Ethereum is one of the leaders of today’s crypto world: it is second only to Bitcoin by market cap with 20.5 billion US dollars; right now, it is also standing at number four in terms if its monetary value following Bitcoin, Maker, and Bitcoin cash with almost 200 USD for one coin of Ether.

But, of course, Ethereum is not only a giant platform that generates its own cryptocurrency: it also lets other cryptocurrencies use its Blockchain network, so long that all of the technical rules are observed within the ecosystem. As a result, all cryptocurrencies that are hosted by Ethereum, apart from its own Ether, must be ERC-20 compliant (Ethereum Request for Comment), and every holder of an Ethereum-based cryptocurrency is thus also a de facto holder of an ERC-20 token.

This means that ERC-20 token holder figures are indicative of how well a crypto coin is doing within the larger Ethereum framework. The more ERC-20 token holders there are, the better that “guest” currency is doing, and since Ethereum is also one of the market leaders, any given cryptocurrency’s internal popularity on Ethereum also directly reflects on how well it is paddling through the crypto sea in general.

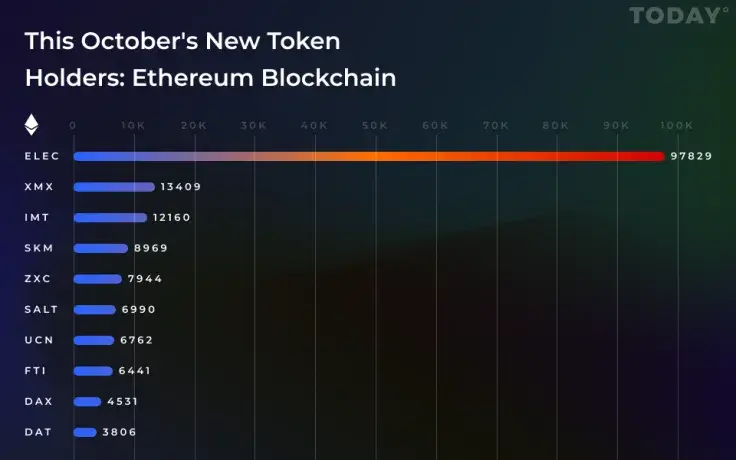

Below is the top 10 list of this October’s new ERC-20 token holders for each of the leading Ethereum-based cryptocurrencies:

The current winner by a landslide is Electrify.Asia with almost 100 000 new ERC-20 token holders this October, followed by XMax with around 13 500 new token holders, then Moneytoken with around 12 000, Skrumble Network with around 9 000, 0xcert with roughly 8 000, SALT with 7 000, UChain is lagging slightly behind with around 6 800, FansTime has close to 6 500 token holders, DAEX around 4 500, and finally Datum is in last place with just under 4 000 new ERC-20 token holders this October.

Being “the first retail electricity marketplace in Southeast-Asia addressing the need for transparency and security in the consumption of energy” and with their slogan promising to “build an intelligent energy ecosystem for Asia”, the Singapore-based Electrify.Asia, headed by Julius Tan and Martin Lim, have set very high expectations for themselves. Let’s see what happens closer to the New Year!

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov