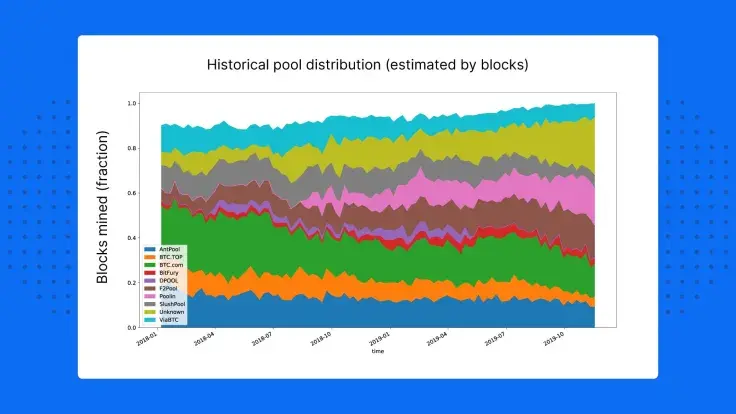

Blockchain, one of the largest companies in the crypto space, has recently analyzed how the distribution of blocks has changed over time among the biggest mining pools. The graph shows that there is still some tough competition and no clear leader.

? Our data science team looked at how the proportion of blocks mined by top pools has changed over the past few years. Encouragingly, there seems to be a large degree of competition across these pools. Check out the latest values of these figures here: https://t.co/WxWJDvmzGG?from=article-links pic.twitter.com/yw7mx4Hizk

— Blockchain (@blockchain) December 3, 2019

Things change fast

BTC.com, which is owned by mining juggernaut Bitmain, ruled the roost during the previous year. However, its market share has dwindled its market share over the last couple of years. According to data provided by Blockchain, BTC.com is now responsible for only 15.5% of mined Bitcoin blocks.

Its crown has been taken by upstart competitor Poolin, which ushered onto the crypto mining back in 2017 as a project started by former Bitmain employees. The pool's meteoric rise, however, only started in late 2018 and steadily continued throughout 2019. As of now, Poolin has a market share of 16.6%, and it's not far-fetched to assume that it could soon become a dominant force in the market.

F2Pool and AntPool take third and fourth places with 14.8 percent and 9.9 percent respectively. Notably, AntPool is the only pool whose market share has been pretty much consistent for the past two years.

It's good for Bitcoin

Unknown pools that are currently responsible for 24.7 percent of all mined blocks are important because they make the Bitcoin network more decentralized.

In the first half of 2018, Bitmain's pools (BTC.com, AntPool, and ViaBTC) became so powerful that they were close to controlling a whopping 51 percent of Bitcoin's hashrate, which could open the doors for a deliberate 51 percent attack to reorganize the blockchain.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov