- What is Crypto Lending?

- How Does Crypto Lending Work?

- What is a Crypto Lending Platform?

- How to Obtain a Bitcoin Loan or Crypto Loan: Explanation

- Bitcoin and Crypto Lending Tips

- Top 3 Crypto Lending Platforms

- Top 15‌ ‌Crypto‌ ‌Lending‌ ‌and‌ ‌Bitcoin‌ ‌Loan‌ ‌Websites‌

- Best‌ ‌Crypto‌ ‌Lending‌ ‌and‌ ‌Bitcoin‌ ‌Borrowing‌ ‌Sites‌ ‌for ‌2019‌

- Crypto Lending and Bitcoin Loans: Highlights

Recently, we discussed altcoin staking as one of the most cutting-edge decentralized financial solutions. Now, let’s talk about crypto lending, a sphere that merges the benefits of classic financial schemes with crypto transparency.

What is Crypto Lending?

Crypto lending programs allow you to leverage your crypto asset holdings without having to liquidate them. With crypto lending you can receive loans using your tokens as collateral or lend fiat and crypto.

How Does Crypto Lending Work?

There are only two scenarios when it comes to crypto lending - one is used to lend, while the other is used to borrow.

Scenario 1: Crypto Lending.

Alice lends her fiat money or stablecoins to a borrower at an agreed rate of interest for some fixed period of time against his/her crypto as collateral. This procedure is called crypto lending.

Scenario 2: Crypto Borrowing.

Bob has some crypto and needs fiat money or stablecoins. He utilizes his tokens as collateral to borrow fiat and stablecoins. This procedure is called crypto borrowing.

What is a Crypto Lending Platform?

A crypto lending platform acts as an intermediary between lenders and borrowers. This platform is therefore responsible for Know Your Customer and Anti-Money Laundering (KYC/AML) checks, holding the funds and interacting with users.

Crypto Lending Platforms: KYC/AML Checks

When an individual registers for a crypto lending platform, that individual is asked to submit some form of information - phone number, e-mail address, and the public address of your crypto wallet.

An individual may also be asked to submit a photo or a scanned copy of his/her driver's license or identification (ID) card to meet the KYC/AML requirements.

Crypto Lending Platforms: Holding Funds

Both the individual’s loan and the other interested party’s collateral are frozen on the platform’s internal wallet. This ensures the safety of your money/tokens and the money/tokens of your counterparty.

Crypto Lending Platforms: Matching Lenders and Borrowers

A crypto lending platform utilizes algorithms to locate loan orders that are suitable for both parties, and matches these orders.

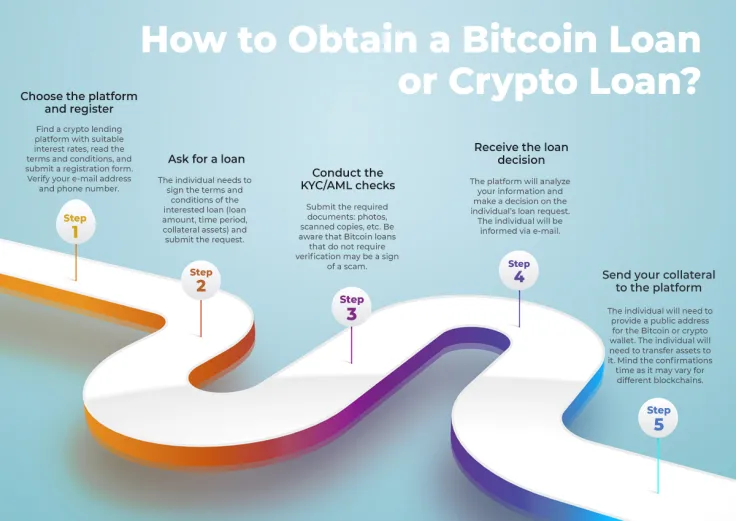

How to Obtain a Bitcoin Loan or Crypto Loan: Explanation

Almost every crypto lending program follows a simple plan that allows you to obtain an instant loan. Acquiring a crypto loan and a Bitcoin loan are two simple procedures.

Step 1. Choose the platform and register.

Find a crypto lending platform with suitable interest rates, read the terms and conditions, and submit a registration form. Verify your e-mail address and phone number.

Step 2. Ask for a loan.

The individual needs to sign the terms and conditions of the interested loan (loan amount, time period, collateral assets) and submit the request.

Step 3. Conduct the KYC/AML checks.

Submit the required documents: photos, scanned copies, etc. Be aware that Bitcoin loans that do not require verification may be a sign of a scam.

Step 4. Receive the loan decision.

The platform will analyze your information and make a decision on the individual’s loan request. The individual will be informed via e-mail.

Step 5. Send your collateral to the platform.

The individual will need to provide a public address for the Bitcoin or crypto wallet. The individual will need to transfer assets to it. Mind the confirmations time as it may vary for different blockchains.

Bitcoin and Crypto Lending Tips

While the crypto lending process looks really unsophisticated, there are some tips that an individual needs to keep in mind.

Bitcoin and Crypto Lending: Mind Safety

Beware of phishing! Double-check the domain name and HTTPS encryption. Every fair crypto lending platform should utilize them. Avoid offers with ultra low or zero interest rates when borrowing, and ultra high interest rates when lending.

Bitcoin and Crypto Lending: Mind Volatility

Always remember that with every crypto, both the individual’s loan and collateral could be subject to high levels of volatility. This could result in an individual losing the initial amount of money collateralized or borrowed.

Bitcoin and Crypto Lending: Mind Private Keys

Don’t submit private keys, passwords, or two-factor authentication codes to service administration. Such requests typically mean phishing attempts.

Top 3 Crypto Lending Platforms

The top crypto lending platforms are usually characterized by their stellar reputation, high interest rates, and minimum sign-in requirements. The top 3 within the crypto lending sphere are Celsius Network, YouHodler, and BlockFi.

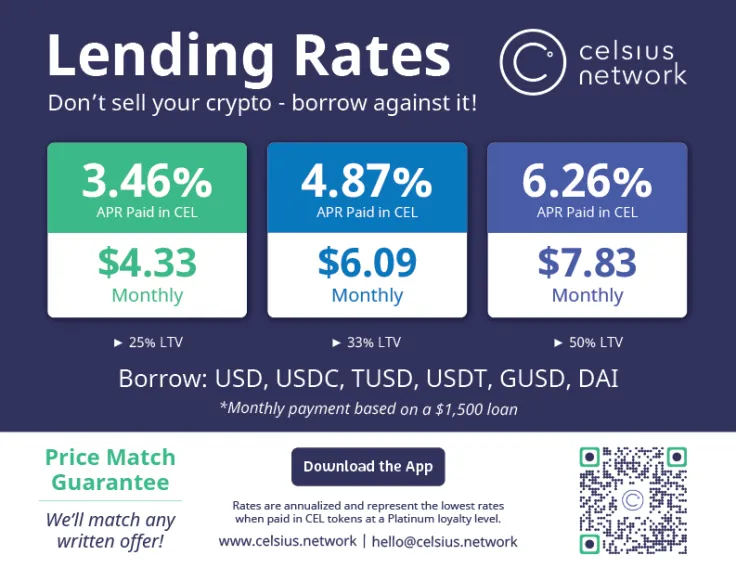

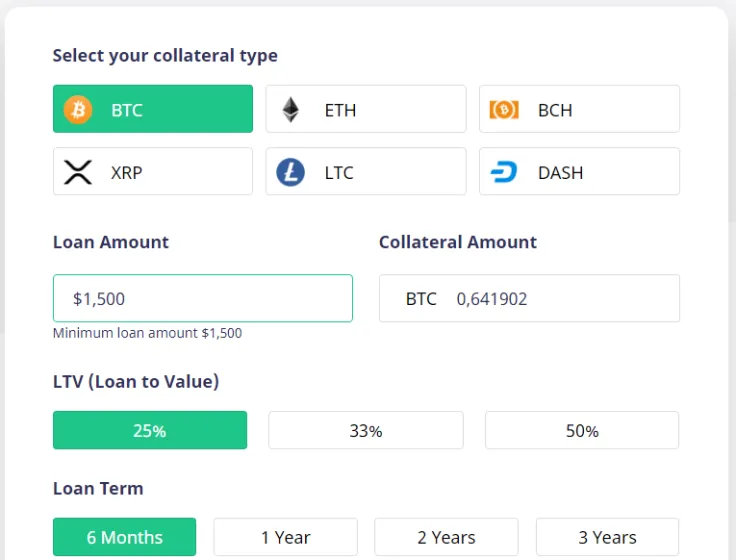

Celsius Network

Celsius Network is a UK-based crypto lending platform. Launched in 2017, Celsius Network is a crypto wallet and mobile application. It offers multiple crypto-backed loans allowing members to borrow fiat or stablecoins against their digital assets on customizable terms.

With Celsius Network, every hodler can earn up to 10% APR weekly on 25 different crypto assets. Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Dash (DASH) and Eos (EOS) can be used as collateral.

Additionally, Celsius will price match any written offer for cash loans.

Interest rates start at around 3,7 %. Celsius Network offers a brilliant loan-to-value ratio in the range of 25-50%.

Pros: Straightforward registration, wide range of interest rates, cash loans, no minimum deposit, no maximum caps, no lockups, and no fees.

Cons: Fully centralized platform.

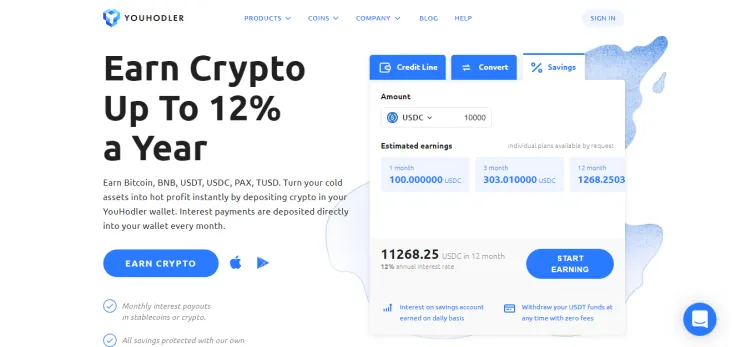

YouHodler

YouHodler is crypto lending platform that was launched as a cold/hot crypto storage in Q1 2018. Crypto loans have been available since January 2019.

YouHodler delivers two classic passive income services (crypto earnings and crypto loans) and two high-risk options within the crypto margin lending sphere (TurboCharge and MultiHODL).

A passive income can be earned not only from stablecoin deposits (with PAX, USDT, USDC and TrueUSD), but also from those with Bitcoins (BTC) and Binance Coins (BNB). Interest rates range between 3% with BTC and 12% with stablecoins.

The crypto loans segment provides an attractive loan-to-value ratio (LTV). Using 1 BTC as collateral, an individual can obtain a Bitcoin loan for an amount up to 90% of the actual BTC price. YouHodler has 2-4% fees, so, free Bitcoin loans are not available here.

With TurboCharge mode, you can enjoy high-risk borrowing when you obtain a chain of Bitcoin loans.

MultiHODL mode provides an individual with the ability to leverage his/her earnings just like with margin trading. The maximum leverage is 6.5x.

Pros: Low entry barrier, high interest rates, high LTV ratio, and the availability of numerous altcoins.

Cons: Cyprus is a shady legislation, and users from the U.S. and China are not allowed.

BlockFi

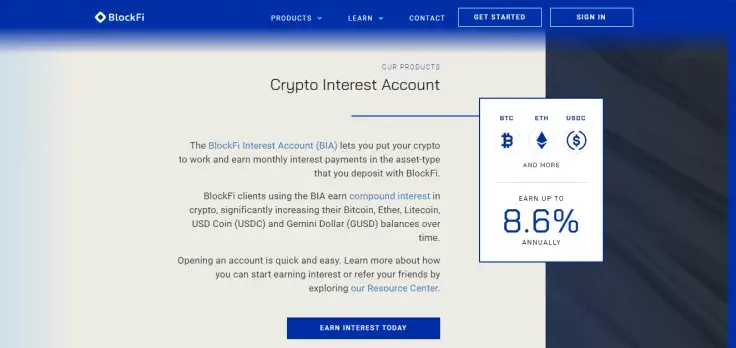

BlockFi is a USA-based crypto lending platform. Launched in 2017, BlockFi offers two main products - BlockFi Interest Account (BIA) and BlockFi Crypto Backed Loan Account.

Using the former, an individual can earn 6% compounded interest on his/her Bitcoin (BTC) and Ethereum (ETH) deposits.

With crypto-backed loans, an individual can deposit Bitcoin (BTC), Ethereum (ETH) or Litecoin (LTC) in order to receive a loan in US Dollars. It’s possible to loan an amount worth up to 50% of the deposited assets.

The interest rates start around 4.5%. BlockFi is only available with a collateral minimum of $15,000 USD.

Pros: Straightforward registration, high interest rates, attractive regulations, and no need for native tokens.

Cons: Fully centralized platform, extremely high collateral minimum, and flexible interest rates.

Comparison of the TOP 3 Crypto Lending and Bitcoin Loan Websites

| Loan-to-Value | Interest Rates | Native Token | Assets | Registered | |

|---|---|---|---|---|---|

| Celsius Network | 50% | >3,7% | CEL | 25 | UK |

| YouHodler | 90% | >4,5% | No | 16 | Cyprus/Switzerland |

| BlockFi | 50% | 3-12% | No | 5 | USA |

Top 15 Crypto Lending and Bitcoin Loan Websites

-

Celsius Network. A crypto financial platform with a good reputation. 25 assets are available for passive income. 7 of the assets (Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Dash (DASH) and EOS (EOS) can be accepted as collateral. Loan-to-value ratio between 25-50%.

-

YouHodler. A multi-purpose crypto lending platform with 16 available assets. Crypto margin lending with a 6.5% leverage. Very high Loan-to-Value (LTV) ratio. 3-12% interest rates.

-

BlockFi. The U.S.-based crypto lending platform has two main products - BlockFi Interest Account (BIA) and BlockFi Crypto Backed Loan Account. Relatively low loan-to-value and interest rates. No native tokens required.

-

Biterest. A peer-to-peer LocalBitcoins-like lending platform. Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP) are available. Refunds in US Dollars (USD) Russian Rubles (RUB), and Ukranian Hryvnias (UAH). High interest rates.

-

BTCPop. A peer-to-peer crypto banking platform with crypto lending as its focus. Staking pools and wallet services are also available. Very shady registration on the Marshall Islands.

-

CoinLoan. A peer-to-peer crypto lending platform. Relatively high loan-to-value ratio (70% average). Refunds in Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) are available, as well as in stablecoins. Small service fees (10 EUR). Shady registration in Estonia.

-

Crypto.com. A multi-function crypto trading and storage platform. High interest rates. Requires native tokens (MCO and CRO). 16 available assets. Low LTV ratio. Loan refunds in PAX and TrueUSD.

-

Ethlend. A crypto lending marketplace for ERC-20 (Ethereum-like) tokens. Highest assortiment of collateral tokens (30+) with loan refunds in Ethereum (ETH), native token LEND, and three stablecoins. High interest rates from 6% to 24%. Relatively low LTV ratio up to 50%. Shady registration in Estonia.

-

Fulcrum. A crypto lending platform for ERC-20 tokens with an emphasis on margin lending. Leverage is up to 4x. Requires an Ethereum-friendly wallet extension. Relatively low interest rates (up to 7.8%). Good registration in the State of Delaware (U.S.).

-

Kiva. A non-profit organization for charity loans. Loans are directed to charitable causes, such as developing countries, refugees, low-income people. Credits are guaranteed by partnered banks. Registered in San Francisco, California (U.S.).

-

Lendabit. A peer-to-peer platform, with Bitcoin (BTC) and Ethereum (ETH) as accepted collateral. Credit lines in fiat money. Integrated BitGo wallet and trading services. Only USDT refunds.

-

Lendingblock. One of the few lending platforms built for institutional investors. Provides users with API features and a couple of professional investment tools. Works with Bitcoin (BTC), Ethereum (ETH), and with PAX and USDT stablecoins. Incorporated in Gibraltar, which has a shady legislation.

-

Nebeus. A crypto lending platform with high interest rates and a low entry barrier of 250 EUR. Accepts Bitcoin (BTC) and Ethereum (ETH) as collateral. Loan refunds are available in EUR, USD and GBP. Relatively high LTV (72%). Works with credit cards. Incorporated in Canada.

-

Nexo. One of the oldest crypto lending services. 45+ fiat currencies are available for lending. Has its own NEXO token. Numerous coins are accepted as collateral: Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Ripple (XRP), Binance Coin (BNB), Stellar (XLM), and EOS. NEXO credit card can be used for deposits and withdrawals.

-

Salt Lending. A platform with extremely high interest rates (up to 16.25%) and low LTV (30-70%). Accepts 8 cryptocurrencies and 4 stablecoins. Requires SALT native token. Registered in the U.S.

Best Crypto Lending and Bitcoin Borrowing Sites for 2019

According to our previous article, here’s how the list of top crypto lending services looked in 2019:

-

Lendabit.

-

Biterest.

-

Celsius Network.

-

HODL Finance.

-

BTCPOP.

-

Salt Lending.

-

Kiva.

-

Bitbond.

-

ETHLand.

-

Nebeus.

Crypto Lending and Bitcoin Loans: Highlights

-

Crypto lending is a procedure of obtaining a loan against a collateralized amount of crypto.

-

Crypto lending platforms are used to verify KYC/AML, organize interactions between lenders and borrowers, and to store their funds.

-

The conditions for crypto lending may vary in terms of interest rates, toolkits of collateralized crypto assets, instruments for loan transfers (stablecoins, cryptocurrencies, fiat currencies), loan-to-value ratios, minimum amount for a loan, and approved legislations.

-

The one who asks for the loan should be ready to provide all the KYC information and credit history.

What do you think about crypto lending? Tell us in Comments!

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov