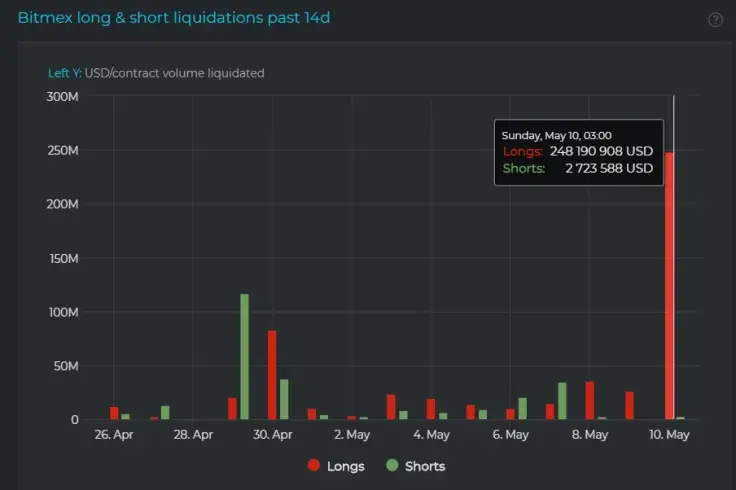

According to Datamish, more than $247 mln worth of long positions has been liquidated on the BitMEX cryptocurrency exchange on May 10 in practically no time.

This massive wipeout happened after the price of BTC tanked 15 percent in minutes.

card

Stairs up, elevator down

After printing seven back-to-back green candles on the weekly chart, Bitcoin was on track to extend its winning streak.

On May 7, the BTC price once again surpassed the $10,000 level on the news about billionaire investor Paul Tudor Jones getting into the crypto game.

However, it didn’t stop Bitcoin from taking a major nosedive three days later. At 0:12 UTC, it started plunging at breakneck speed, taking a $1,500 haircut in a matter of minutes.

At press time, BTC is trading at $8,729 as the bulls and bears continue to play tug-of-war.

Open interest plunges across the board

In the meantime, popular crypto trader Hsaka noted that open interest, the total number of outstanding derivative contracts, nose-dived across major cryptocurrency exchanges, with Binance taking the biggest hit.

OI wiped across the board, with Binance getting absolutely nuked.$BTC pic.twitter.com/nxb50bH9Fw

— Hsaka (@HsakaTrades) May 10, 2020

Notably, Chicago-based CME Group recorded its highest open interest to date (nearly $500 mln) on Friday, which coincided with Jones announcing his Bitcoin bet just one day earlier.

Considering that BTC CME futures closed at $10,030 on May 8, the bulls can hope that the $1,200 gap will be filled in the nearest future.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov