Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Nearing the end of the week, most of the coins are in the red zone.

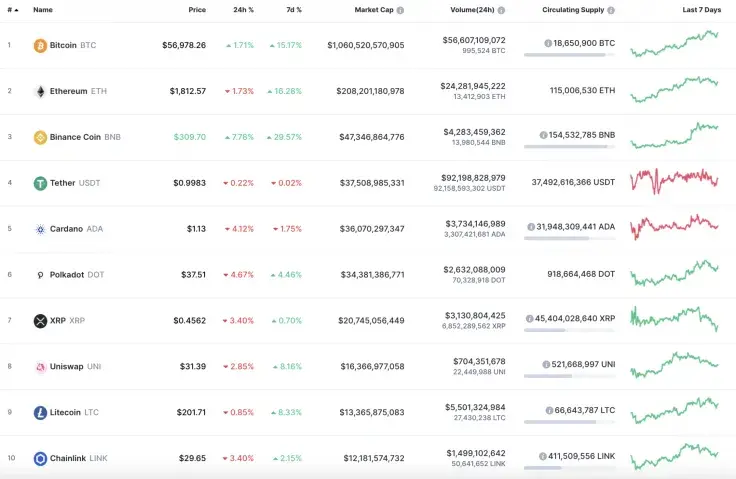

The vital data for Bitcoin (BTC), Ethereum (ETH), XRP, Binance Coin (BNB), Stellar (XLM), Cardano (ADA) and UNI:

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Bitcoin |

BTC |

$1,060,520,570,905 | $56,356.77 | $56,607,109,072 | 0.33% |

|

Ethereum |

ETH |

$208,201,180,978 | $1,792.21 | $24,281,945,222 | -2.46% |

|

XRP |

XRP |

$20,745,056,449 | $0.4518 | $3,130,804,425 | -4% |

|

Binance Coin |

BNB |

$47,346,864,776 | $291.29 | $4,283,459,362 | 2.38% |

|

Stellar |

XLM |

$9,194,323,663 | $0.4027 | $869,504,687 | -3.78% |

|

Cardano |

ADA |

$36,070,297,347 | $1.12 | $3,734,146,989 | -4.91% |

|

Uniswap |

UNI |

$16,366,977,058 | $30.72 | $704,351,678 | -4.01% |

BTC/USD

Bitcoin (BTC) could withstand the short-term bearish wave and remain to trade in the green zone. The price change since yesterday is +0.33%.

Bitcoin (BTC) is slightly approaching the vital $60,000 mark and there are quite high chances of reaching it as the bulls have accumulated enough power for a price blast.

Bitcoin is trading at $56,440 at press time.

ETH/USD

Ethereum (ETH) could not follow Bitcoin (BTC), and the rate of the chief altcoin has dropped by 2.46%.

Despite the decline, the long-term scenario remains bullish as ETH is trading above the vital level of $1,700. If buyers keep dominating, there are high chances of seeing a retest of the resistance at around $2,000 next week.

Ethereum is trading at $1,805 at press time.

XRP/USD

The rate of XRP has gone down much deeper than that of Bitcoin (BTC) or Ethereum (ETH). The price change is -4%.

XRP is not an exception to the rule, as it has successfully bounced off the daily MA 50, which has confirmed the power for a retest of $0.50, most likely next week.

XRP is trading at $0.4537 at press time.

ADA/USD

Cardano (ADA) is the biggest loser today. Its price has decreased by 4.91% since yesterday.

From the technical point of view, Cardano (ADA) has accumulated the strength for a sharp move. If bulls keep the level of $1.11, there are chances for a retest of $1.33.

Cardano is trading at $1.12 at press time.

BNB/USD

Binance Coin (BNB) is the top gainer today. The rate of the native exchange token has increased by 2%.

Binance Coin (BNB) has broken the resistance at $282, having confirmed the bullish trend. However, at the moment, the asset needs to accumulate some time in the range of $300-$320 to keep the growth.

Binance Coin is trading at $293 at press time.

XLM/USD

Stellar (XLM) is also located in a short-term downtrend since yesterday. The drop is 3.78%.

Stellar (XLM) is trading similar to XRP as the coin is still trading above the MA 50 level. If selling volume remains low, the resistance at $0.46 might be tested next week.

Stellar is trading at $0.4049 at press time.

UNI/USD

Uniswap (UNI) has failed to keep the growth as the drop is around 4%.

At the moment, neither bulls nor bears are controlling the situation. However, if bulls remain above the vital $28 level, the resistance at $35 may be tested soon.

UNI is trading at $31 at press time.

Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide Dan Burgin

Dan Burgin