CNBC host and TV expert Jim Cramer has released a new commentary on the financial markets, with a special focus on cryptocurrency and China.

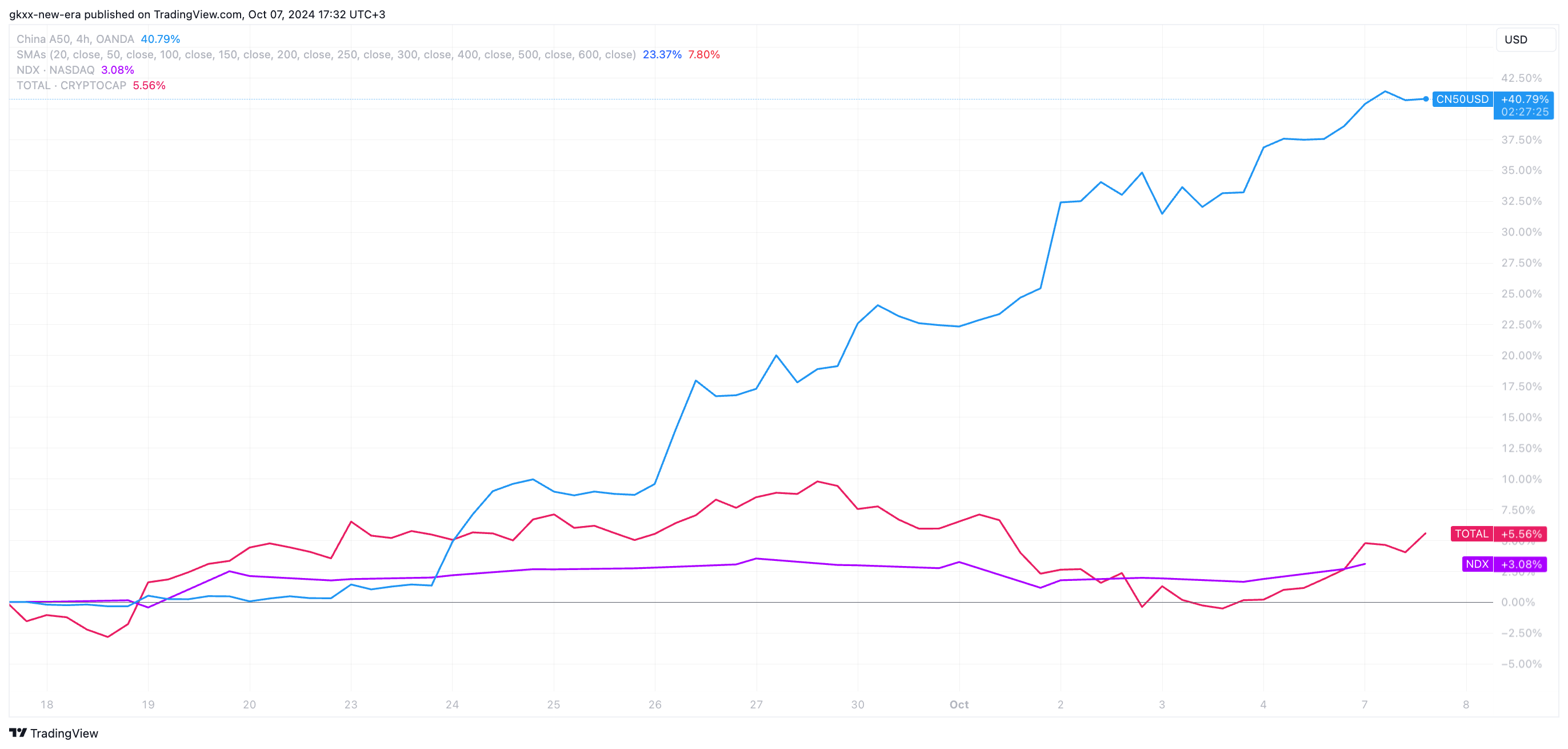

As many may know, Chinese stocks have been on a crazy parabolic run in recent days after the People's Bank of China, a key player in the country's monetary policy, eased policy and lowered interest rates. The result was immediate as, for example, the China A50, a major index of the Chinese stock market, has soared over 41% since Sept. 18.

Such an epic anomaly would not have gone unnoticed, and many pundits began analyzing and projecting how such a turnaround would further impact the global financial markets. This is when Cramer weighed in with a rather bold statement.

In-n-out, but it is crypto and stocks

Thus, the Mad Money host stated that as China pumps all the hot money - which probably means that of a speculative nature - out of tech into China, it is only rivaled by the hot money out of crypto into China.

In other words, Cramer is saying that China is now becoming the main attraction for traders and investors, and all those who have been trading tech stocks and crypto will now move their capital there.

While such a correlation is something to look into, the argument can be made that crypto and NASDAQ as the main index for tech stocks are still on the rise since mid-September.

Maybe the inflow of capital into these markets has slowed down a bit, as attention has been focused on the Chinese fund market, but the crypto market and U.S. tech stocks still gained 8.67% and 3.08%, respectively.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov