In a recent tweet, Ripple CEO Brad Galirnghouse says that governments are now taking a serious look at blockchain after dismissing the technology as a “scam” for years.

Garlinghouse also claims that the U.S. dollar isn’t going to be toppled by gold, the yuan, or crypto anytime soon, but it’s gradually getting weaker.

He notes that crypto is so far up a whopping 80 percent in 2020 while the greenback is actually down three percent year-to-date in spite of a massive flight to liquidity that was observed during the March market crash.

Looking for alternatives

Garlinghouse was referring to a recent Bloomberg article that explores the advantages and disadvantages of potential replacements for the dollar whose viability as a store of value has come under question during the ongoing crisis.

In an attempt to shore up the wounded U.S. economy, the Federal Reserve ended up printing $3 trln since February while slashing interest rates to zero and vowing to maintain them at this level through 2022.

This justifies the concerns of Goldman Sachs strategists who recently predicted that the greenback could lose its global currency status:

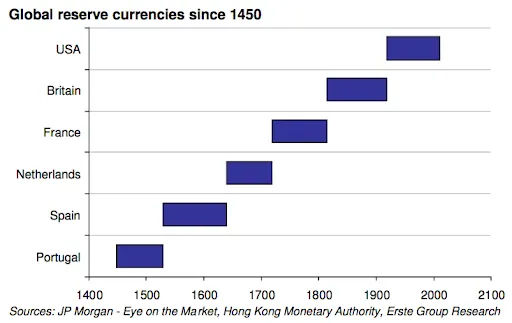

“Real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge.”

Advertisement

While Goldman called gold “the currency of last resort,” Bloomberg’s Garfield Clinton Reynolds notes that its supply cannot be managed to respond to economic difficulties.

China poses a real threat

As reported by U.Today, Garlinghouse urged U.S. lawmakers and regulators to lean into digital currencies back in May in order to be able to compete with China.

While cryptocurrencies like Bitcoin are too volatile, China’s central bank digital currency, called “DCEP,” could eventually elevate the yuan to the status of a new reserve currency if the greenback isn’t getting digitalized.

Garlinghouse’s concerns are particularly understandable given that the emergence CBDCs could crowd XRP out of the cross-border payments sector, making it completely redundant.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin