Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

John Todaro, the head of research at TradeBlock and a former Citi bond, believes DeFi on Ethereum is going mainstream.

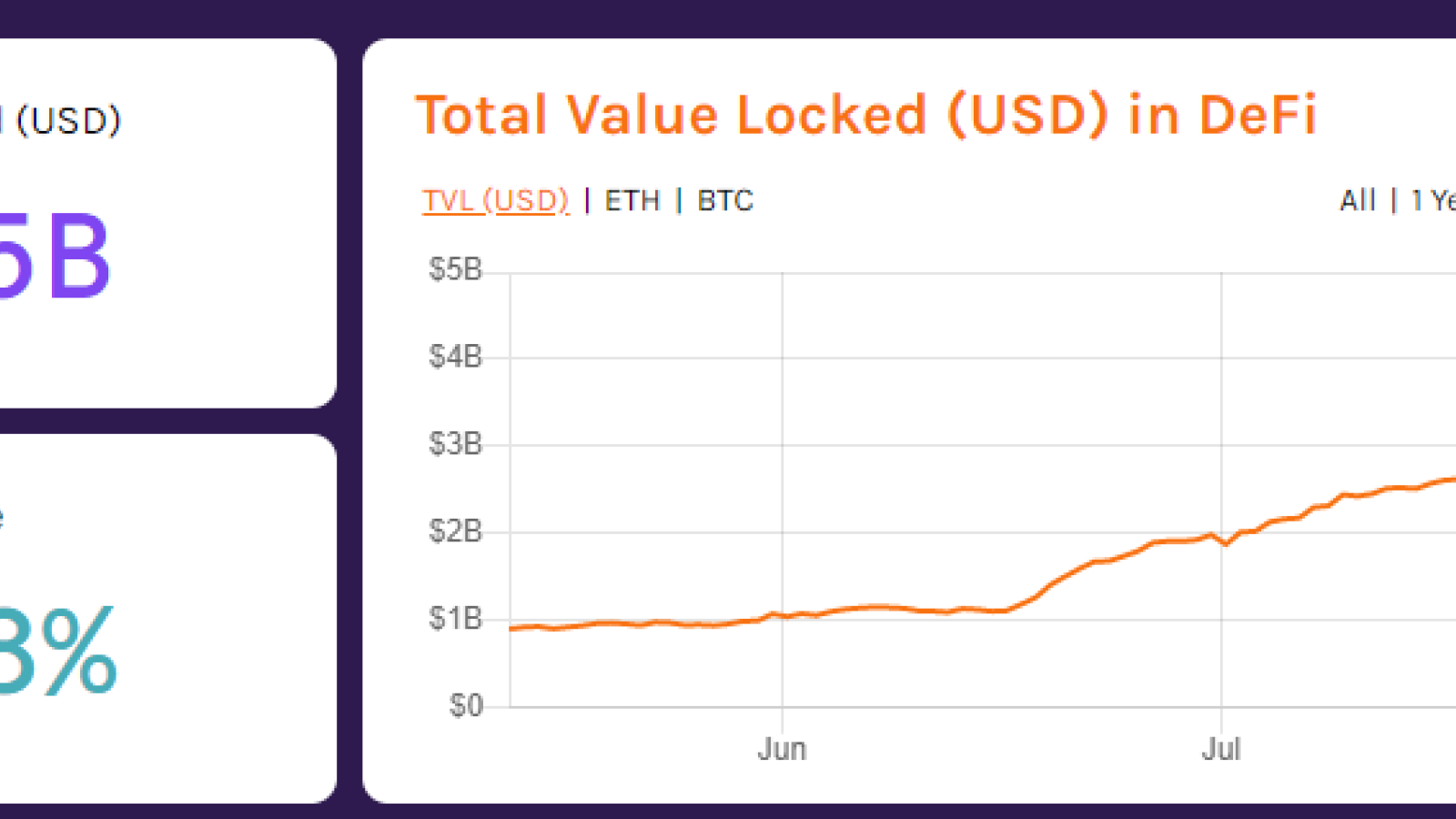

DeFi, short for decentralized finance, has seen exponential growth in the second half of 2020. Since June 1, data from Defipulse show that total value locked in DeFi protocols rose by over $3.4 billion.

He said:

“DeFi is going mainstream. This all bodes very well for Ethereum.”

Why the rapidly-growing DeFi market immensely improves Ethereum outlook

With the start of the Compound DeFi protocol in early June, the demand for DeFi services spiked noticeably. Up-and-coming protocols, including Aave, Balancer, and Curve Finance already have $250 million to $500 million value locked.

The fast-paced growth of the DeFi space could continue to boost the outlook of Ethereum. Researchers at TradeBlock emphasized since 2019 that users generally utilize Ethereum on DeFi platforms as collateral. As such, to gain access to DeFi services, users typically purchase Ethereum.

The researchers noted last year:

“Year-over-year, the average monthly growth rate in net new ETH added across DeFi platforms stood at ~17%. In the figure below we diagram the amount of net ether (ETH added subtracted by ETH removed) flowing into DeFi platforms each month. Over the last year, more than 125,000 ETH, on average, were added across DeFi platforms each month.”

On average, the researchers found that around 125,000 ETH was added to DeFi platforms every month in 2019. At a price of $390, that is nearly $48.75 million in new capital per month.

In 2020, that figure rose substantially as the demand for both DeFi and Ethereum soared. From July 1 to July 31, value across DeFi platforms surged from $1.87 billion to $3.91 billion.

In a single month, the DeFi space added more capital than in the entirety of 2019.

If the upward trend of DeFi continues, by the fourth quarter of 2020, the researchers said the demand for Ethereum could exceed new supply. They said:

“Our conservative projections demonstrate that in November 2020, the demand for ether, just from DeFi services, could outstrip new supply. There are also various other decentralized applications (dApps) that could result in further demand for ether such as games, medical dapps, and others.”

The lacking puzzle is ETH 2.0

There are two optimistic narratives buoying the sentiment around Ethereum. First is the positive trend of the DeFi space, and the second is ETH 2.0. As cryptocurrency investor Andrew Kang explains:

“The best time to maximize exposure to DeFi was last year. The best actionable time is now. Prices have increased, but so has conviction.”

As U.Today previously reported, developers described the Medalla testnet of phase 0 of ETH 2.0 as an “excellent experience.” Medalla is the final testnet of ETH 2.0 before the main launch.

The demand for both DeFi and Ethereum appears to be increasing, but the missing element is scalability and blockchain capacity. Ethereum faces competition in the proof-of-stake (PoS) space, against blockchain networks that include Cardano and Cosmos.