The first-ever decentralized financial ecosystem on "XRPL utility fork" Flare, a soon-to-be-released programmatic blockchain, now has its tokens' use cases explained by community enthusiasts.

Introducing YFLR, YFIN, YMIN

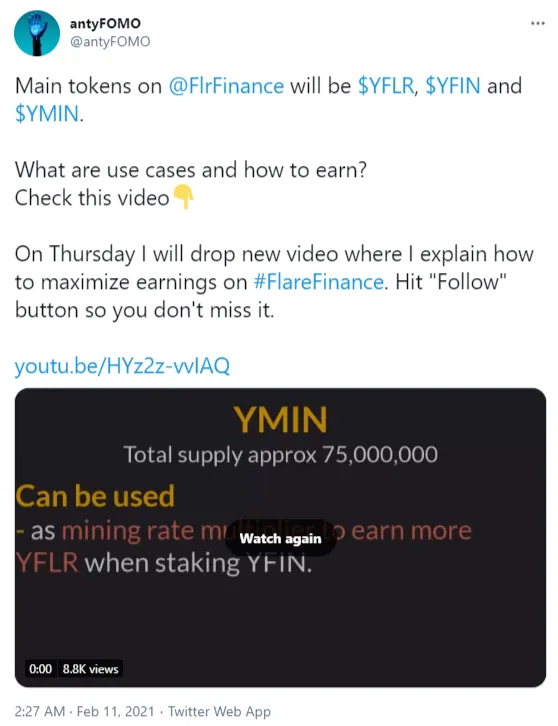

An anonymous blockchain expert who goes by @antyFOMO on Twitter has shared an educational video to explain the opportunities available to holders of Flare Finance tokens YFLR, YFIN and YMIN. According to the video, YFLR will be distributed via DAO offering. It can also be earned by participating in Flare Finance mechanisms.

A total of 40,000,000 YFLR tokens are allocated to reward YFIN stakers on FlareX, a decentralized exchange and staking environment by Flare Finance. Also, all liquidity providers for pairs with YFLR will receive these tokens for their contribution.

In addition, YFLR is a governance token required for participation in referenda on crucial issues related to Flare Finance progress: listings, commission policy, etc. Finally, it is accepted as a fee on FlareUSD and FlareX and incentivizes YFIN farming on FlareFarm.

YFIN can be earned by providing liquidity on FlareX to any pair with YFIN and by farming on FlareFarm with FLR, YFLR, FXRP and FUSD. Also, YFIN will be distributed between lenders of assets within the framework of FlareLoan pools.

Flare Finance approaches public beta testing while Certik conducts its security audit

The third token of the Flare Finance ecosystem, YMIN, has a net supply of 75,000,000 coins. They can be earned by "mining" FLR on FlareMine and by providing YMIN liquidity.

Additionally, it boosts the mining rate while earning YFLR for YFIN staking.

Meanwhile, Flare Finance teases the upcoming launch of its public beta testing. As covered by U.Today previously, top-notch cybersecurity vendors Certik are assigned as Flare Finance security auditors.

Also, centralized cryptocurrency exchange Biki is announced as the first platform to support DAO Flare airdrop of DFLR assets for FLR tokenholders.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov