Grayscale Investments fund has acquired another mind-blowing amount of cryptocurrencies in just 24 hours: $0.9 billion in digital assets.

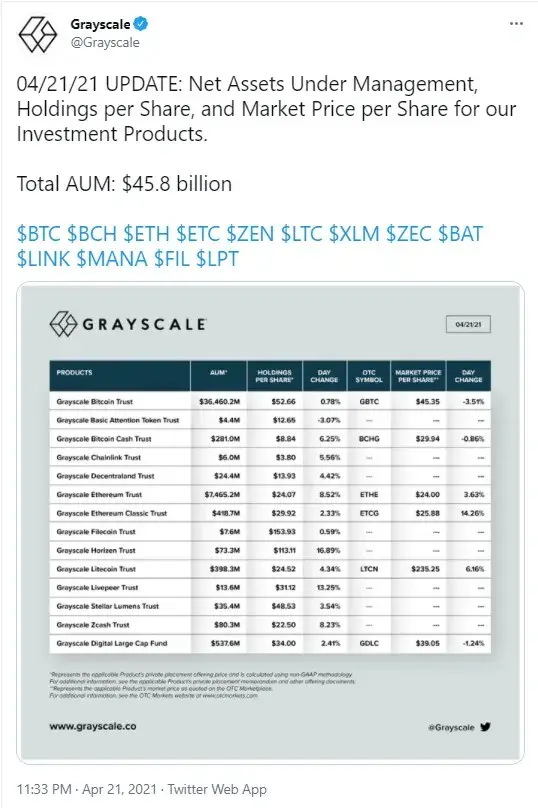

As of April 21, the company holds $45.8 billion worth of Bitcoin and other cryptos.

Grayscale adds big amounts of altcoins

Data from analytics service Bybt indicates that Grayscale has bought more altcoins to add to its holdings, which are massive already.

As of April 22, the company has purchased 519 ZEN, 967 LPT and 29,990 LINK.

Also, over the past seven days, Grayscale has acquired 71,035 XLM and 2,965 ZEN, along with the altcoins on which the five recently launched trusts are based:

MANA: +278,206

LPT: +20,145

FIL: +3,525

LINK: +42,506

BAT: + 259,424

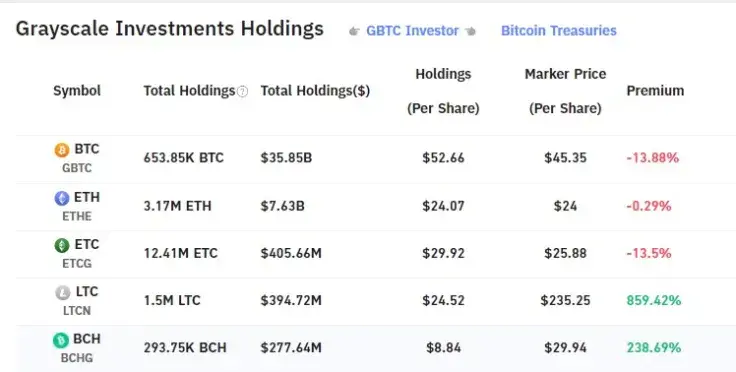

LTC and BCH premiums show eye-twitching surge

While premiums for the Bitcoin Trust, Ethereum Trust and ETC Trust remain negative (-13.88% for GBTC, -0.29% for ETHE and -13.5% for ETCG), the premiums that LTC and BTC products are trading at have demonstrated a massive spike.

Litecoin Trust shares (LTCN) are trading at a whopping 859.42 percent premium ($235.25 per share vs. $24.52 NAV) and Bitcoin Cash Trust shares (BCHG) are changing hands at a +238.69 percent premium ($29.94 per share vs. $8.84 NAV).

Extremely high Grayscale premiums indicate overbought products, showing that investors are beginning to lock in their profits.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin