According to data shared by Bybt analytics service, over the past 24 hours, Grayscale Investments fund spearheaded by Barry Silbert acquired another large amount of BTC.

Grayscale has added 7,188 BTC to its crypto holdings – that is $136,960,870 at the current exchange rate.

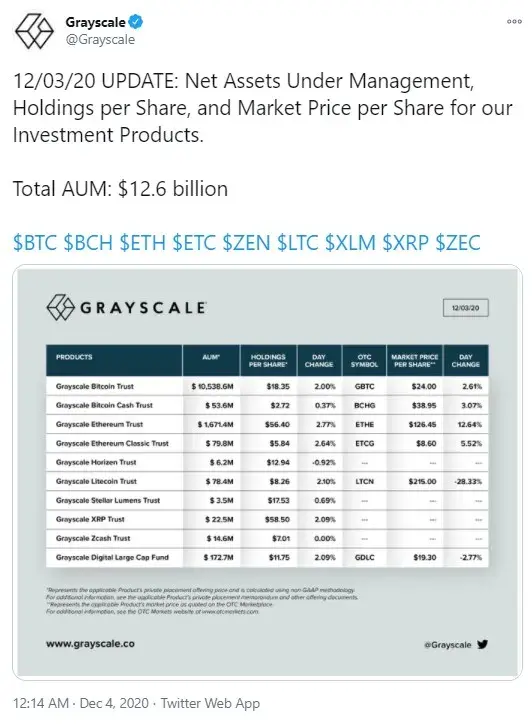

Grayscale now manages $12.6 billion in crypto

Over the past 24 hours, Grayscale Investments fund added another $137 million to its Bitcoin holdings, allowing financial institutions buy more of its Bitcoin Trust (GBTC) shares.

Grayscale tweeted on Thursday that, now, the amount of digital assets under its management now totals a whopping $12.6 billion.

Earlier it was reported that, in November alone, Grayscale laid its hands on 55,015 BTC. That equals $1,068,127,228, whereas Bitcoin miners managed to produce only 27,881 BTC that month ($538,973,187).

"Grayscale is the biggest Bitcoin buyer now"

Vocal Bitcoin critic Peter Schiff has recently referred to Grayscale, calling it the biggest Bitcoin buyer, expecting the company to turn into the largest BTC seller when "the bubble pops."

Schiff went at Grayscale for relaunching its viral Bitcoin vs. gold television ad and rebuking the investment fund for manipulating the Bitcoin market and pumping the coin's exchange rate via paid ads on CNBC.

Schiff also stated that the media giant pays back for these ads by inviting Bitcoin supporters as guests and keeping Bitcoin critics away from the air.

Peter Schiff bashes PayPal over Bitcoin

As reported earlier by U.Today, Peter Schiff also slammed PayPal for choosing to embrace Bitcoin and other top cryptocurrencies rather than allow its customers to use gold to purchase goods from 28+ million vendors in 2021.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov