Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

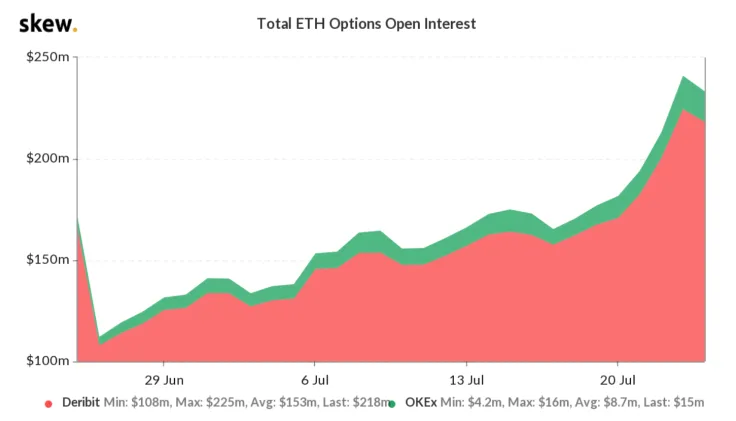

Since the start of the second quarter of 2020, Ethereum has seen an extended uptrend. Data shows the ETH options market was one of the primary catalysts of the rally.

Deribit Insights, the research arm of the top options exchange, said:

“ETH option volumes break all-time notional value highs, with 3:2 Call. Puts traded, 1m vol jumps from 52% to 67%, Call skew indicating upside Calls in demand across maturities. BTC 1m vol at 50%, and has not justified the same response, as ETH spot massively outperformed BTC.”

Advertisement

Compared to February 2020, when the price of ETH peaked below $290, the funding rate of futures exchanges is significantly low. It indicates that retail demand from spot and options markets are fueling ETH, rather than futures.

Could indicate a more stable rally

The term funding rate refers to a mechanism that incentivizes long o r short holders based on market sentiment. If there are more longs in the market, short holders are incentivized, and vice versa.

In February, the funding rate of Ethereum futures was ranging in between 0.1% and 0.2%. This time around, it is at 0.06% on BitMEX, with a predicted rate of 0.03%.

It shows that the futures market is not the main driver of the ongoing rally. Since the futures market allows leverage of up to 100x on many exchanges, it can make a rally more vulnerable to corrections.

Currently, market data, such as volume and open interest, suggest much of Ethereum demand is coming from the spot and options market.

If the funding rate of the Ethereum futures contract stays closer to the median rate, it could catalyze a more stable uptrend in 2020.

What’s behind the Ethereum uptrend?

The largest fundamental catalysts backing Ethereum since June are seemingly the exploding DeFi sector and anticipation of ETH 2.0.

Due to the growing user activity across DeFi protocols, the demand for ETH as gas has increased. The user activity is high to the extent that the Ethereum blockchain network is starting to clog.

Bobby Ong, the COO at CoinGecko, explained:

“Persistently high gas price on Ethereum is here to stay until the scalability solutions that everyone has been talking about are implemented. 100 gwei transactions are here to stay for some time. DeFi yield farming is crowding out ALL other non-DeFi activity on Ethereum.”

Consequently, the revenues of miners have surged, suggesting that the number of transactions on the Ethereum network is rising rapidly.

Researchers at Glassnode said:

“Ethereum miner revenue from fees is surging and at an all-time high (7d MA). On the hourly chart, we're seeing that currently more than a third of the #ETH miner revenue comes from fees rather than block subsidy – up from less than 5% in April.”

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya