Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

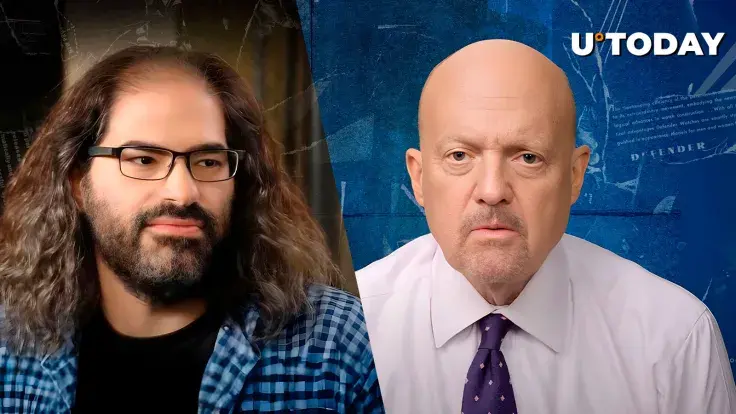

David Schwartz, the CTO of blockchain payments firm Ripple Labs Inc., has reacted to CNBC broadcaster Jim Cramer's market commentary. Different market reactions have followed the ongoing global sell-off on the stock market, which removed over $5 trillion from the S&P 500 in two days over the past week. To Cramer, this has fueled the possibility of a "Black Monday" sell-off ahead.

Finally some good news

April started on a massively bearish note for the stock market, with crypto also suffering from the sell-off. In Jim Cramer’s opinion, the market might face a 1987 "Black Monday" style stock market crash on Monday.

Ripple's CTO ironically referred to this as "some good news" in part because of Cramer's reputation in the prediction market. Notably, the reverse of whatever he predicts is typically what is experienced, a trend that has played out on many occasions with Bitcoin and the crypto industry in general.

Drawing on the so-called “Inverse Cramer Effect,” the price of Bitcoin rebounded to $100,000 in late January after Jim Cramer's grim projection. David Schwartz is counting on a repeat of history with the top analyst's current projection.

Possible rebound factors to watch

At press time, Bitcoin was trading for $76,342.27, down 7.77% in the past 24 hours. Amid this sell-off, the ETH/BTC ratio has dropped to 0.02, an indication of intense bearishness in the altcoin world.

According to an analysis by Michael van de Poppe, the market has likely hit the bottom due to technical indicators. With the mainstream market seeing a drop of about $10 trillion, the analyst is optimistic that a rebound will be staged from this position, as has been seen historically.

Beyond the reverse actions of the market, there are chances Bitcoin and other top altcoins will start seeing a reaccumulation.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov