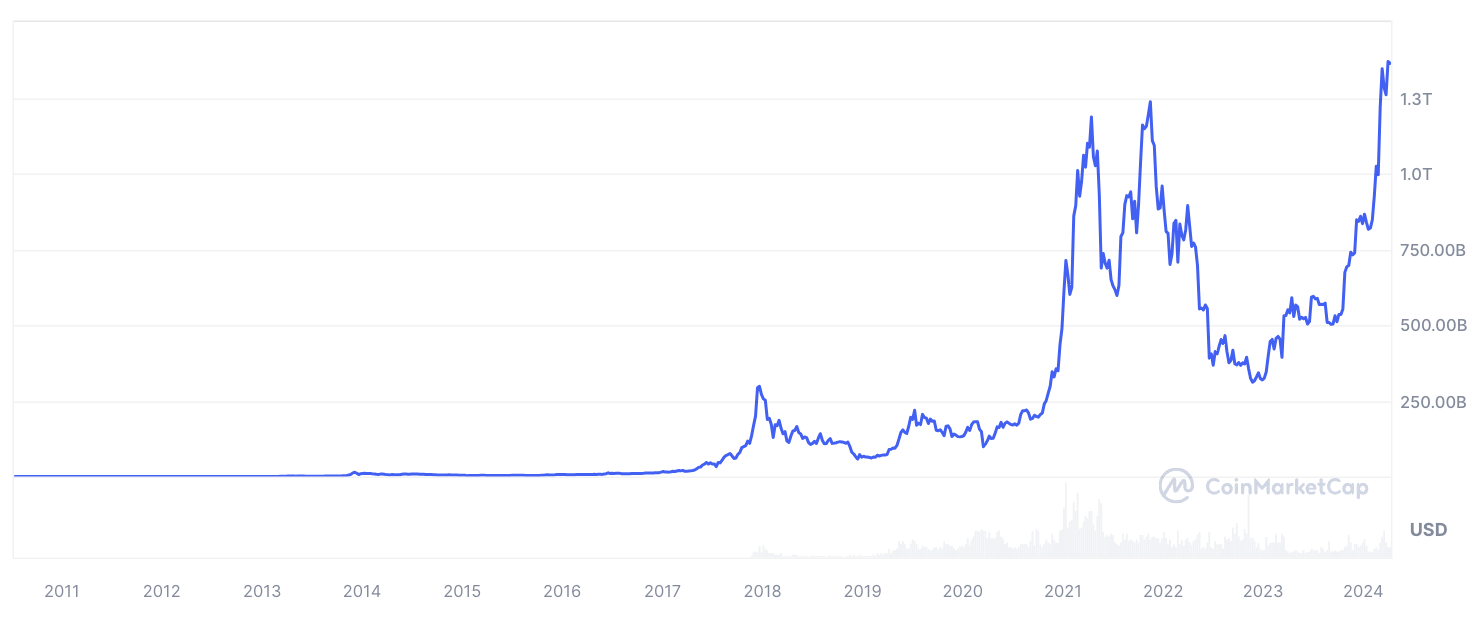

Bitcoin's supremacy over major banks has been underscored by Gabor Gurbacs, strategy advisor at Tether and VanEck. With a staggering market capitalization exceeding $1.3 trillion, Bitcoin stands taller than the top four largest banks in the world combined.

Surpassing banking behemoths like JPMorgan Chase, Bank of America, ICBC, Wells Fargo, Agricultural Bank of China, Bank of China and China Construction Bank, Bitcoin's market cap is 2.4 times larger than that of JPMorgan Chase alone. Such a feat underscores the growing significance of decentralized digital currencies in the global financial landscape.

Gurbacs challenges the narrative surrounding Bitcoin's success, questioning why journalists fail to acknowledge its triumphs while scrutinizing its failures.

Gurbacs emphasized the significance of this milestone, noting that the cryptocurrency's success challenges the traditional banking narrative. He questioned why Bitcoin's resilience is not juxtaposed against the perceived failures of the banking system, particularly when its market cap surpasses that of the top four banks combined.

Bigger than what?

Remarkably, Bitcoin's market capitalization places it among the ranks of tech titans like Amazon and Meta (formerly Facebook), showcasing its influence and relevance in the digital age. This positioning further solidifies Bitcoin's status as a formidable force in both the financial and technological spheres.

The expert also underscores the urgency for institutions, including The Fed, to acknowledge Bitcoin's significance. He asserted that ignorance or disrespect toward BTC is no longer tenable given its formidable presence in the financial landscape.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov