Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

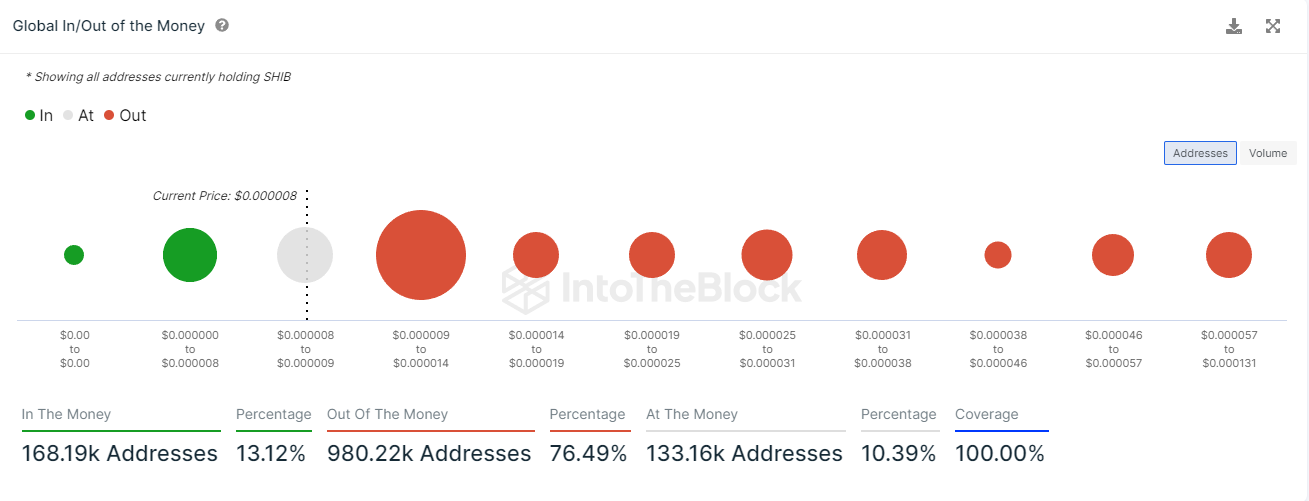

Shiba Inu (SHIB) is currently in a state of low volatility. As of the latest data, SHIB is trading at $0.00000813, and it has been hovering around this level for the past seven days. This lack of price movement may be a precursor to a significant shift, and one key metric, global in/out of the money (GIOM) by IntoTheBlock, could provide some insights.

The GIOM metric identifies the average cost at which tokens were purchased for any address with a balance. If the current price is greater than the average cost, the address is "in the money"; if less, it is "out of the money." According to this metric, only 76 trillion SHIB tokens are left for the price to move forward. This suggests that a large portion of SHIB holders are currently "in the money," which could act as a resistance level for the cryptocurrency.

From a technical standpoint, the low volatility in SHIB's price could be a double-edged sword. On the one hand, it indicates a lack of buying pressure, but on the other, it means that less liquidity is needed for the price to move upward. This could be advantageous if a sudden surge in buying power occurs, as it would require less capital to push the price higher.

Moreover, the upcoming developments in the Shiba Inu ecosystem, such as the relaunch of Shibarium, could act as catalysts for price movement. Despite initial hiccups, like more than 1,000 ETH being stuck in the bridge, the relaunch could influence market sentiment and potentially drive the price up.

While the current low volatility and the GIOM metric indicate a resistance level for SHIB, they also present an opportunity. A sudden influx of buying power could easily push the price higher due to the low liquidity needed.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov