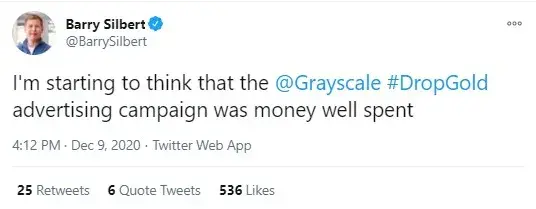

Grayscale founder Barry Silbert has tweeted that Grayscale's "Drop Gold" advert campaign was not a waste of money after all.

The JP Morgan statement quoting large investor funds inflows into Grayscale Bitcoin Trust seem to have provoked Silbert to do that.

"Drop Gold advertising campaign was money well spent"

Barry Silbert, founder and CEO of Digital Currency Group and its subsidiary Grayscale, has posted a tweet in which he confirmed the positive result of the recent television advertising campaign with the "Drop Gold" commercial.

The viral Bitcoin ad was once more brought to all major U.S. television channels.

When tweeting, Barry Silbert commented on the recent Bloomberg article. The latter quoted the recent figures of investment inflows into the Grayscale Bitcoin Trust, and its GBTC shares, which have totaled almost $2 billion since October of this year.

In the meantime, gold-based exchange traded funds (ETFs) have seen outflows of $7 billion, according to the JP Morgan data.

The managing director of Grayscale, Michael Sonnenshein, also cited that data on his Twitter page.

Currently, Grayscale has a whopping $12.6 billion in crypto under its management.

"Crypto is rising in mainstream finance at the expense of gold," JP Morgan

A recent report by JP Morgan's quantitative strategist, Nikolaos Panigirtzoglou, says that the trend of funds leaving gold and flowing into Bitcoin (which has been taking place since October) is going to continue in the future.

Financial institutions are likely to continue entering Bitcoin and other cryptocurrencies as crypto's reputation as a popular asset is spiking.

The JP Morgan expert wrote:

The adoption of bitcoin by institutional investors has only begun, while for gold its adoption by institutional investors is very advanced.

However, as for family offices, so far their BTC holdings account only for 0.18 percent compared to 3.3 percent in gold.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin