The number of Britons who hold cryptocurrencies more than quadrupled in the last few months to surpass 21.6 percent. These U.K. residents face new tax issues. Read to discover how two leading fintech startups collaborate to streamline tax data.

New epoch of crypto taxation for the U.K.

Financial authorities and watchdogs recognize Bitcoin (BTC), Ethereum (ETH) and Dogecoin (DOGE) as "assets" and repeatedly made it clear that cryptos should be taxed accordingly. Here is why crypto operations should be included in periodic tax fillings in Great Britain.

Amidst the euphoria around decentralized financial potocols (DeFis), the taxation of crypto operations has become quite sophisticated. In particular, it is valid for reporting the gains of "yield farming" activity and liquidity management. Receiving periodic rewards for staking and saving also represent sensitive use cases.

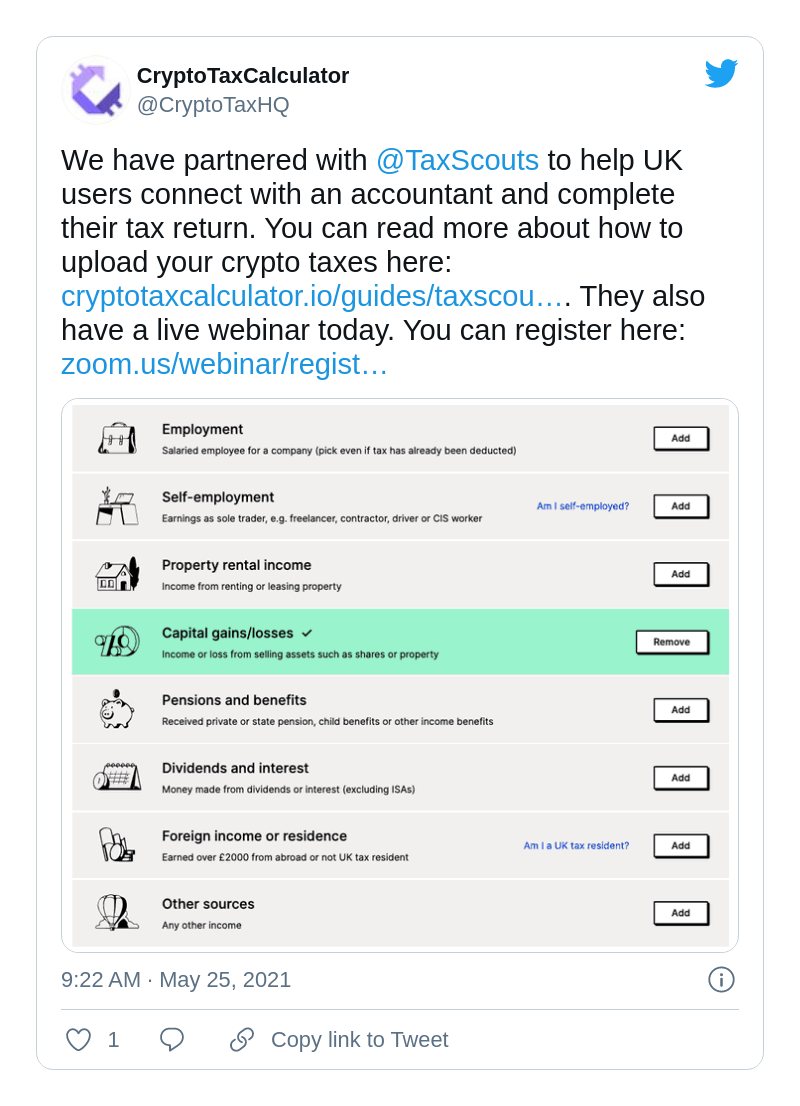

Here is why the partnership of the two fintech teams, CryptoTaxCalculator and TaxScouts, addresses a crucial segment of the cryptocurrency scene. CryptoTaxCalculator tracks the transactional data of crypto accounts that belong to the taxpayer and organizes this data for the needs of self-filers and tax accountants.

In turn, TaxScouts delievers the services of tax accounting and tax return optimization for all U.K. taxpayers, including those who hold and trade cryptocurrencies.

Building cost-efficient bridges between crypto holders and tax experts

The services of both teams are available at reasonable fees. For instance, CryptoTaxCalculator tariffs start at £39/year for 100 transactions or fewer. In fact, this is more than enough for the majority of taxpayers.

For £249/year, the service will track and organize the data for up to 100,000 transactions and taxable events that take place in decentralized financial protocols.

TaxScouts charges £119 for its services, including VAT, last-minute changes and multi-level customer support for every taxpayer. It also has purpose-made solutions for sophisticated and unusual situations.

Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya Arman Shirinyan

Arman Shirinyan