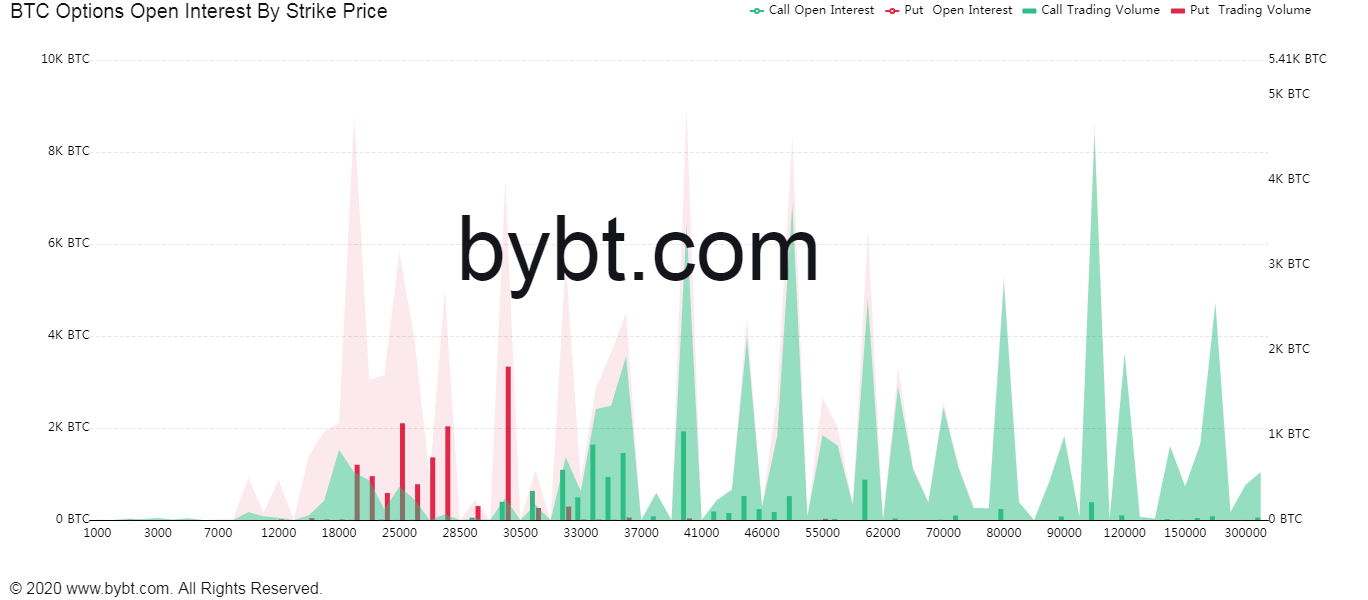

More investors are opening positions on the $20,000 and $22,000 Bitcoin put options according to CoinGlass BTC Options Open Interest By Strike Price. Cumulative open interest on both prices is almost 10,000 BTC. Most of the interest emerged after the recent Bitcoin price drop below the $30,000 mark.

Options are derivative financial instruments based on the value of the underlying assets, which in our case is Bitcoin. Options allow you to buy the underlying asset for a selected price. But the main value of such an instrument is the ability to choose—to buy or sell the asset when the options contract is expired. Due to high risk and volatility, options are not being used by traders or investors for speculation. The main purpose of these contracts is to hedge opened positions.

By opening $20,000 and $22,000 put (sell) options, some traders may aim for the significant $8,000 to $10,000 drops, which are more than 25 percent away from the current price. Bearish sentiment prevails on the cryptocurrency market followed by the stock market drop due to additional COVID-19 risks and the crash in oil prices.

Usually, it seems like an extremely bearish signal for the market, as if traders are actually betting on the $20,000 price for Bitcoin. But it is not necessarily true since you are not obligated to sell or buy the asset after you sign the options contract. Such a major and rapid volume increase might be the result of hedging by large investment funds or whales. As already mentioned, options are mostly being used as a tool for hedging trading risks, and that may be the case with Bitcoin today since we have witnessed a $1.7 billion buy in Bitcoin yesterday.

Another reason for such a strong bearish signal is the common speculative interest that appeared and followed market sentiment after every major move on the Bitcoin markets, according to Open Interest History.

Ethereum is also following the same trend with rising open interest on $1,280 and $1,120 put options.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin