Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

John Bollinger is not buying into the bear market panic just yet. The man behind the well-known Bollinger Bands indicator, a tool many traders swear by, recently shared his take on Bitcoin’s latest price drop. His message? Hold off on calling it a bear market - at least for now.

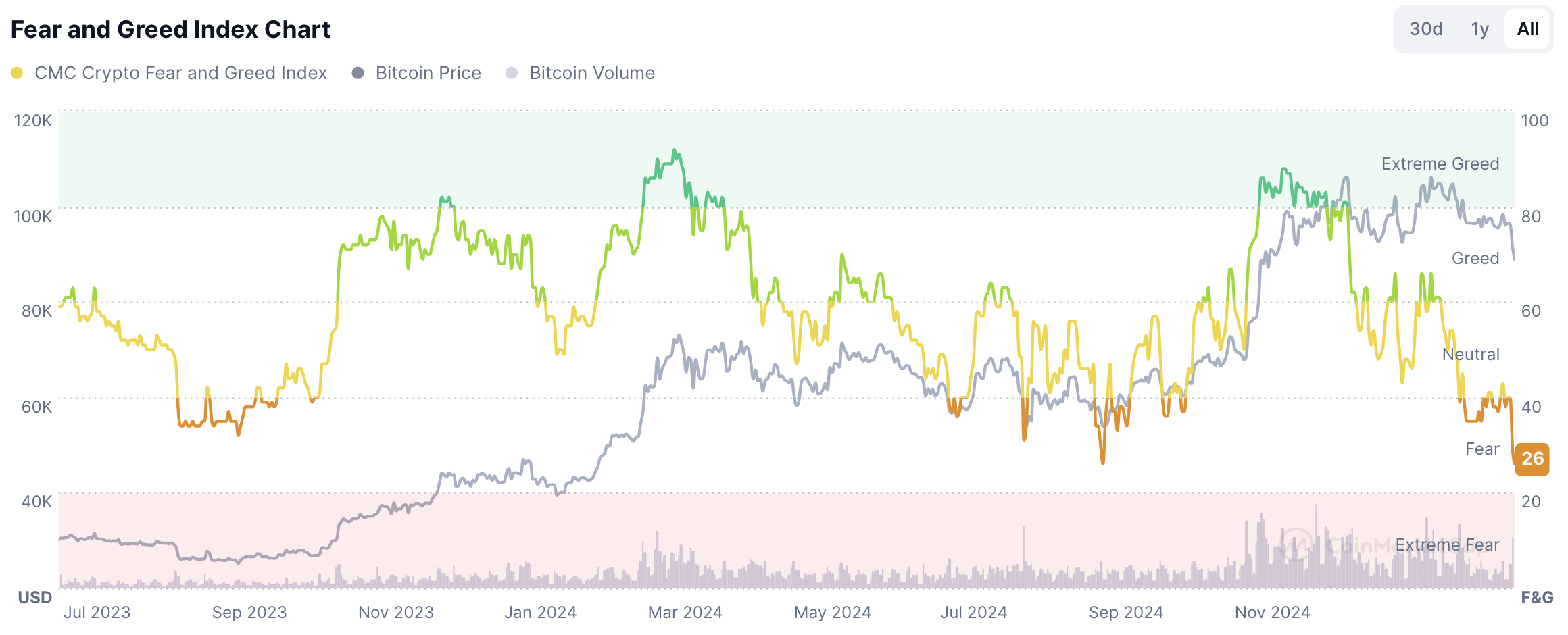

Bitcoin has been on a rough ride. Crashing down to $85,000, dragging altcoins with it, it has left many on the market rattled. The Fear and Greed Index is down to 29, a level of fear we have not seen since September 2024.

The narrative is shifting, with traders whispering about the beginning of a prolonged downturn. But Bollinger does not see it that way - at least not yet.

He took to X to push back against the wave of bearish sentiment, making it clear that it is too soon to draw conclusions. His view? Wait for a sustainable bottom. That is the real signal. Only then does it make sense to take the other side of the trade.

If you are wondering how to spot that bottom, the Bollinger Bands might just help with that.

Bitcoin price through Bollinger Bands

Looking at Bitcoin through the lens of the Bollinger Bands on the daily time frame, one thing stands out — it has stepped outside the lower band, a classic sign of an oversold asset.

Historically, when prices dip below that lower boundary, a reversal is not far behind. But that is not a guarantee, just a possibility. The upper bands are sitting at $95,640 and $100,910. That is 7.57% and 13.46% above the recent low, respectively - not insignificant levels.

Bollinger’s perspective is a call for patience. Instead of rushing to label this market as bearish, he suggests waiting for a clearer picture.

Market fear is high, yes. But technical indicators show there is more to consider. Traders looking for direction might find it in the bands, watching for that next key move.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov