Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Avalanche (AVAX) is experiencing one of its lowest periods in history as many of its holders are recording massive losses, according to on-chain data from crypto analytics platform IntoTheBlock (ITB).

Avalanche plunge

Avalanche was once a prominent digital asset that was a very close rival to Terra (LUNA) prior to the latter's implosion. Avalanche recorded a huge market embrace that pushed its price to a high of $146.22 back in November 2021. Unfortunately, from the current trend, it appears as though the majority of long-term HODLers bought the coin when it hit its all-time high (ATH).

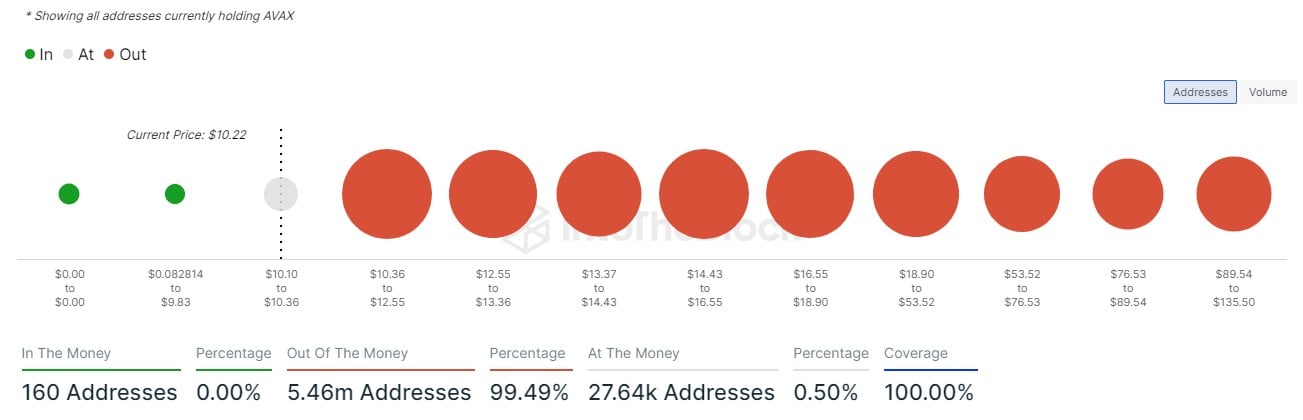

Data from ITB shows that as many as 99% of addresses resident on the Avalanche network are in losses. This percentage accounts for a total of 5.46 million of the total addresses holding AVAX. The data highlights addresses in profit to be pegged at just 160, while those that are making neither profits nor losses, per ITB, are pegged at a massive 27,640 addresses.

For a project as enormous as Avalanche, these data are damning and might notably discourage investors looking to back the blockchain in the near term. The sheer luster being exhibited by Avalanche is based on its current price outlook, which has surged by a marginal 0.98% to $10.22, a price point that is 93% below its ATH.

Despite these losses, Avalanche is still maintaining its stance as the 20th most capitalized coin, an indication that investor sentiment toward it is still robust.

Changing paradigm

Judging by the top protocols in the Web3.0 ecosystem today, Avalanche will need to pivot its technology to embrace more of the trending innovations, like doubling down on its EVM compatibility the way Filecoin did. Additionally, Avalanche may need to explore scaling solutions like Ethereum, while generally presenting itself as an attractive chain for meme coins, NFTs and enterprise adoption across the board.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov