Investors are paying top dollar in order to get exposure to Ethereum (ETH) via Grayscale's Ethereum Trust (ETHE).

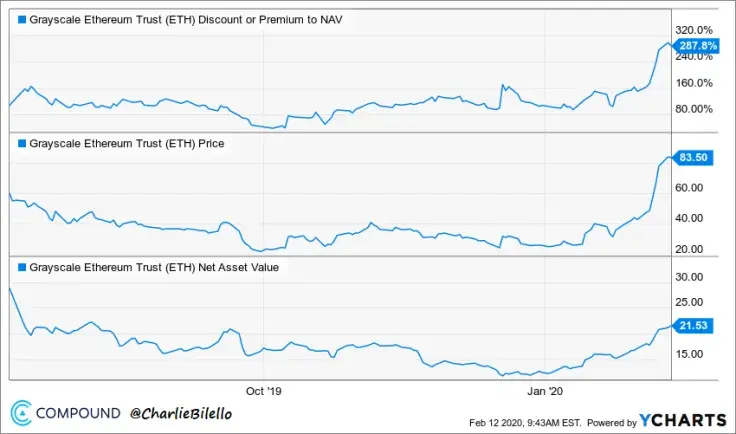

According to Charlie Bilello, the CEO of Compound Capital Advisors, the shares of the trust are currently trading at a 287 percent premium to the net asset value (NVA).

Investors in the Ethereum Trust are paying $83.50 for underlying assets worth $21.53, a 287% premium to NAV. $ETHE pic.twitter.com/OyzDOFynLy

— Charlie Bilello (@charliebilello) February 12, 2020

Wait, is someone buying Ethereum at $830?

Considering that one share of the Ethereum Trust is worth less than 10 percent of Ether, buying them at $83.50 a pop means that investors are paying an insane price for the cryptocurrency that is currently trading at $257 on spot exchanges.

While it might seem unappealing, there seems to be no shortage of buyers who are willing to accept such a trade-off. According to Grayscale's latest update, it has more than $3.2 bln of assets under management.

Accredited investors can acquire publicly traded Grayscale shares in a convenient way without worrying about custody solutions or regulatory issues. As reported by U.Today, ETHE obtained approval from FINRA back in May, which opened the doors for mom-and-pop investors.

The crown jewel of Barry Silbert's Digital Currency Group also recently became an SEC-reporting company, thus reaching a major milestone for the cryptocurrency industry.

Ether price goes through the roof

That said, such ridiculously high premiums are seen only during the periods of FOMO with products that have a significantly lower level of liquidity compared to the Grayscale Bitcoin Trust (GBTC).

The price of Ethereum has so far surged by almost 100 percent in 2020. During the peak of the previous crypto market rally in June 2019, there were those who bought Ethereum at $6,000 in the form of at least one ETHE share.

At that time, Ethereum was changing hands at $350.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya