswap users can stake their NMX tokens to get rewards.

Its multi-level referral program allows users to monetize their social media influence and start earning NMX tokens for every friend invited to the platform.

Nomiswap’s codebase and smart contracts architecture are audited by highly reputable third-party tech audit provider CertiK.

Trading

First and foremost, Nomiswap DEX launched to offer secure KYC-agnostic trading and exchange instruments on the BNB Chain (BSC). As such, it supports a variety of assets issued on BSC, including PoS coins, stablecoins, native tokens of DeFi protocols and so on.

As Nomiswap DEX has no registration/verification procedure, it works with third-party noncustodial wallets for EVM-compatible blockchains. To start using Nomiswap, the user should just authorize his/her Metamask,TrustWallet or other compatible wallets, save seed phrases, connect the new wallet to Nomiswap and start trading.

Trading operations are charged with a 0.1% fee - which is the lowest level on the market. Out of this sum, 0.03% is returned to liquidity providers while 0.07% is used for referral program rewards, trading fees cashback, NMX burning and Nomiswap profits.

Yield farming

Besides trading, DeFi enthusiasts can lock their liquidity in Nomiswap’s yield farming module. In the “Liquidity” dashboard, traders can choose two assets to be used for liquidity providing activity; 37 token pairs are available by Q3, 2022. NMX-USDC and NMX-BUSD are the three most rewarding pools with over 70% in APR.

Also, in the “Farms” section, crypto holders can choose one of the hottest “farms” to earn yield in the form of NMX tokens.

Actual size of user rewards depends on his/her farming level. Farming level can be obtained by placing money into pools with ‘level up’ tag.

|

Farming level |

STARTER |

PARTNER |

PRO |

VIP |

ELITE |

MAX |

|

USD value |

<100 |

100 |

300 |

1000 |

5000 |

10000 |

“Farms” users are eligible for lucrative rewards: they can participate in incentivized Team Farming programs in order to get 100 percent cashback, own farming/trading rewards and team farming/trading rewards (see below)

Also, Nomiswap users can get a “Holder Bonus” for unstoppable farming. “Holder Bonus” program can give users a 10x boost; it is paid out of 20 percent of the NMX daily distribution pool.

Last but not least, the “Launchpools” segment is the most resource-efficient way to farm yield on Nomiswap: traders can lock their NMX to get periodic rewards.

Referral program

Nomiswap’s referral program allows every user to benefit from his/her audience on social media platforms. Once the user joins the referral program, he/she can earn 5-10% from the amount of NMX farmed by his/her own referrals, depending on the farming level.

Also, in the “Team Farming” rewards program, traders can earn 5-10% from the total amount of NMX farmed by the “weak” team (the branch of the referral tree with lower farming volume) depending on the farming level.

Trading rewards include 10-20 per cent from the trading expenses of the own referrals depending on the farming level plus 5-10 percent from the total trading expenses conducted by the weak team

Nomiswap’s referral platform is a multi-level one; each member has two places at the first level, four places at the second level and so on.

NMX token

The tokenomic design of Nomiswap (just like that of Nominex) is underpinned by its core native utility and governance asset, NMX. NMX’s circulating supply is capped at 200,000,000 tokens.

Not unlike Binance’s BNB, NMX tokens can be used for paying trading fees with a 50% discount for trading on Nominex CeDeFi.

Also, NMX tokens can be staked in an isolated Nomiswap pool with over 70% in APR.

Closing thoughts

Launched in January 2022 by leading CeDeFi Nominex, Nomiswap (NMX) DEX with AMM unlocks more profitable trading and yield farming opportunities for Web3 professionals and newbies globally. It allows noncustodial conversion of cryptocurrency assets on BNB Chain (BSC) and multi-product yield farming - for NMX-based pairs, for NMX tokens, and for 37 BSC-based pairs.

The protocol has the lowest possible trading fees of 0.1%; this amount can be subsidized through 100% cashback in NMX tokens.

Nomiswap introduces a multi-level referral program with lucrative rewards for participants with various levels of expertise in crypto and blockchain.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov