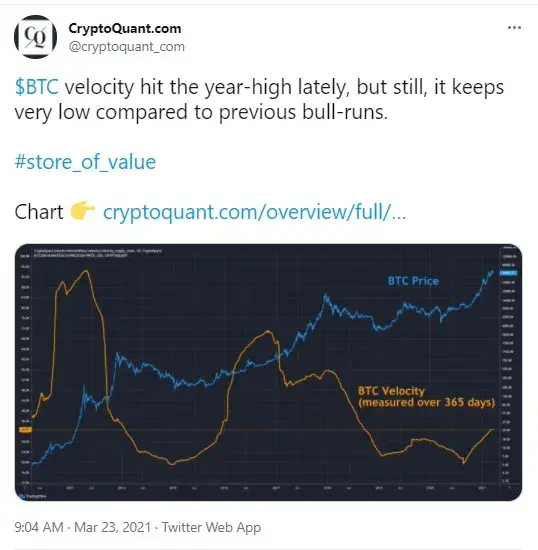

While Bitcoin has continued its recent correction, coming down from the $58,000 level to $53,896 on the Kraken exchange at the moment, Bitcoin's velocity has reached a yearly high.

Still, it remains very low compared to 2017, according to data shared by CryptoQuant. Here’s what it means.

Bitcoin is trending as a store of value

Bitcoin's velocity allows us to figure out how quickly money is circulating in the economy. It shows if BTC is trending toward being used as a store of value or as a means of payment.

A recent tweet by analytics data provider CryptoQuant shows that, despite hitting a yearly high recently, Bitcoin's velocity is still rather low compared to the bull run back in 2017.

Since the flagship crypto's rate of circulation is not high, the trend is toward being a store of value, the data agency states.

Institutional investors hunting BTC as an SoV

This year, corporations and hedge funds' interest in Bitcoin has surged. The use of Bitcoin as a store of value (rather than as a means of exchange) has been emphasized by such crypto influencers as Michael Saylor (MicroStrategy CEO), Mike Novogratz and Anthony Pompliano recently.

As reported by U.Today last week, the company spearheaded by Michael Saylor purchased another portion of approximately 200 Bitcoins. Tesla allocated an astounding $1.5 billion in Bitcoin, and the head of SkyBridge Capital, Anthony Scaramucci, believes that SpaceX also holds Bitcoin on its balance sheet—and Elon Musk owns it personally, too.

Besides, former stockbroker Jordan Belfort—also known as "The Wolf of Wall Street"—has reversed his negative stance on Bitcoin.

He now believes that the flagship cryptocurrency is here to stay and may well reach $100,000 per coin in the future.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin