- Ethereum (ETH) mainnet is 10 years old: Key milestones

- What is Ethereum?

- Ethereum turns 10: Why this matters

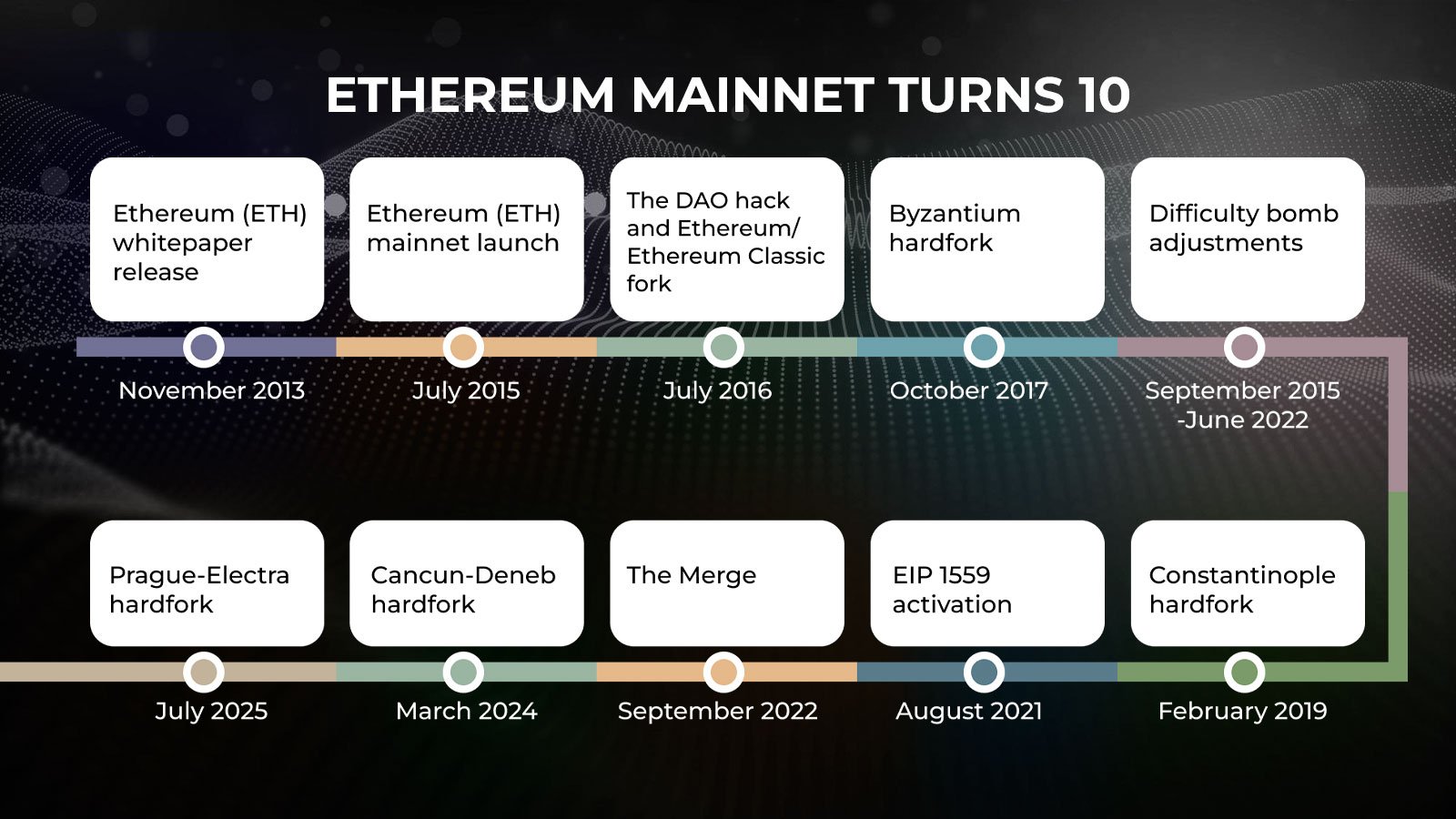

- Ethereum (ETH) blockchain 10 key milestones: Overview

- Ethereum (ETH) price: How has it changed in 10 years?

- Bonus: What's next for Ethereum?

- Wrapping up: Understanding Ethereum (ETH) disruption and ecosystem effect

Introduced by Vitalik Buterin, Joseph Lubin, Charles Hoskinson, Gavin Wood and others, the Ethereum (ETH) blockchain evolved into the backbone of the global cryptocurrency economy.

It pioneered the practical realization of the smart contracts concept, originated dozens of second-layer blockchains and, to some extent, shaped Web3 as we know it today.

In this guide, U.Today makes a look-back on key milestones Ethereum (ETH) accomplished so far — and provides an overview of some major upcoming developments.

Ethereum (ETH) mainnet is 10 years old: Key milestones

Ethereum, the first and largest programmable blockchain (decentralized network suitable not only for payments, but also for smart contract execution), went live on mainnet July 30, 2015. Here are Ethereum's (ETH) main milestones.

- Ethereum (ETH) whitepaper release — November 2013

- Ethereum (ETH) ICO and mainnet launch — July 2014-July 2015

- The DAO hack followed by Ethereum/Ethereum Classic fork — June-July 2016

- Byzantium hard fork — October 2017

- Difficulty bomb adjustments — September 2015-June 2022

- Constantinople hard fork — February 2019

- EIP 1559 activation — August 2021

- The Merge — September 2022

- Cancun-Deneb hard fork — March 2024

- Prague-Electra hard fork — July 2025

In these 10 years, Ethereum (ETH) cemented itself as the backbone for the global digital assets economical segment.

Despite severe competition from Solana (SOL) and its own L2 platforms like Polygon (POL), Optimism (OP), Arbitrum (ARB) and Base (BASE), Ethereum (ETH) remains the dominant blockchain for decentralized applications of all types.

What is Ethereum?

Ethereum (ETH) is a programmable blockchain, i.e., a decentralized protocol capable of running smart contracts — isolated autonomous software programs. Thanks to this opportunity, Ethereum (ETH) acts as the “world computer” for decentralized applications or dApps.

Ethereum (ETH) was launched on mainnet in 2015 after a successful $18 million initial coin offering (ICO).

Ethereum (ETH) was launched by six co-founders: Vitalik Buterin, Gavin Wood, Joseph Lubin, Mihai Alisie, Anthony Di Iorio and Charles Hoskinson. Vitalik Buterin is known as Ethereum's (ETH) inventor, while Gavin Wood was the first CTO, and Joseph Lubin launched the major Ethereum (ETH) development studio ConsenSys.

Ethereum (ETH) pioneered the usage of blockchains for decentralized applications, moving its technical role far beyond sending transactions, which was casual for early-stage blockchains like Bitcoin (BTC), Litecoin, or XRP Ledger (XRPL).

Ethereum turns 10: Why this matters

Ethereum (ETH) celebrating its 10th anniversary is a massive milestone for the entire cryptocurrency ecosystem and the decentralized applications scene globally.

- Sustainability. Ethereum (ETH) managed to create sustainable and balanced technical and economical systems that don’t need external fundraising.

- Leadership. Despite savage rivalry in the blockchain segment, Ethereum (ETH) remains the biggest blockchain by TVL, the total number of active dApps and many activity metrics.

- Flexibility. Ethereum (ETH) promptly adapts to changes in the blockchain segment, activating more and more features and adjusting its tech design.

- Ecosystem. Ethereum (ETH) originated an array of Layer-2 blockchains and Ethereum Virtual Machine, an execution engine for smart contracts.

Also, Ethereum (ETH) and its stack — Solidity, Hardhat, Typescript — remains the gateway to blockchain development for the new generation of engineers.

Ethereum (ETH) blockchain 10 key milestones: Overview

In this brief overview, we are going to observe the major events that shaped Ethereum (ETH) and paved the way for its technical excellence.

Ethereum (ETH) whitepaper release

The Ethereum whitepaper was released by Vitalik Buterin in November 2013. At the time, Buterin was a 19-year-old software engineer in Canada and the co-founder of Bitcoin Magazine. The whitepaper proposed a new blockchain platform designed to go beyond Bitcoin by enabling programmable smart contracts.

Buterin envisioned Ethereum as a decentralized world computer that developers could use to build trustless applications. Key earliest figureheads and co-founders included Gavin Wood, Joseph Lubin, Mihai Alisie, Anthony Di Iorio and Charles Hoskinson. Their shared motivation targeted overcoming Bitcoin’s limited scripting abilities and creating a more flexible, general-purpose platform.

Ethereum aimed to democratize blockchain development by allowing anyone to deploy decentralized applications (dApps), not only transacting on-chain. The whitepaper unlocked the opportunities of a new era of decentralized finance, governance and digital infrastructure.

Ethereum (ETH) mainnet activation

The Ethereum (ETH) mainnet launched July 30, 2015, with the release of its first live version, Frontier.

The Ethereum Foundation non-profit, based in Switzerland, coordinated development and community efforts leading up to the launch. The platform introduced smart contracts and the Ethereum Virtual Machine (EVM), enabling decentralized applications (dApps) on-chain.

Ethereum’s ICO (initial coin offering) took place from July 22 to Sept. 2, 2014, accepting Bitcoin (BTC) in exchange for Ethereum (ETH), the eponymous asset of the new blockchain. The initial rate was 1 BTC for 2,000 ETH, and the sale raised around 31,000 BTC (about $18 million). Over 60 million ETH were distributed to contributors, making it one of the most successful and influential token launches in crypto history.

The DAO saga

In June 2016, The DAO — a decentralized venture fund built on Ethereum — was hacked due to a vulnerability in its smart contract code. An attacker exploited a recursive call bug to drain 3.6 million ETH (worth about $60 million at the time and about $12 billion in current prices) from The DAO’s funds.

The DAO had raised over $150 million in ETH during its crowdfunding phase, making it the largest crowdfunding project ever then.

The hack led to an intense debate in the Ethereum community. Some argued for immutability (the “code is law” principle), while others supported reversing the hack — reorganizing the Ethereum (ETH) blockchain as a whole — to restore stolen funds.

As a result, Ethereum underwent a hard fork (backward-incompatible network upgrade) on July 20, 2016, splitting the chain: Ethereum (ETH) with restored funds and Ethereum Classic (ETC), which preserved the original chain and code.

Byzantium hard fork

Ethereum Byzantium hard fork was activated Oct. 16, 2017, at block 4,370,000 as part of Ethereum’s Metropolis upgrade phase. Its key rationale was to improve network security, privacy and scalability while preparing the protocol for future consensus changes. Byzantium also introduced features to make smart contract development straightforward and cut block rewards from 5 ETH to 3 ETH to prevent Ether from deflation.

Major Ethereum Improvement Proposals (EIPs) included EIP-649 (difficulty bomb delay and block reward reduction), EIP-658 (transaction status codes) and EIP-197/198 (support for zk-SNARKs to enable privacy tech). The last EIPs pair laid the foundation for zero-knowledge tech on Ethereum, i.e., for advanced privacy of value transfers.

Byzantium was widely seen as a smooth and successful upgrade that strengthened Ethereum’s position as a smart contract platform and demonstrated the network’s ability to coordinate complex protocol improvements.

Difficulty bomb adjustments

Difficulty bomb was the mechanism in Ethereum (ETH) on proof of work — a blockchain consensus based on mining — that eventually made adding the next block more and more difficult. On the one hand, it pushed ETH miners closer to switching to proof of stake — as this was the endgame goal for Ethereum from the very beginning. On the other hand, if reached too early, it would make ETH mining completely unprofitable and seriously threaten ecosystem stability.

As a result, to strike the balance between these two catalysts, Ethereum (ETH) developers postponed the difficulty bomb mechanism five times — in Byzantium (2017), Constantinople (2019), Muir Glacier (2020), London (2021) and Gray Glacier (2022) upgrades (hard forks).

When Ethereum (ETH) finally migrated to proof of stake (PoS), the difficulty bomb concept became irrelevant as in staking systems, blocks are validated in another way.

Constantinople hard fork

The Constantinople hard fork was activated Feb. 28, 2019, at block 7,280,000. Also part of the Metropolis transition, Constantinople aimed to improve network efficiency, performance and future-proofing for Ethereum 2.0. The upgrade was delayed from its original January date due to a last-minute vulnerability found in one of the EIPs. Constantinople also included a block reward reduction from 3 ETH to 2 ETH, lowering inflation.

Key EIPs included EIP-145 (bitwise shifting for cheaper computations), EIP-1052 (efficient smart contract verification) and EIP-1283 (gas cost improvements for SSTORE operations). EIP-1234 delayed the difficulty bomb, maintaining reasonable block times. As a result, Ethereum became more developer-friendly, cost-effective and achieved more optimized data logistics.

EIP 1559 activation

EIP 1559 activation was among the boldest tokenomic upgrades for Ethereum (ETH). It completely rewrote the network fees design. Instead of an auction-based fees model, it introduced base fees and so-called “miner tips.” The exact amount of fees for this or that block depended on network activity: The more transactions were included into the block, the higher the fees.

Also, EIP 1559 — introduced by the London hard fork in August 2021 — pioneered the periodical base fee burns. As such, if ETH issuance doesn’t keep up with burn events, ETH becomes scarcer step by step.

EIP 1559 is a powerful tokenomic mechanism in Ethereum (ETH) that adds another layer of verifiable scarcity for ETH as a token.

It made transaction fees more predictable, improved user experience and introduced deflationary pressure on the ETH supply. Since activation, millions of ETH have been burned, helping offset new issuance. Although it didn’t directly lower gas prices, it laid important groundwork for Ethereum’s monetary policy and sustainability.

The Merge

The Merge was Ethereum’s (ETH) hotly-anticipated transition from proof of work (PoW) to proof of stake (PoS), completed Sept. 15, 2022, at block 15,537,393. It combined Ethereum’s (ETH) original execution layer (mainnet) with the Beacon Chain, which had been running staking architecture since Dec. 1, 2020. This marked the end of Ethereum (ETH) mining and the start of a more energy-efficient consensus model.

The motivation behind The Merge was to significantly reduce Ethereum’s (ETH) energy consumption, improve network sustainability and lay the foundation for future scalability upgrades like sharding — splitting the blockchain into an ecosystem of interconnected shards (subblockchains). PoS also enhanced Ethereum's (ETH) security and economic model by reducing ETH issuance and enabling ETH staking as a form of network validation.

The Merge reduced Ethereum’s (ETH) energy usage by over 99.9% and ushered in a new era of eco-friendly blockchain operation. The transition from one type of blockchain consensus to another was a game-changing move from Ethereum (ETH): In three years, no blockchains replicated this upgrade.

Cancun-Deneb hard fork

The Cancun-Deneb upgrade (also called Dencun) was activated March 13, 2024, at block 19,078,888. It was one of the first upgrades that separately affected the execution layer (Cancun) and consensus layer (Deneb). Dencun’s most anticipated feature was EIP-4844, also known as proto-danksharding, which introduced a new transaction type called “blobs.”

The upgrade targeted the improvement of data availability and significant reduction of Layer-2 transaction fees. With EIP-4844, large data chunks used by rollups are stored more efficiently, paving the way for future full sharding. As such, the largest EVM L2s such as Optimism and Arbitrum were the ones who benefited the most from EIP-4844 going live.

Dencun improved Ethereum’s performance for rollups, made the network cheaper for users and demonstrated Ethereum’s ability to roll out complex changes across both consensus and execution layers.

Prague-Electra hard fork

Activated May 7, 2025, Prague-Electra (or Pectra) hard fork was among the most ambitious changes in Ethereum (ETH) design post-Merge. It included 11 EIPs focused on functionality, security, operability and cost-efficiency for Ethereum (ETH) and its second-layer solutions.

Its main changes, EIP-7251 “INCREASE_MAX_EFFECTIVE_BALANCE” and EIP-7702 “Set EOA (Externally Owned Account) account code,” paved the way for raising maximum validator balance to 2,048 ETH and for blurring the line between smart contracts and on-chain accounts on Ethereum (ETH). Externally owned accounts (actually, on-chain wallets) were equipped with a number of functions only smart contracts had previously.

Also, Pectra improved BLS signatures design and streamlined operation logistics for validators. This upgrade builds on top of Dencun and its EIP-4844 as a key improvement.

Ethereum (ETH) price: How has it changed in 10 years?

Ether (ETH), the core native cryptocurrency of the Ethereum (ETH) ecosystem, is a gas cryptocurrency, staking asset and was a miner reward in proof-of-work Ethereum in 2015-2022.

Ethereum (ETH) price dynamics usually serve as altcoin season indication — when it starts surging to the highs of the previous cycle, it means that liquidity is flowing from Bitcoin (BTC) to altcoins.

Ether ICO price | ETH Price (2018 high) | ETH Price (2021 high) | ETH Price (current value) | Gap to ATH, % |

$0.311 | $1,431 | $4,891 | $3,776 | 23.21 |

As such, Ethereum (ETH) remains the largest cryptocurrency that hasn’t set a new all-time high in this cycle yet. Bitcoin (BTC), BNB and XRP all set new records in 2025.

Bonus: What's next for Ethereum?

Ethereum (ETH) core developers have already outlined the next steps for its development. In late Q4, 2025, the activation of the Fulu-Osaka (Fusaka) hard fork is expected. Fusaka is set to introduce Peer Data Availability Sampling (PeerDAS) — validators will be able to only check blobs off-chain instead of downloading full datasets. It will save network resources and make the operations of validators more cost-effective.

Also, the EOF update will change the way Ethereum Virtual Machine handles smart contract bytecode to make it more performant and cost-effective.

Expected in H1, 2026, Ethereum (ETH) Gloas-Amsterdam (Glamsterdam) upgrade will introduce reduced slot times and so-called Enshrined Proposal-Builder separation (ePBS) to further accelerate the scalability and cost-effectiveness of the network. Block time will drop to six seconds, while the increased gas limit (to 45 million gas) will ensure more powerful computations design.

Wrapping up: Understanding Ethereum (ETH) disruption and ecosystem effect

In 10 years of its mainnet activity, Ethereum (ETH) evolved into the largest ecosystem in the blockchain world. Introduced in 2013 as the “world computer,” it onboarded thousands of dApps and originated dozens of L2 networks.

Since its mainnet activation July 30, 2015, Ethereum (ETH) went through 20+ hard forks to adjust to changing demand, competition and growing transactional volume. Constantinople, London, Dencun and Pectra are among the most ambitious of them.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov U.Today Editorial Team

U.Today Editorial Team