Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

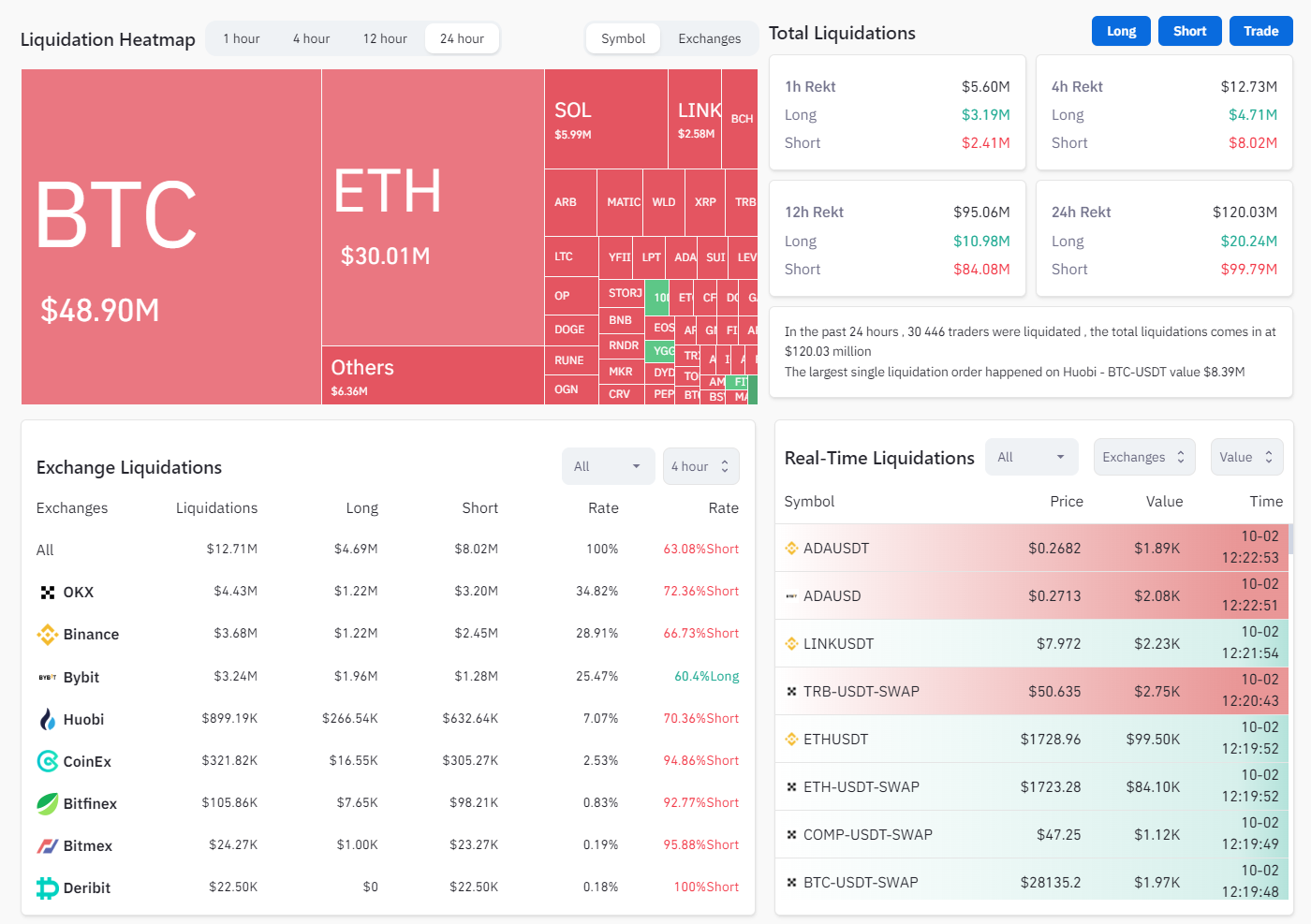

The cryptocurrency market has been a battleground for bulls and bears, but the recent surge in Bitcoin's price to $28,000 has left many bears in a precarious position. According to market data, nearly $100 million worth of short positions were liquidated as Bitcoin made its unexpected move. This has put several traders and investors underwater, questioning the sustainability of their bearish outlooks.

Interestingly, on-chain data reveals that some bears are not backing down. Instead of closing their short positions, they are stacking up, betting on a market reversal. One trader notably increased his on-chain short position by $1.5 million, with a liquidation price set at $2,033. This bold move indicates that some market participants still believe Bitcoin's rally is overextended and due for a correction.

Price analysis on Bitcoin shows explosive performance, with the asset breaking multiple resistance levels on its way to $28,000. The bullish momentum does not seem to be slowing down, making it a risky proposition for those holding short positions. The market's sentiment is overwhelmingly positive, further fueled by the strong performance of altcoins like Solana, which has also seen significant gains.

However, the high level of liquidations serves as a cautionary tale for traders. Betting against a strong bullish trend can be perilous, as evidenced by the $100 million in liquidations. While some bears are doubling down on their positions, the risk of further liquidations remains high, especially if Bitcoin continues its upward trajectory.

Bitcoin's recent surge has led to a wave of liquidations, catching many bears off guard. Despite this, some traders are still increasing their short positions, betting on a market reversal. In this situation, only time will reveal who will ultimately gain the advantage.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov