Our recent financial analysis highlight about short-term Ethereum price prediction was the following:

We estimate that, due to the liquidity diminishing as we get closer to the Christmas holiday season, a moderate move up to the price level of $125-$150 is possible. The cryptocurrency has fallen significantly, and while we favor trading with the trend, a dominant downtrend with the possibility of a moderate move up is our basic scenario for the rest of December 2018.

At the end of December the price of Ethereum is at $132.35 validating our forecast on Ethereum price predictions for the remaining of 2018. Was it luck? It could be as we cannot claim that our Ethereum predictions can be accurate or be any sort of financial advice or recommendation. What lies ahead in 2019 for Ethereum and the cryptocurrency market?

Ethereum price prediction 2018

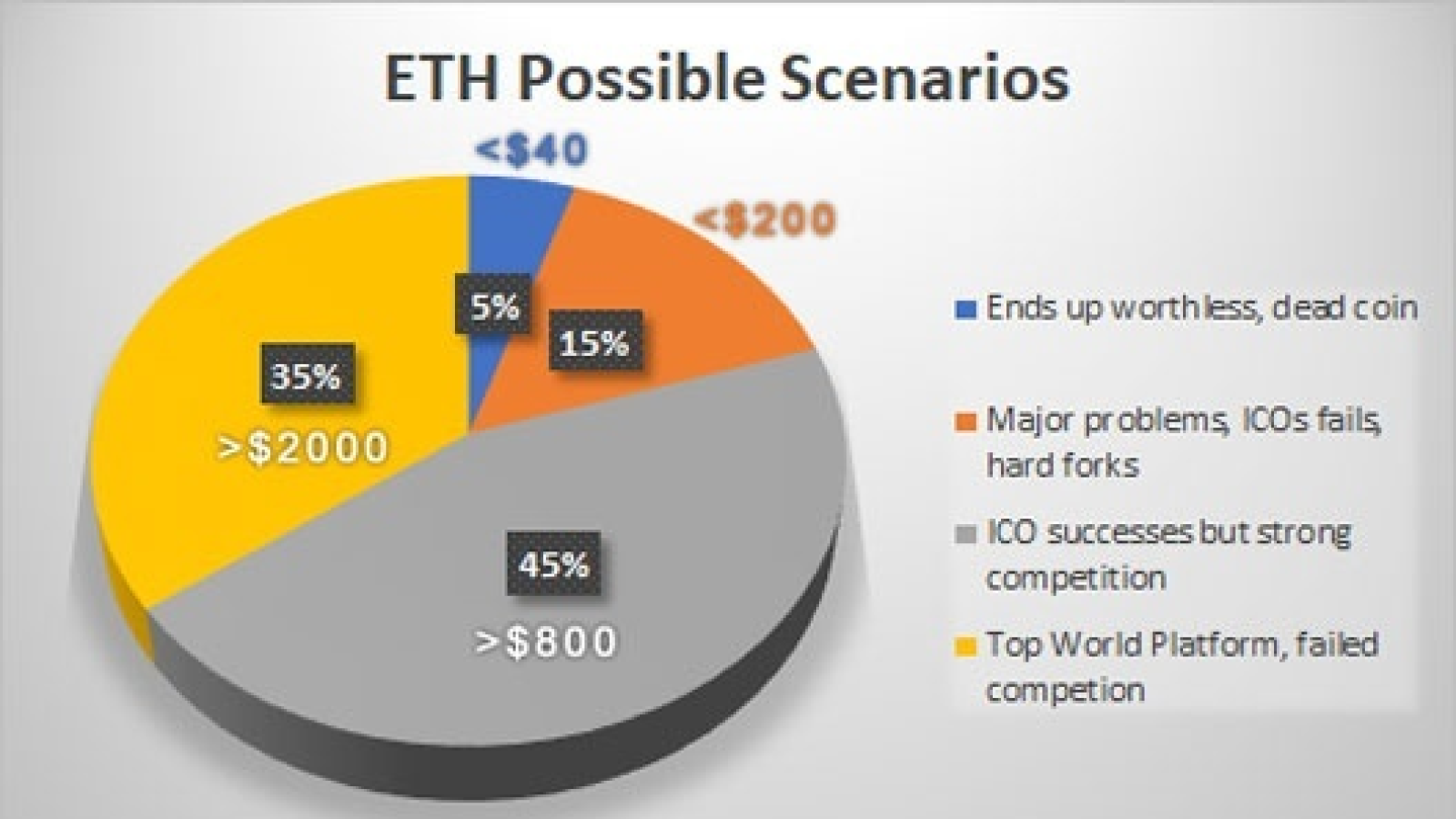

Some of the price predictions 2018 and beyond are the following ones:

The current technical structure will remain negative as long as the price is below $515, but a successful 2-hour close above this level may perhaps decrease the current bearish pressure and open the doors for a fresh upward wave. On the flip side, the recent low of $477.31 may act as a decent support, the next buy zone being around $450. Overall Ether could consolidate in the short term, but it remains at a risk of more losses until there is a break above $515 Aayush Jindal

· $1000 price target by Joseph Raczynski

· $1400 price target by Clem Chambers

· $2500 price target by Nigel Green. He mentioned that

The price of Ethereum is predicted to increase significantly this year, and could hit $2,500 by the end of 2018 with a further increase by 2019 and 2020 … This general upswing will be fueled by three mains drivers. First, more and more platforms are using Ethereum as a means of trading. Second, the increased use of smart contracts by Ethereum. And third, the decentralization of cloud computing.

With a recent price of $132.35 the above opinions about Ethereum forecast prove that any attempt to make a reliable Ethereum price prediction 2018 is very hard if not impossible.

Ethereum price prediction 2019

A wide range of values related to Ethereum price forecast in 2019 follows by nine experts in the cryptocurrency market:

1. Matthew De Silva: Close to $0.

2. Joseph Raczynski: Ethereum will hit $1,200 by Q4 2019. This is a huge increase from the current price of about $133.

3. Tom Lee: $1900 by the end of 2019, again a very large increase.

4. Nigel Green: $2500 with a further increase in 2019 and 2020. An optimistic view.

5. Brian Schuster: $10,000 or even $100,000, if it replaces gold as a store of value. A very optimistic view.

6. Jeff Reed: Ethereum is more valuable than Bitcoin. No specific price target was given but the main concept is that over time Ethereum will be larger than Bitcoin in terms of market capitalization which measures the total value of the cryptocurrency.

7. Ian McLeod: Ethereum will be on an overall upward trajectory throughout 2019. He estimates “Ethereum to hit $500 by the end of 2018 and go on an overall upward trajectory throughout 2019.”

8. Chris McClure: Ethereum is overdue for a rally going into 2019. Again, no specific price target was given.

9. Fred Wilson: Ethereum feels like the easiest one to make a bull case for right now.

No price target was given.

All these predictions appear very optimistic so the main question to ask is what will be the catalysts that could drive the price of Ethereum to these high levels? A wider business adoption and broader business solutions could be an important factor and regulation issues are another aspect to consider.

Ethereum price forecast 2019

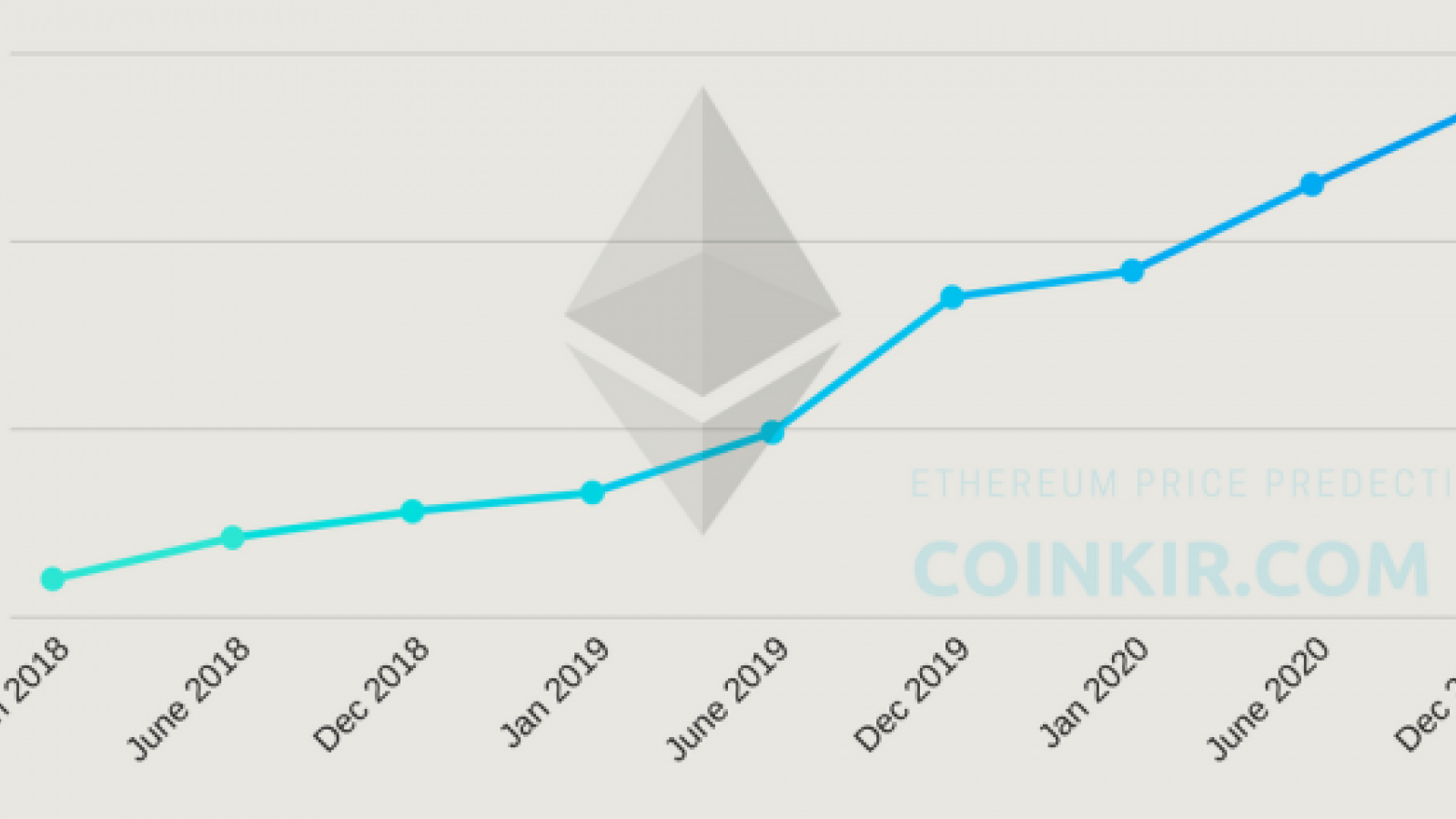

A more conservative range of Ethereum projections is that “By the end of next year that is 2019, it is expected that Ethereum would be somewhere around $ 500. Similarly, by the end of the year 2020, it is assumed that Ethereum would be around $ 2,000.”

If the target price of $500 by the end of 2019 is reached this will represent a return of about 275% compared to the price of Ethereum at $133 as od December 23, 2018. A very large price appreciation indeed.

What about the years 2020 and beyond? What are the Ethereum predictions for a longer time frame?

Ethereum price prediction 2020

A range for the closing prices is for $81 in January 2020 and $186 in December 2020.

A more optimistic view by analyst Bobby Ullery is that Ethereum will be worth $11,375 in 2020 based on his model which places emphasis on fundamental factors such as the broader adoption of Blockchain technology in the financial and business sectors worldwide.

Can we even try to predict the Ethereum price up to 2025? The answer is yes, but this will be only an opinion without any sort of investment recommendation whatsoever.

Ethereum price prediction 2025

A price prediction made by Cryptoground.com is that in 5 years the price of Ethereum will be at $1,487.3665. A second opinion is the optimistic scenario of the Ethereum reaching its historical high in 2025, without any specific target price given because it will a top platform for Dapps. A business catalyst that could indeed support price appreciation.

But what about our technical analysis and Ethereum price prediction for 2019?

card

Ethereum technical analysis for 2019

While it is almost an impossible task to make an accurate prediction for the price of any financial asset and despite the fact that our price target of $125-$150 was reached in December 2018, the following technical analysis is only an opinion on where the price of Ethereum may be at some point of time in 2019.

These are our key points to consider:

· A short-term bottom, in fact, a double bottom has formed at the $83 level. A rally has followed that took price to the level of $139, a 67% increase from the bottom. This is positive as the rally occurred within only seven days.

· The latest downtrend that moved price from the swing high price of $225 to the swing low price of $83 has ended and reversed to a current uptrend, evidenced by the latest higher highs and lows observed. Also, the ADX/DMI indicator which measures the strength of the trend has shown a loss of momentum for the former downtrend, plus the value of +DI line is at 29.52 higher than the value of -DI line at 15.53, which confirms the act that now the dominant trend is an uptrend.

· The daily Bollinger bands are currently at $74.03 and $135.47 for the lower and upper band respectively. A resistance at the upper level should be expected.

· The 50-period, 20-period and 200-period exponential moving averages are declining and are at $132.70, $109.02 and $271.64 respectively.

· A sustained period of closing prices above the 50-period exponential daily moving average or above the $132.70 level is considered positive for further future gains.

· Important support levels are at $83, $105 while important resistance levels are at $173, $190, $202, $208 and $270.

· A price target for 2019 if the current uptrend is to continue would be the range of $190-$270. This is because there was a period of consolidation at the $190 level for many days and at $270 is now the 200-period exponential daily moving average that professional and institutional traders monitor closely.

· We do not think at this moment that 2019 will skyrocket the price in the absence of important fundamental catalysts. In fact, on the weekly chart, the upper Bollinger band is currently at $330 and this could be another price target as well. But we prefer to express a more conservative price range, so we will remain with our $190-$270 price range.

The Ethereum as the majority of cryptocurrencies exhibits increased volatility and its price can move either higher than our price range or lower. If the support of $83 is tested again and does not hold then there are not any important support levels below it.

2019 may be either a different year for the cryptocurrency market compared to the collapse of major cryptocurrencies in 2018, or a continuation of the selloff experienced during all year 2018. Time will tell.