The Ethereum options market is getting wild.

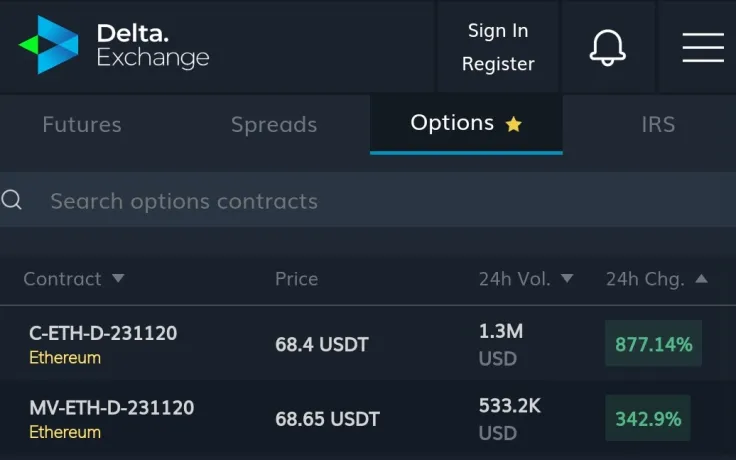

On Nov. 23, the daily trading volume for Ethereum call options on the Delta exchange is up a whopping 875 percent.

First Tether-settled options contracts

The Delta Exchange is one of the leading cryptocurrency derivatives platforms that was launched back in August 2018.

This September, it became the first exchange to launch options that are settled in the popular Tether (USDT) stablecoin.

It offers options for Bitcoin, Ethereum, Chainlink and Binance Coin, with maturities ranging from one day to an entire month.

Cryptocurrency options simulate traditional platforms that give traders the opportunity to purchase call options and put options. While the former allow exposure to future appreciation, the latter are used to bet on a market downturn and earn a premium. It is important to note that traders are not obliged to exercise an option.

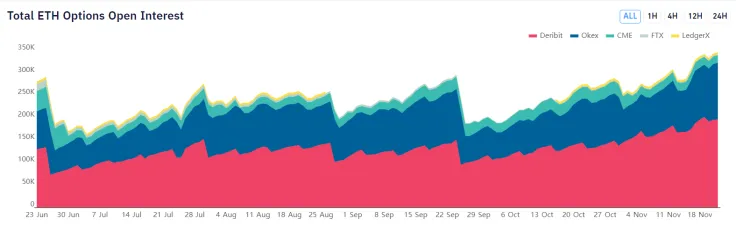

OI on Ethereum options hits a new high

Ethereum, the largest alternative cryptocurrency by market capitalization, reached a 2020 high of $598, leaving Bitcoin's subdued rally in the dust.

According to data provided by Bybt, open interest in Ethereum options recently reached its highest level to date.

Dutch derivatives exchange Deribit rules the roost in this market with 1.41 million ETH worth of contracts, while troubled OKEx comes in second place with 167K.

Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev Caroline Amosun

Caroline Amosun