While naysayers routinely dismiss Bitcoin as another ‘tulip bubble’ that is based on nothing but thin air, PlanB, the Dutch analyst behind the stock-to-flow model, has proven that this insult certainly doesn’t apply to the crypto king in a recent tweet.

He claims that ‘billions and billions’ of dollars are currently flowing into new ASIC miners, which displays the true value of the network.

According to PlanB, this figure can be verified by calculating the required amount of miners and the coin’s energy usage.

An energy-backed cryptocurrency

Back in January, Capriole Investments founder Charles Edwards wrote an article about how Bitcoin was predicted by American industrialist Henry Ford a century ago.

Ford envisioned an energy-backed currency that could not be controlled by international banking groups.

While it was impossible for Ford to translate his plan into reality, Bitcoin is now viewed as its long-overdue realization.

As reported by U.Today, former Wall Street trader Tone Vays believes this is one of the reasons he’s a staunch Bitcoin maximalist.

Bitcoin’s intrinsic value

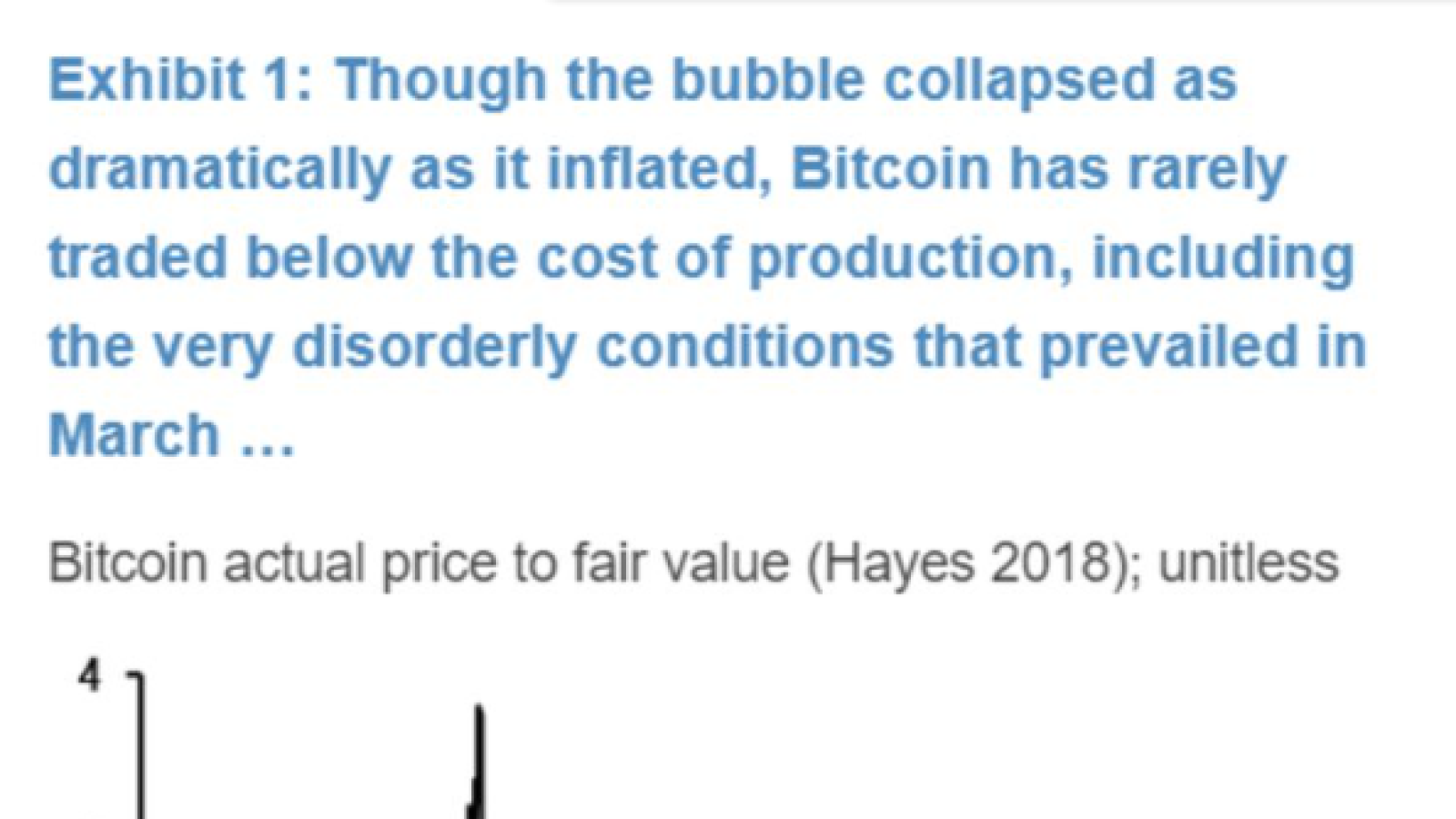

According to JPMorgan, Bitcoin’s intrinsic value equals its cost of production, which went up dramatically after the quadrennial reward cut.

The graph above shows that Bitcoin rarely trades below its average price of mining one coin.