Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Koinly, a one-stop platform that allows users to calculate taxes and process tax documents on crypto trading, shares the details of its latest integrations with leading blockchain ecosystems.

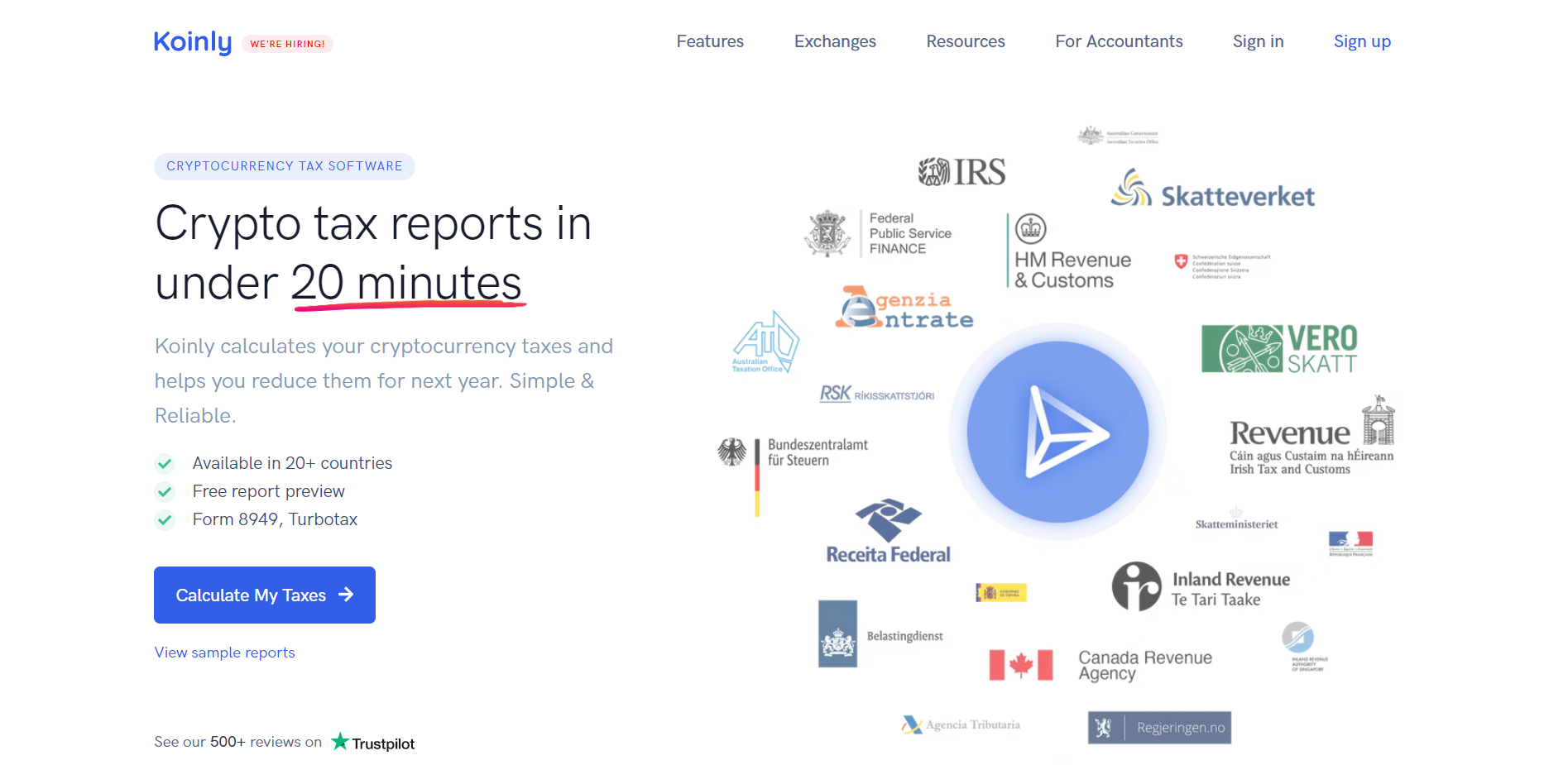

Introducing Koinly, a straightforward instrument to pay taxes on crypto

Despite more and more investors adding cryptocurrencies to their portfolios, taxation of the trading of cryptos and digital assets remains cumbersome and inefficient in most countries.

Different regions imposed different requirements for crypto taxation: even within the EU and U.S. there are a variety of approaches. At the same time, almost all developed countries ask their tax residents to fill out reports on their crypto investments and send them to tax authorities.

To ease this procedure for crypto newbies and professionals, Koinly, a heavy-hitting Web3 team, created a tax-reporting mechanism. As of Q2, 2022, it works with the financial and tax watchdogs of 20+ countries across the globe. Besides calculating crypto taxes and filling out the corresponding form, Koinly can also help its users in optimizing their taxes for the next fiscal year.

Koinly supports integration with major CEXes and DEXes through API endpoints and CSV spreadsheets. It can easily track and analyze activity on 300+ exchanges, wallets and DeFi protocols.

At any time, traders can preview their capital gains together with aggregated portfolio ROI, growth over time, paper P/L and realized and unrealized profits and losses. Reports on profits and losses can be previewed by traders prior to sending the information to tax authorities.

To be informed of the taxes they should pay, traders can download every document created by Koinly; previews and overviews are available for free. For instance, U.S. residents can generate filled-in IRS tax forms (Form 8949, Schedule D). Koinly instruments are compatible with popular TurboTax software and can be used by both traders themselves and their third-party consultants and accountants.

Koinly platform is free to sign up. As such, trying its instruments can be a smart bet for newbies and trading professionals from all over the globe.

Koinly now supports Cosmos, XinFin XDC Network, what’s next?

To ensure maximum accuracy and user-friendliness, Koinly integrates various mainstream blockchain ecosystems. In Q2, 2022, it added cross-network protocol Cosmos (ATOM) and XinFin XDC Network (XDC), a hybrid Ethereum fork.

Promoted as the “Internet of blockchains,” Cosmos (ATOM) ecosystem boasts 260 different protocols and applications. Dozens of Web3 teams in different countries are using Cosmos’ technology, Inter-Blockchain Communication (IBC), together with Cosmos software development kit (Cosmos SDK). Also, Cosmos-based cross-network mechanisms are used to bridge heterogeneous blockchains between each other.

As the integration kicks off, Koinly starts supporting three blockchains of the Cosmos family, including Cosmos itself, Osmosis and Kava. More protocols of the IBC stack will be added in the coming months.

Also, Koinly integrated XinFin XDC Network (XDC), a high-performance smart contracts platform for global cross-border remittances. XinFin XDC Network (XDC) is used by both retail clients and corporations. It combines the features of public and private distributed ledgers to ensure advanced interoperability, security and attack-resistance.

Both Cosmos and XinFin XDC Network accounts can now be seamlessly connected to Koinly instruments: transactions on these blockchains can be tracked on both centralized and decentralized services.

Koinly services are reviewed by 711 users of the TrustPilot portal; the application is ranked 4.6/5 and with the status of “Excellent.” Mostly, its clients interact with U.S., EU and British watchdogs.

Simply put, Koinly allows users to save time and resources on filing tax documents on crypto, making them 100% regulatory compliant.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov