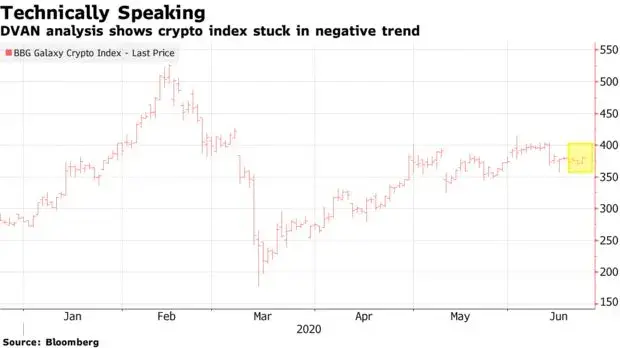

According to the Bloomberg Galaxy Crypto Index, the Bitcoin and other top cryptocurrencies are currently in a negative trend.

The index is struggling to break above the 400 level after numerous days of sideways trading.

Bitcoin and Ethereum comprise 60 percent of the index’s weighting, with XRP coming in third place (20.59 percent).

An arduous resistance level

Miller Tabak & Co's lead strategist Matt Maley states that the Bitcoin price could make ‘a moon shot’ if it manages to break above the $10,000 level:

I must admit, I’m surprised that Bitcoin hasn’t done much recently given some of the speculation that more central banks are looking at cryptocurrencies in general.

The leading cryptocurrency surged to a local high of $10,429 on June 1, but a painful rejection came the following day.

Since then, Bitcoin has so far failed to win back its five-digit price tag.

June 26 might be the day

In today’s chart alert, Kitco’s market analyst Jim Wyckoff noted that this indecisiveness still ‘favored the bulls.’

On June 22, the crypto king surged to an intraday high of $9,631 on the news about PaPal and Venmo planning to offer cryptocurrency to their customers.

While it wasn’t enough of a catalyst for breaching $10,000, the expiration of more than $1 billion worth of Bitcoin options on June 26 is bound to bring more volatility to the market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov