Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Even though the cryptocurrency market is bullish, some coins have already entered the correction phase.

ETH/USD

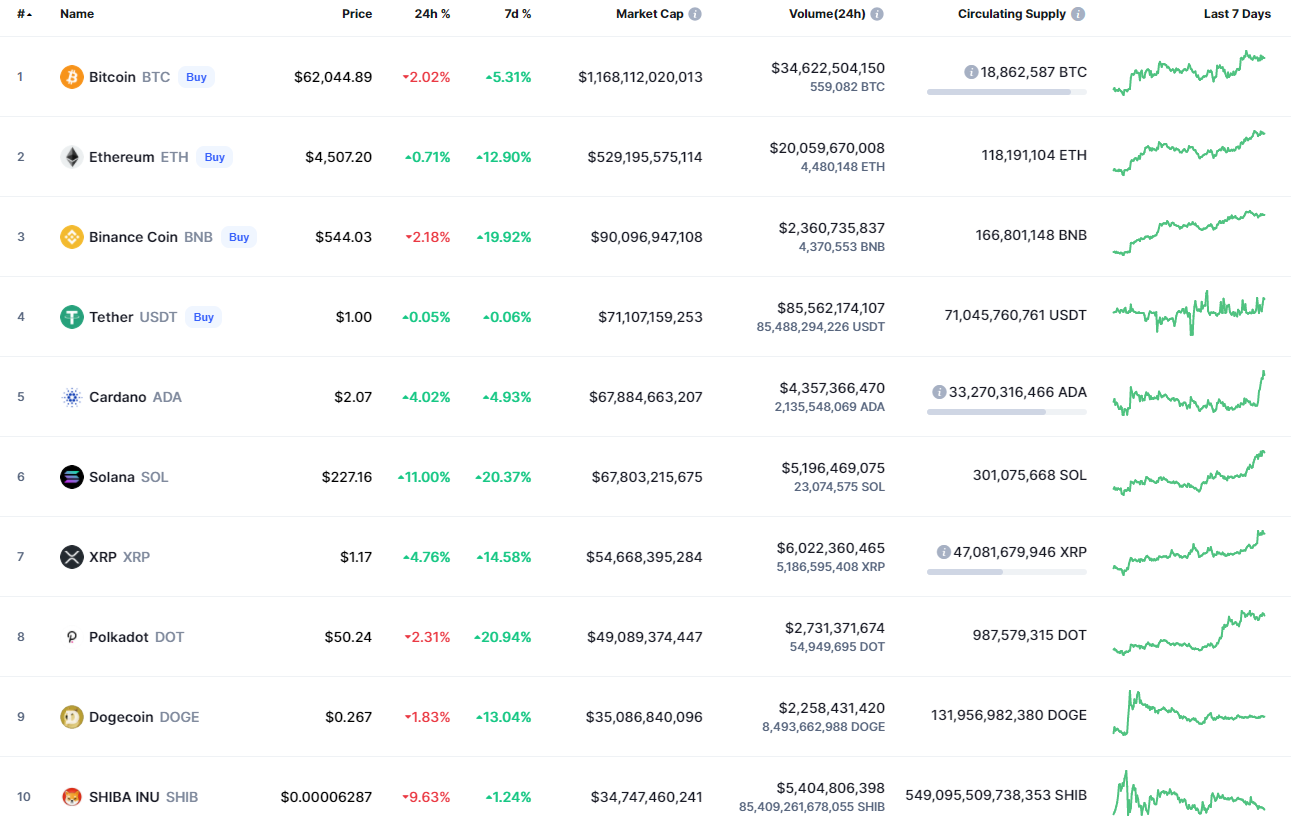

The rate of Ethereum (ETH) is almost unchanged since yesterday. The price rise has increased by 0.86% over the last 24 hours.

On the hourly chart, Ethereum (ETH) has touched the zone of the most liquidity around $4,500, which means that bulls may have gained enough power for continued growth. In this case, the main altcoin may come back to the resistance at $4,591 by the end of the day.

At the moment, trading volumes have decreased, and the price has retraced slightly. One believes that sellers can push the pair back to the zone of yesterday's high, and then growth may resume to a new historical maximum around $4,700.

Ethereum (ETH) made a false breakout after setting a new peak at $4,643. The selling volume is low, which means that the current decline might be considered as a pullback before further growth.

However, one may expect the price to drop to the nearest support level at $4,375, followed by a fast bounceback.

Ethereum is trading at $4,497 at press time.

Godfrey Benjamin

Godfrey Benjamin Gamza Khanzadaev

Gamza Khanzadaev Caroline Amosun

Caroline Amosun