In the past five weeks in the DeFi (decentralized financial applications) sphere, something happened that every staker Token holder and lender will hope to forget. The drop in total value locked in DeFi was even worse than the Ethereum (ETH) price decline.

Recovery of DeFi

The first indicators of fledging recovery on DeFi markets were noticed by seasoned trader and analyst Mati Greenspan, founder of Quantum Economics think-tank. According to him, decentralized financial applications are going through their ‘own recovery’.

DeFi staging its own recovery. pic.twitter.com/UvVHoSLBbq

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) April 7, 2020

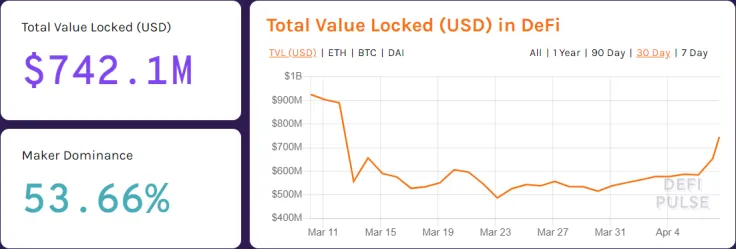

His findings are based on statistic data provided by the DeFi Pulse decentralized financial explorer. According to their statistics, the USD-pegged total value locked (TVL) in Defi demonstrated growth for seven days in a row on a 30-day chart. In the last two days, it gained almost $160M and is now estimated at $742M.

It is interesting that, unlike cryptocurrencies prices, the TVL continued its drop even after Black Thursday and had its own local bottom on March, 23.

DeFi life, DeFi rules

Mr. Greenspan was asked whether these positive dynamics are plainly caused by the Ethereum (ETH) price surge. The analyst didn't have a concrete answer regarding this correlation:

Interesting question.

Advertisement

Additionally, it doesn’t look like DeFi recovery is caused only by price increase. It is also a question of people’s trust. The DeFi infrastructure had its own unique dynamics leading up to Black Thursday, as its TVL reached $1B for the first time in its history before the carnage.

Also, the sector was shaken up by a series of very suspicious hacks that resulted in more than $1M in Ethereum (ETH) lost.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov