Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The Bitcoin (BTC) derivatives market is gearing up for a potential blow to overleveraged buyers if the price turns in the wrong direction.

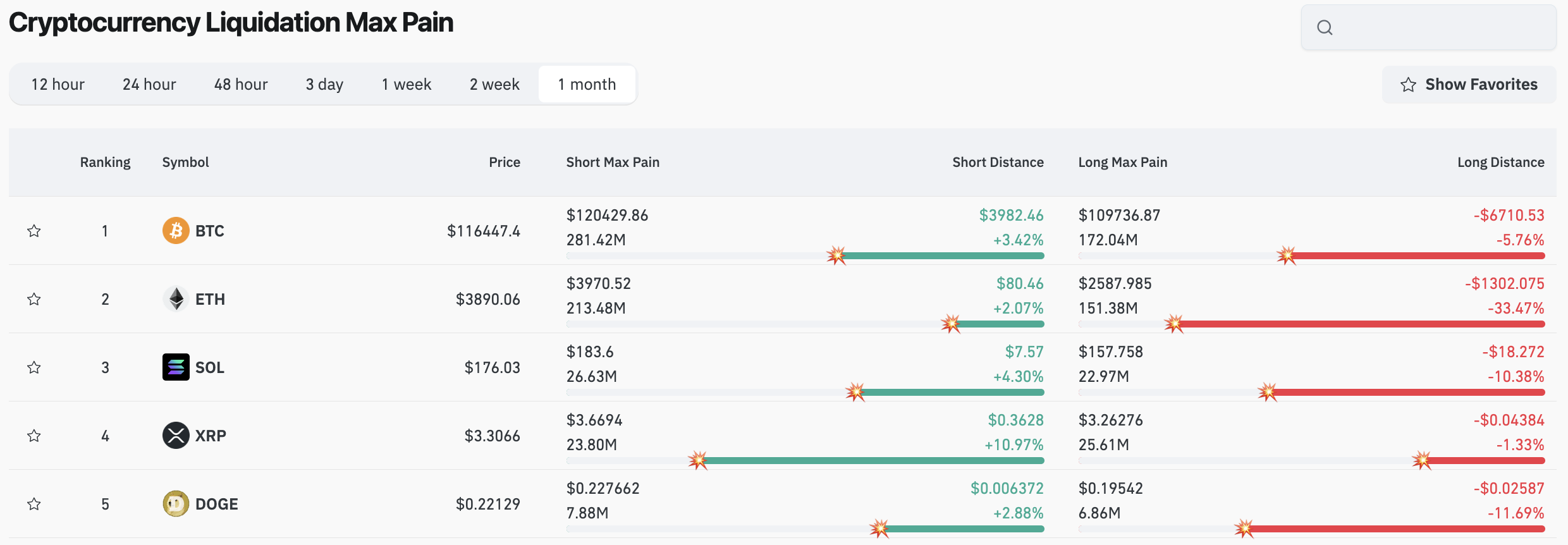

According to fresh data from CoinGlass, around $172 million in long positions could be at risk if BTC falls toward its monthly "maximum pain" zone, which is currently located near $109,736 — around 5.8% below its current trading price. This level marks the point at which a rapid decline would trigger a flood of forced liquidations, potentially escalating selling pressure within minutes rather than hours.

Over the past month, the market has been stretched between two pain points, with short exposure peaking at $120,429 — approximately 3.36% above the current spot price. While a sudden push higher could endanger $281 million worth of short bets, the current situation indicates that the risk of downward movement is more imminent.

Liquidation data from the past 24 hours supports this: $93.09 million in long positions were erased compared to $191.50 million on the short side. This shows that volatility affects both sides but leaves longs just a few bad ticks away from trouble.

Crypto liquidations: State of affairs

The larger heatmap reveals that Ethereum was the day's biggest casualty, with $103.05 million liquidated — far exceeding Bitcoin's $28.84 million and XRP's $27.52 million. Solana, Dogecoin and a range of other large-cap coins also bled out, adding up to a total liquidation tally of $284.59 million from over 101,000 traders.

The single largest hit was an ETH/USDC position worth $3.29 million, which was closed out on Binance.

On the four-hour chart, Bitcoin has been struggling to hold the $117,000 level, retreating to around $116,500 at the last check. The nearby support levels at $115,254 and $114,887 are now key; losing these would open the path toward the high-risk liquidation zone.

If the market shifts even slightly, the chain reaction could be swift — and, for overleveraged bulls, unforgiving.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov