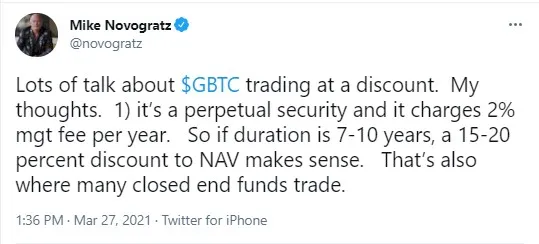

Mike Novogratz, former Goldman Sachs asset manager, and the founder of Galaxy Digital crypto fund, has taken to Twitter to share his take on the main product of Graysclale product – Grayscale Bitcoin Trust (GBTC) and why it keeps trading at a discount.

Here’s what the crypto influencer has to say on this.

Why 15-20% discount to NAV makes sense

Novogratz has commented on the frequent talk about GBTC continuing to trade at a discount. He believes that since GBTC is a perpetual security and charges a 2-percent management fee annually, a 15-20 percent discount makes sense if the investment is for 7-10 years.

Many closed end funds trader on the same terms, Novogratz pointed out. The second what he has mentioned was the role of Grayscale as a pioneer with its cryptocurrency-based trusts. Now, several ETFs based on crypto have launched in Canada that charge 40 basis points, narrowing the market for Grayscale.

Similar funds also exist in the US but they charge low fees.

As of March 26, the GBTC discount amounts to 7.28 percent.

As reported by U.Today last week, Grayscale had launched five new cryptocurrency trusts based on LINK, FIL, MANA, BAT and LPT.

Novogratz thanks Barry Silbert as Grayscale targets an ETF launch

In other tweets in the thread, the CEO of Galaxy Digital stated that Grayscale with its Bitcoin Trust has been very well serving the crypto community, as well as accelerating cryptocurrency adoption.

Novogratz also reminded the community that Grayscale is making attempts at launching a Bitcoin ETF and said that it is “difficult but elegant”.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin