A short while ago, the Whale Alert account on Twitter spotted 68,490,648 XRP (that’s $17,175,334) was transferred from an anonymous wallet to the Singapore-based Bybit crypto exchange, which launched in 2018.

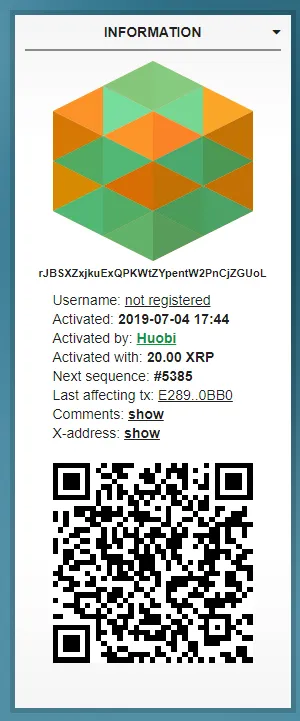

However, the Bithomp analytical website shows that the sender’s wallet was activated by a top crypto exchange via several other users and wallets.

? 68,490,648 #XRP (17,175,334 USD) transferred from unknown wallet to #Bybit

— Whale Alert (@whale_alert) February 3, 2020

Tx: https://t.co/XrQIR2DlHk?from=article-links

Huobi sends a large XRP portion to Bybit

Whale Alert has detected that almost 68.5 mln in XRP has been moved to Bybit from an anonymous wallet. Still, data from the Bithomp website shows that if you follow the user who activated this online crypto storage space, you will end up seeing a cryptocurrency wallet set up by the Huobi exchange.

The community again suspects that a dump of the XPR price is coming (however, some users in the comment thread, on the contrary, believe this transaction is aimed at pumping XRP), as it often happens when large XRP amounts are moved to crypto exchanges.

Recently, it seems that investor interest in XRP has spiked (many gargantuan transactions have been spotted by Whale Alert and XRPL Monitor) since the coin recovered the psychological level of $0.25.

Many in the XRP community are certain that this year is going to be successful for the coin.

Ripple unleashes 1 billion XRP

Following schedule, on February 1, the San-Francisco-based blockchain giant Ripple released two portions of XRP from escrow, 500,000,000 XRP each.

Together they total 1 bln XRP – the standard amount released by the company on the first of each month to cover Ripple’s needs and support other projects with investments, etc.

In other words, to increase the XRP liquidity and adoption, as Brad Garlinghouse once stated in a series of tweets. The community was enraged at yet another 1-bln-XRP release, expecting that now the amount of the coin in the market would increase, preventing the asset's price from surging.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov