Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

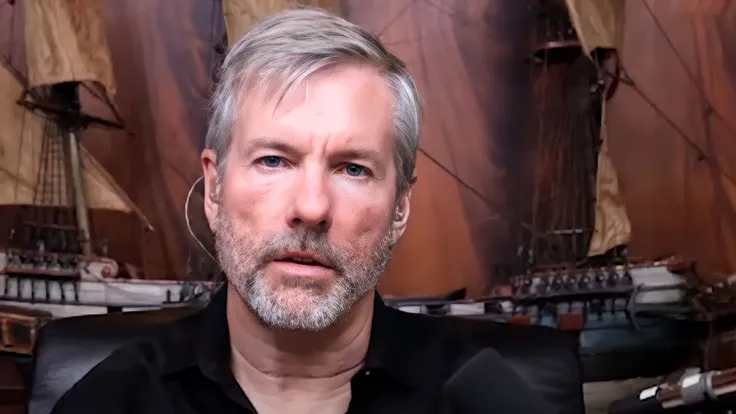

The cryptocurrency market got an unpleasant surprise with the official resignation of Michael Saylor as the CEO of the most pro-Bitcoin company on the U.S. market: MicroStrategy. While some investors think it is going to have a negative impact on the industry, there is an alternative opinion.

As we all know, Saylor was a huge Bitcoin and crypto advocate who provided enormous support for Bitcoin and held more than $3 billion worth of crypto on the company's balance sheet. His last purchase as the CEO was made back in June, when MicroStrategy acquired more than $10 million worth of BTC.

[DB] Saylor: As Executive Chairman I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives

— db (@tier10k) August 2, 2022

According to the official letter, Saylor will now work as an executive chairman and is going to focus on crypto and Bitcoin operations. The entrepreneur himself said that he is going to focus more on the Bitcoin acquisition strategy and other initiatives related to the cryptocurrency.

The fact that one of the most bullish and influential entrepreneurs in the industry is going to aim at crypto operation should be considered nothing but bullish as Saylor will be able to manage the company's portfolio more precisely and possibly make more Bitcoin acquisitions in the future.

Unfortunately, the poor performance of Bitcoin and the cryptocurrency market in general created massive pressure on MicroStrategy's stock, which faced a 60% price plunge in the last few months. The movement of the stock pretty much correlates with the performance of the first cryptocurrency.

At press time, BTC is exchanging hands at around $23,000 and showing a mild 0.5% price increase, which shows that the market is still fighting for local support points despite the complicated macro environment.

Tomiwabold Olajide

Tomiwabold Olajide Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin