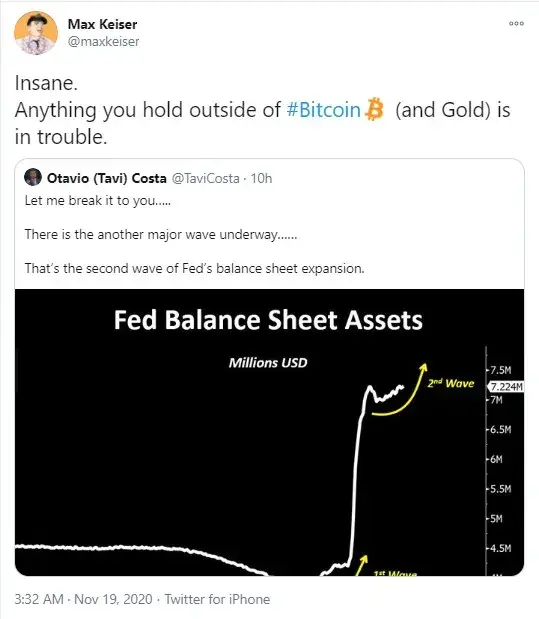

Bitcoin maximalist and Russia Today financial show host Max Keiser has tweeted that, due to another wave of expansion of the Fed's balance sheet, all assets you hold are now in trouble—all, that is, except Bitcoin and gold.

Fed's balance expected to pump to $10 tln in 2021

Economists believe that the U.S. Federal Reserve will continue to expand its balance sheet to provide stimulus measures for the economy and businesses next year as well.

According to SeekingAlpha, the estimated figure for the balance sheet by the end of this year is around $7.4 tln as the Fed is acquiring $25-$30 bln of treasuries and mortgage-backed securities weekly.

Throughout 2020 so far, the Fed's balance sheet has grown from approximately $4 tln to $7 tln.

In 2021, the authors of the article suggest, the figure may expand between as much as $8.5 tln and $10 tln by the time 2021 ends.

We could see the Fed's balance sheet expand to between $8.5 trillion and $10 trillion by the end of 2021 depending on the size of the U.S. budget deficit.

The data has come from the analysis of the Fed's statements and guidance published this year.

After a tweet with a chart regarding this expansion was published on Twitter, Max Keiser commented on it, saying that Bitcoin and gold are the only assets that can be stored safely these days.

Answering a question from a Twitter user, Keiser also shared his firm belief that Bitcoin has a 100 percent chance of becoming the "currency of the world."

Dan Tapiero voices a similar view

Macro investor and cofounder of the Gold Bullion International investment conglomerate, Dan Tapiero, has shared a similar view about the value of Bitcoin and gold amidst the current market instability.

Tapiero referred to low interest rates and a possible rise in more debt issuance. He also spoke of the fact that all fiat currencies—not only USD—are gradually making all cash worthless, apart from the increase of the paper supply in finance.

In this situation, he pointed out, only Bitcoin and gold have a limited supply.

Bitcoin gains another super-wealthy supporter

Bloomberg has reported that the third wealthiest entrepreneur in Mexico, Ricardo Salinas Pliego, holder of an $11.8 bln fortune, had allocated 10 percent of his liquid portfolio into Bitcoin.

The man has stakes in banking, retail and broadcasting businesses, according to data from the Bloomberg Billionaires Index.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin