Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Mining Bitcoin costs money, and it is getting pricier for miners considering the most recent reward halving. CoinShares tells us it is about $53,000 to mine one Bitcoin these days, and that is an average that large mining companies spend on one BTC.

For those who do not know, halving means miners get half the Bitcoin they used to get for decoding blocks that contain data about the Bitcoin network. Because they will be getting less Bitcoin, what it costs to run their mining machines, mostly the electricity, could feel like it has doubled.

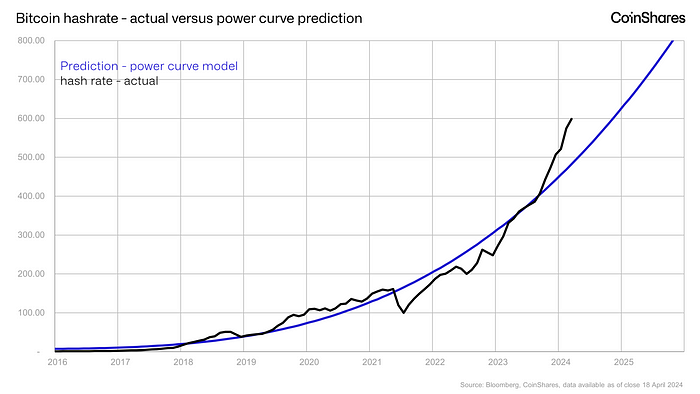

And there's more: experts think the total power of Bitcoin mining might jump up to 700 Exahash by 2025. A whole lot more power will be needed to run the Bitcoin network. But right after the halving, some less profitable mining machines might get turned off, dropping that number by about 10%.

There is a bright side, though. Some smart miners are moving to places where they can get cheaper, often wasted energy, like gas that would be burned off anyway. And they are starting to use AI to make more money in countries where energy is stable and not so expensive. This could be a game-changer that could fuel the network in the foreseeable future.

So, after the halving, the cost of mining a Bitcoin could go even higher. Miners' bills for things like electricity and the machines themselves might almost double on paper, while the price for Kw/h stays the same. They are trying to deal with this by getting better deals on their gear and finding cheaper power.

They are using extra cash from the bull run and cheap mining cost to pay off debts and getting ready for a shift in the miners' market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov