Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

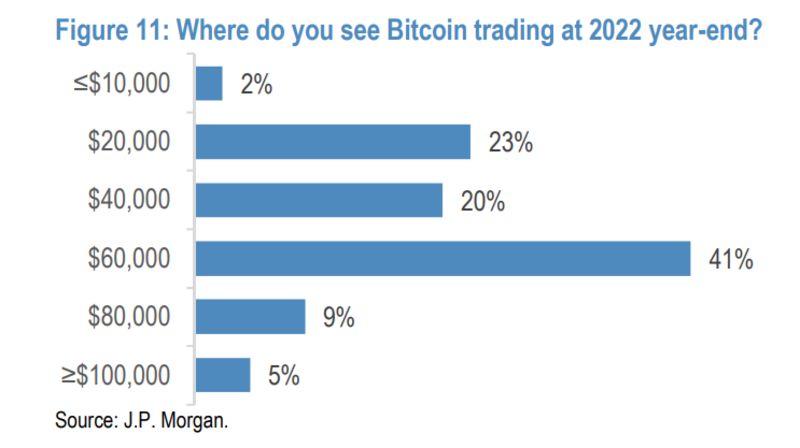

The majority of clients surveyed by U.S. banking giant JPMorgan Chase believe that Bitcoin, the benchmark cryptocurrency, will end this year above $60,000.

Only a minuscule 2% of respondents believe that Bitcoin will end up trading below $10,000 by 2023.

This flies in the face of bears who predict that 2022 will be a repeat of 2018, the year the Bitcoin price careened more than 70%. Some analysts expect Bitcoin to endure a massive correction due to the U.S. Federal Reserve turning more hawkish.

With that being said, JPMorgan clients do not expect the flagship cryptocurrency to stage a massive rally this year either. According to the poll, only a minuscule 5% of them believe that the cryptocurrency will be able to climb above the $100,000 level.

Goldman Sachs recently estimated that Bitcoin could topple $100,000 over the next five years if it were to continue eating away at gold's market share.

As reported by U.Today, Fundstrat’s permabull Tom Lee predicted that Bitcoin could climb to as high as $200,000 this year. Cryptocurrency evangelist Brock Pierce also sees Bitcoin briefly topping out at the above-mentioned in 2022.

Oversold conditions

JPMorgan Chase analyst Nikolaos Panigirtzoglou says that Bitcoin has entered oversold territory:

Our Bitcoin-position indicator based on Bitcoin futures looks oversold.

On Monday, the cryptocurrency dropped below the $40,000 level for the first time since late September amid another stock market sell-off, but bulls managed to save the day by pushing Bitcoin back to $42,000.

The leading cryptocurrency would need to recover roughly 39% in order to reclaim its all-time high of $69,000.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov