Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

In a whirlwind of activity, Bitcoin has experienced a significant shuffle on the Coinbase exchange, hinting at potential bullish momentum on the cryptocurrency market. Within the span of just a few hours, a total of 4,069 Bitcoin, valued at $182.26 million, were initially transferred from an undisclosed wallet to Coinbase Institutional.

Subsequently, withdrawals totaling 2,510 Bitcoin, equating to over $112 million, were made to two separate unidentified wallets. Following this, an additional 1,359 Bitcoin, valued at $60.8 million, were transferred from Coinbase Institutional to a new undisclosed wallet, as reported by Whale Alert.

This flurry of transactions, strategically timed just prior to U.S. trading hours, suggests the involvement of significant institutional investors within the United States.

Bitcoin price eyes 27% upside

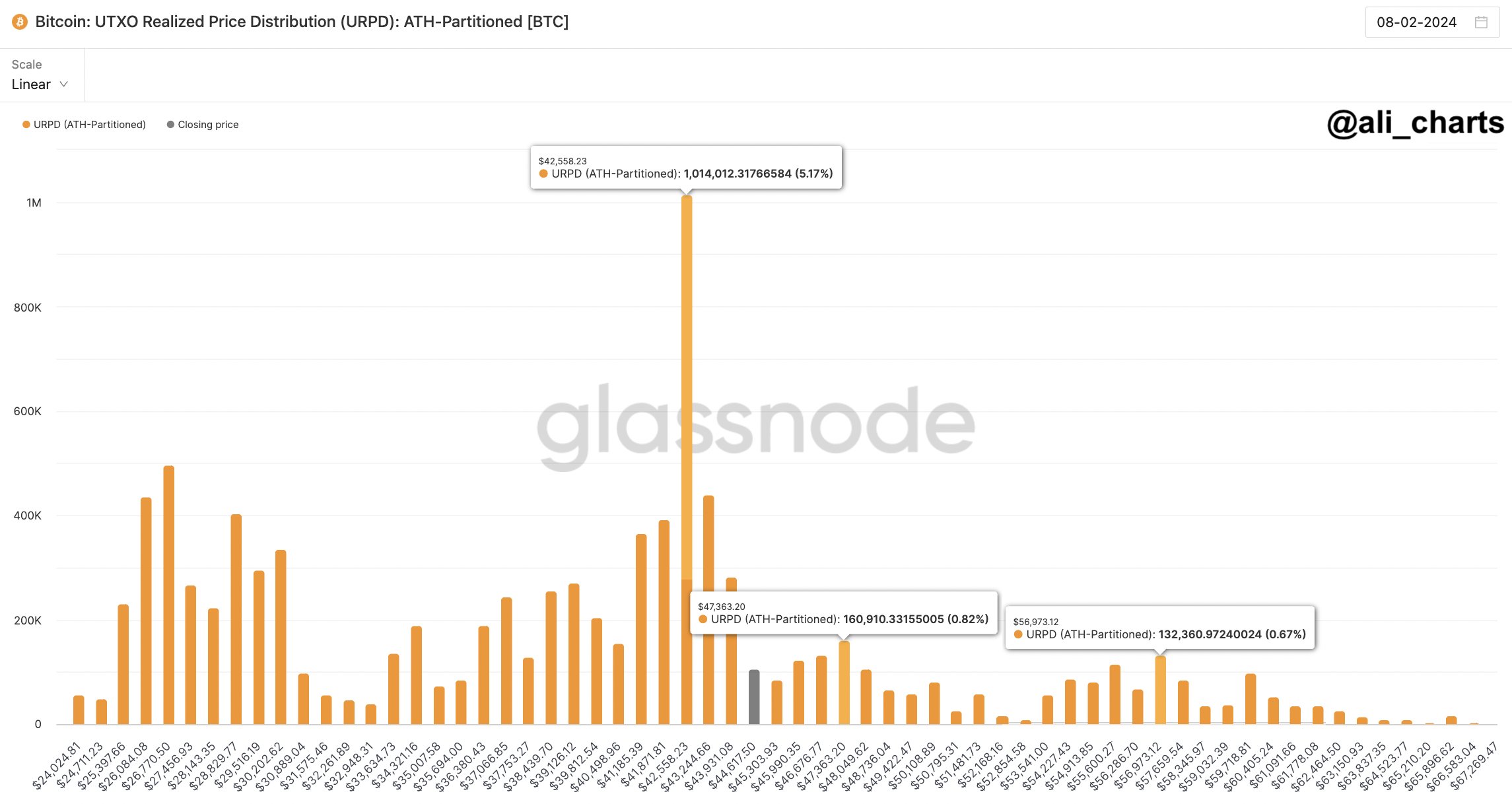

In parallel with these developments, prominent crypto analyst Ali Martinez has provided insights into Bitcoin's on-chain metrics. Martinez highlights the resilience of Bitcoin, citing a significant volume of 1.02 million BTC transacted within the $42,560 price range.

Such robust on-chain activity suggests strong support for Bitcoin at this critical level. Martinez also identifies key resistance levels at $47,360 and $56,970, indicating potential price targets for an upward trajectory.

If Martinez's projections materialize, with Bitcoin reaching the upper resistance level of $56,970 per coin, it would signify a remarkable 27% increase from the current market price. Investors are eagerly watching to see whether the recent flurry of BTC transfers on Coinbase will indeed propel the cryptocurrency toward these anticipated highs, or if unforeseen factors will dampen its ascent.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin