Michael Saylor has confirmed his reputation of a firm Bitcoin believer by allocating another $50 million of Microstrategy’s cash reserves into BTC.

With the overall purchase of $475 million in BTC this year, Microstrategy has bought almost twice more BTC than miners produced this November.

Microstrategy adds more Bitcoin to its stash

Publicly-traded business software giant Microstrategy spearheaded by the vocal Bitcoin advocate Michael Saylor has spent another $50 million of its cash reserves on BTC as was reported by the media over the past hours.

The company conducted the deal, acquiring 2,574 Bitcoins at $19,427 per BTC. The same amount of cash was paid for Bitcoin by Square led by the Twitter CEO Jack Dorsey earlier this year after Microstrategy made its first Bitcoin purchase.

Now Michael Saylor’s company’s Bitcoin position has increased to approximately 40,824 Bitcoin, as per Saylor’s recent tweet.

Microstrategy gets almost a double BTC portion than was mined in November

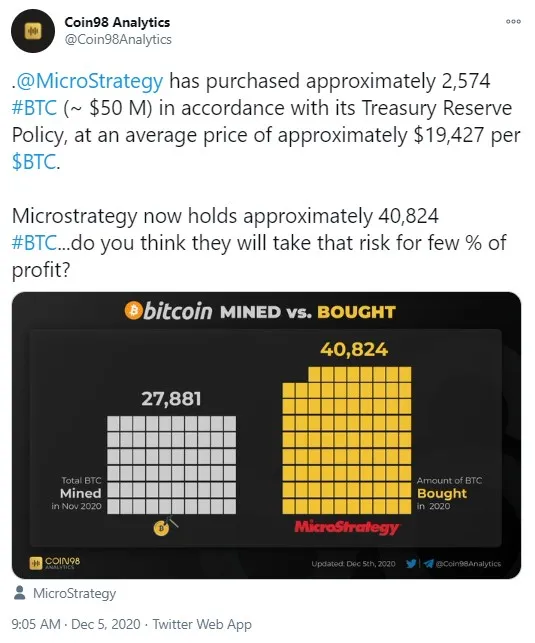

According to the data shared by Coin98 Analytics, Microstrategy acquired a total of 40,824 Bitcoins this year.

However, that is only almost twice as much as was generated in November by crypto miners.

As per the data from the aforementioned analytics firm, in November this year miners produced 27,881 Bitcoins.

CZ to have a chat with Michael Saylor on Bitcoin

This move of Microstrategy has driven a positive reaction on crypto Twitter. Binance CEO, CZ, now intends to take Michael Saylor to a fireside chat next week.

Grayscale owns more Bitcoin than Microstrategy

Microsrategy’s total purchase in 2020 is equal to 40,824 BTC. In comparison, Grayscale Investments fund spearheaded by Barry Silbert bought 55,015 BTC in November alone – that’s twice as more BTC than miners generated that month.

However, as Michael Saylor publicly made it clear several times, the goal of his company is not to gain profit from BTC but preserve its cash from the current USD decline.

As for Grayscale, the vocal Bitcoin critic and a critic of Grayscale now, Peter Schiff, has recently called Barry Silbert’s company the largest Bitcoin buyer.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin