Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin (BTC) started Thursday with a drop to $57,300. The cryptocurrency is currently trading at its lowest level in nearly three months, since the end of April. Ethereum, the second most capitalized cryptocurrency, also started the day with a decline. But so did the rest of the market.

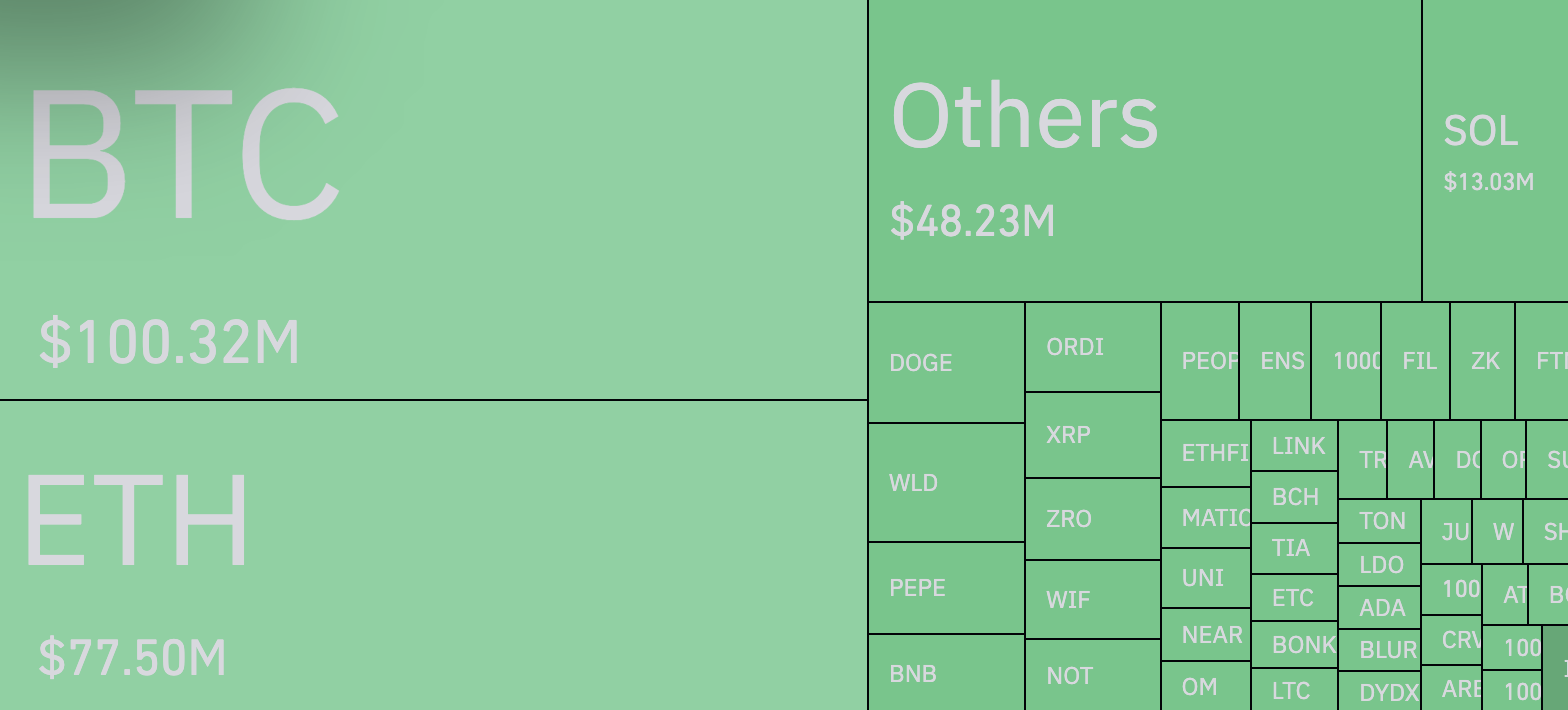

Over the past 24 hours, positions worth $319.98 million have been liquidated, and that is without taking into account two more days since the beginning of the week. According to the interim results of the week, we can now state the loss of $176 billion in capitalization for the entire crypto market.

It is natural that such price action has caused general fear, uncertainty and doubt among market participants. Peter Brandt, a legendary trader and frequent commentator on current events in the financial markets, volunteered to at least clarify the vision.

Bitcoin bulls, beware

In his outlook, Brandt highlighted a significant bearish pattern: the bear flag. In a nutshell, this pattern indicates potential further declines for Bitcoin. Brandt's chart, a critical component of his analysis, visually depicts this bearish trend and signals caution for investors.

"In the U.S., our attention always turns to flags on the 4th of July weekend," Brandt noted, adding a bit of humor to his technical analysis.

As you can see, the mood that Brandt is painting is not quite bullish, meaning that it is possible that buyers are in for a painful period on the market.

Either way, the perspective of the trading legend may help him prepare for further downside. Whether or not that is the case, we will know for sure only in hindsight.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov