Chicago-based investment firm Marlton LLC is going after Grayscale due to the shares of the asset manager's Bitcoin Trust slipping into discount territory.

According to an April 6 Bloomberg report, the family office is now demanding a tender offer to sell its stock at a higher price.

It is unclear how many shares Marlton has in its coffers.

"Destruction of value"

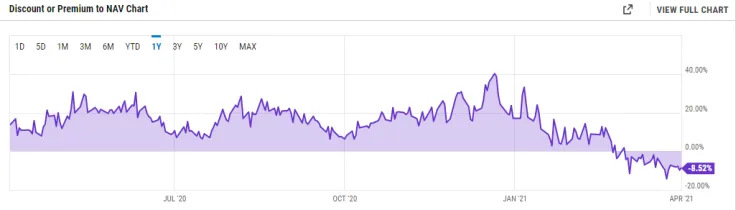

Grayscale Bitcoin Trust, the popular institution-oriented investment vehicle with over $38.1 billion worth of BTC under management, has now been trading at a discount to net asset value for well over a month, raising questions about the product's future.

As reported by U.Today, the asset managed recently confirmed that it was seeking the blessing of the U.S. Securities and Exchange Commission to convert GBTC into an exchange-traded fund.

Such a prospect does not sit well with Marlton's James Elbaor, who accuses the trust of destroying the stock value:

We are frustrated that the board might allow management to squander the company’s leading market share to the detriment of GBTC stockholders, whilst simultaneously rewarding yourselves handsomely with a profligate, market-leading, 2% management fee.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin