Bitcoin (BTC) has once again found itself at the center of market turbulence, not because of any internal crypto drama but as a direct reaction to the macroeconomic situation. U.S. markets opened with a "hangover" pullback following yesterday’s strong rally, as early optimism surrounding the 90-day pause in tariff hikes faded for a moment.

Investors shifted focus toward the bigger picture — specifically, the growing friction with China and its longer-term impact on the global economy.

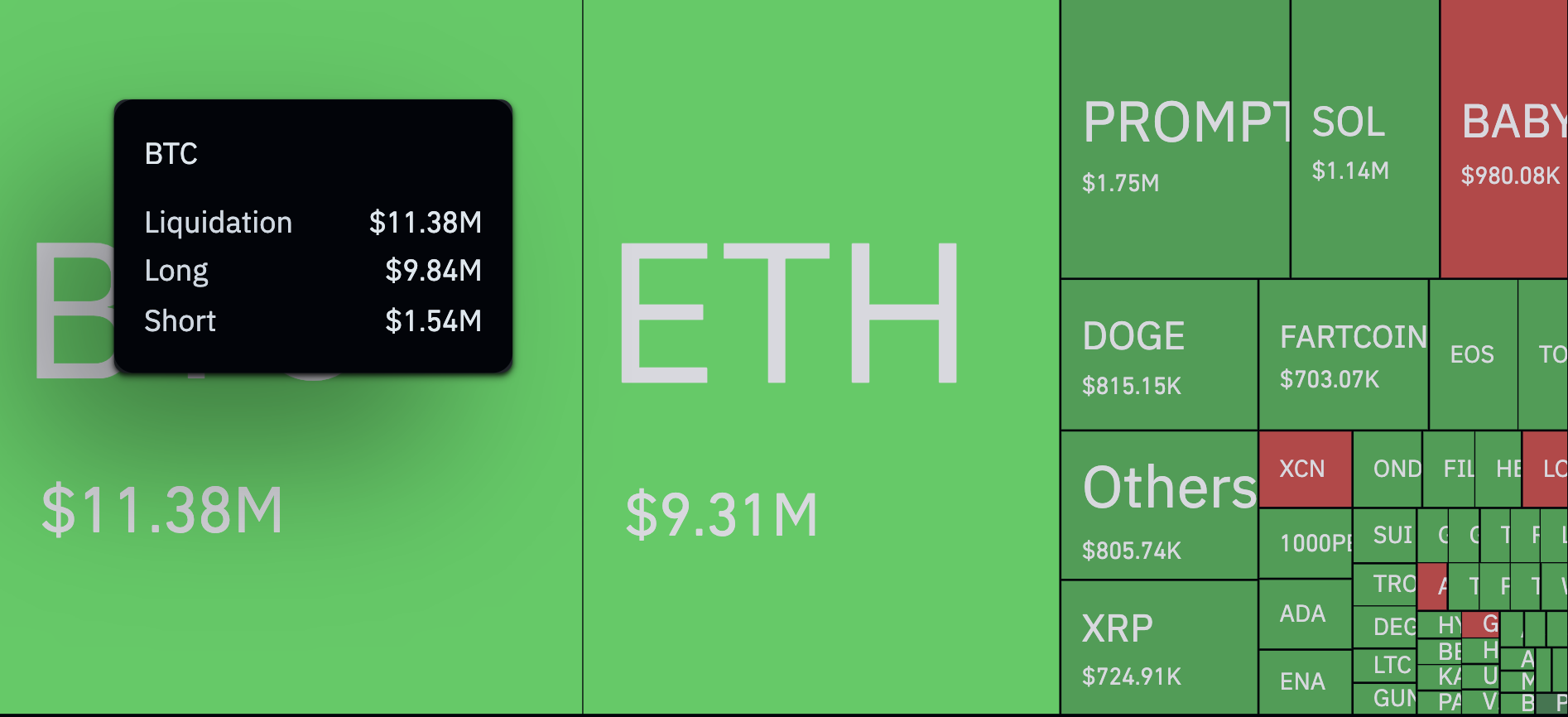

That sentiment carried over into the crypto space, where highly leveraged positioning met a sudden reality check. Bitcoin led the liquidations, with $11.38 million in positions wiped out — $9.84 million from longs, just $1.54 million from shorts — pointing to a market that had clearly been abnormally imbalanced too far in one direction.

The move did not come with much drama on the surface, but under the hood, it reflected traders overextending after a short burst of optimism and being caught offside, in soccer terms, as sentiment shifted.

The correction was not just a blip. Within a single hour, $26.1 million in positions were closed, with a majority again from longs. Over the last four hours, that is $68.7 million liquidated, and in 24 hours, the total reached $465.5 million across 134,811 traders, as reported by CoinGlass.

The largest single liquidation — a $3.33 million BTC/USDT position on Bybit — underscored just how much risk was in play.

While altcoins like XRP, DOGE and SOL also took hits, the data highlights Bitcoin as the market’s volatility anchor. The inflation report out of the U.S. had only a modest effect — CPI fell 0.1% in March, but traders are already anticipating a possible recession if the trade war escalates.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin